July 5, 2022

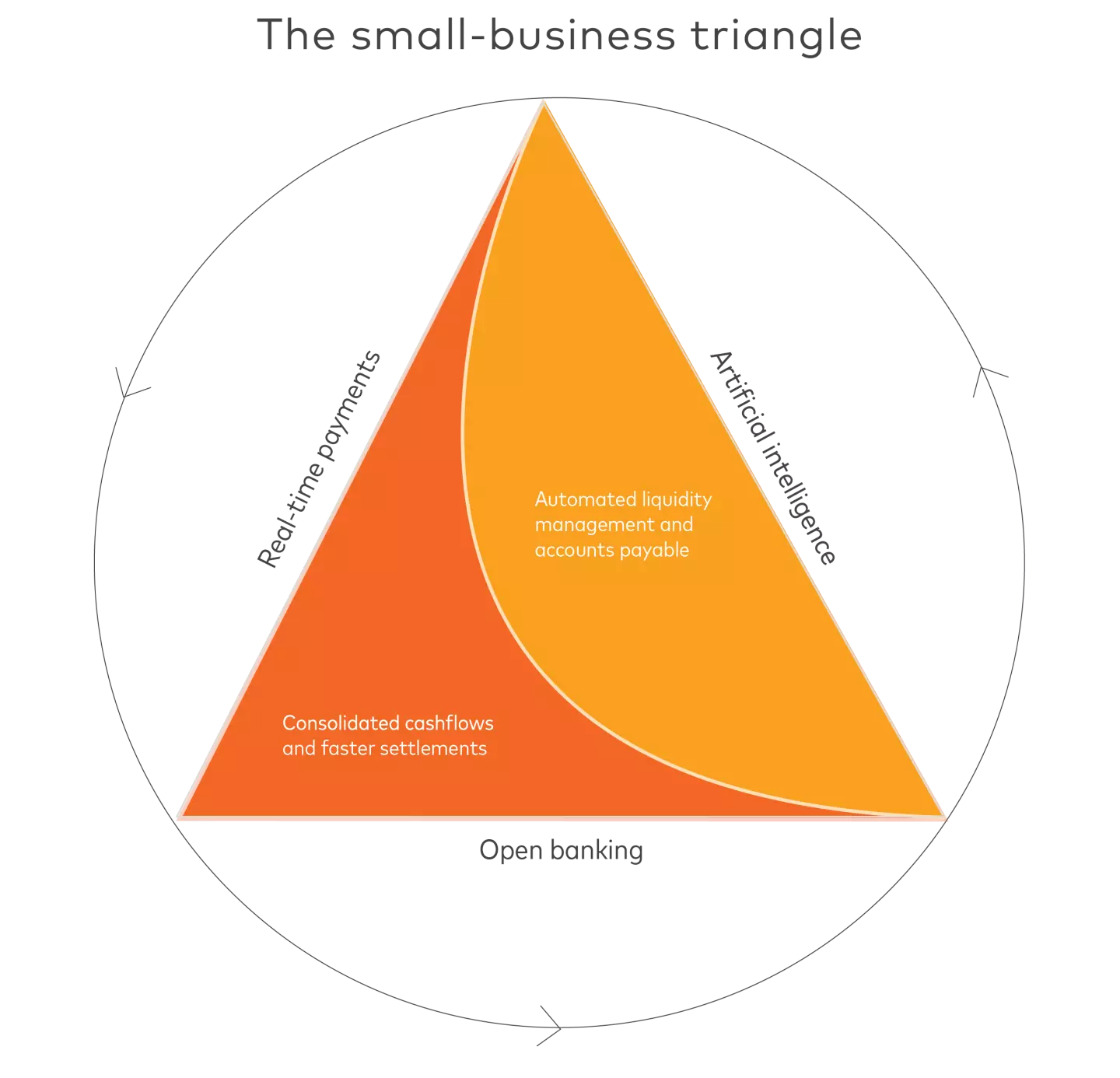

In early 2020, we published the report A small business triangle: Instant, open, intelligent. It showed how the convergence of real-time payments, open banking and artificial intelligence could help small businesses with cash flow issues.

Then Covid-19 hit, and small businesses bore much of the brunt. The report could not have been timelier.

Later that year, we caught up with the three experts who contributed to the original report. Our conversation appeared in the September 2020 issue of The Different Times under the title “Supporting small business in a Covid-19 economy.”

Much of the conversation remains as relevant today as when it first appeared. Here we share their thoughts again, unchanged from the original.

***

September 2020

Difficult Decisions

Patricia “Patti” Reynolds, real-time payment (RTP) specialist, notes a subtle nuance: “It’s not the concept of a downturn that’s unprecedented. It’s being subjected to the vagaries of a pandemic that’s unheralded.” She is referring to the abruptness of the impact and the way it has affected online and offline retailers across various sectors differently. “A major retailer selling daily essentials with a large ecommerce operation is going to fare much better than a small business with a niche offering and a scant online presence,” she adds.

If small businesses are facing difficult decisions, so are their banks. “Many of their small-business customers have suddenly become high risk through an event that was beyond their control,” says Hakan Eroglu, open-banking specialist. He cautions that “it would be callous, and not in anyone’s long-term interest, for banks just to turn their backs on them.”

The problem is that financial bailouts, whether credit lines from banks or government disbursements, are only short-term solutions. “Many small businesses don’t even qualify for PPP loans” laments Patti in reference to the US government’s payment protection program. “That’s where this convergence of technology—RTP, open banking and AI—can help,” offers Brian Wolther, artificial intelligence (AI) specialist.

Virtuous Circles

Brian is not particularly phased by the suggestion that the small-business triangle was written at a time when banks were not inundated with desperate calls from struggling small businesses and when those small businesses were more able to invest in new technology. “Banks have every incentive to keep their customers up and running. Going down the debt collection route is in neither parties’ best interests. Small businesses are looking for a lifeline and banks want to give it to them,” he says.

Still, Brian is realistic: “Financial technology won’t solve the underlying problem. It can’t fix the socioeconomic situation. But it can help small businesses ride this out for as long as possible.” “We’re fortunate that technology providers have reached a sufficient level of development that banks can offer this recourse through them,” adds Hakan in support.

Attempting to allay any doubts, Hakan elucidates further with a description of what amounts to a virtuous circle: “It starts with small businesses turning to their banks for help. The banks then look to their technology providers and fintech partners for solutions. Their technology solutions can alleviate the pressure on small businesses through this triangular relationship of RTP, open banking and AI.” The net result is that the banks, having been able to provide solutions, can be far more comfortable with the level of risk posed by their small business clients.

Technological Convergence

The virtuous circle described by Hakan has multiple immediate benefits to small businesses. “At a minimum, RTPs can really help small businesses with cash flow efficiency through faster payments,” affirms Patti. She is referring to how the ability to make payments as close as possible to due dates, without fear of incurring late penalties, and the ability to receive payments instantly can have big impacts on small businesses’ bottom lines.

“And it’s open banking that’s really enabled RTPs to function at their full potential,” adds Hakan. “Or, rather, RTPs have helped open banking find its true calling,” retorts Patti.

It’s notable that open banking really came into its own through RTPs, and most particularly for the benefit of small-business customers. That’s different from a couple of years ago when individual consumers were anticipated to be as big, if not greater, beneficiaries. Transaction initiation is catching up with data access as the main role for open banking. Hakan describes their combined major benefits as “consolidated views of cash inflows and outflows, easier back-end reconciliation, and efficiently scheduled payments.”

Eking it Out

“On top of RTPs and open banking, we have AI as the third piece of the triangle,” Brian chimes in, clarifying that “otherwise the masses of data can become too unwieldy.” Patti notes that “the advent of enriched transaction data,” which includes relevant data beyond what is needed for a basic transaction, “makes the role of AI even more important.” Brian and Patti are talking about AI’s ability to automatically extract and analyze data. The process generates insights to improve liquidity management and, crucially for small businesses today, accounts payable.

Hakan summarizes the small-business triangle accordingly: “AI allows complete automation so RTPs can run more smoothly in an open-banking environment.” “And more safely,” adds Brian, qualifying that “real-time payments need real-time security.” Cybercrime has spiked as a result of businesses being reliant on ecommerce in the wake of Covid-19. And, although big businesses are more popular targets, small businesses have always been the most vulnerable with limited resources to defend against cyberattacks.

“Although the small-business triangle helps banks conduct better and more favorable credit decisioning for small businesses,” notes Patti, “the triangle is really about helping small businesses make the best use of the money they already have or that is owed to them.” Technology that enables small businesses to eke out every penny and put each one to optimal use is always going to be recommended for competitiveness. But, in today’s unstable environment, it goes beyond just competitiveness.

“It might be the only realistic means of survival,” cautions Patti.