Quickly detect anomalies and investigate authorization issues

In a world where card payments continue to grow rapidly, faster visibility into authorization operations is increasingly important to deliver frictionless experiences to customers.

Through near real-time research into authorization data, Mastercard customers can quickly detect anomalies and investigate issues by using Mastercard Early Detect Insights (MEDI). MEDI is available through the Mastercard Connect Portal and doesn’t require IT integration of any kind.

Mastercard Early Detect Insights allows users to:

Request a demo

Let one of our specialists show you how Mastercard Services can enhance your

business performance, elevate consumer experiences and enable innovation.

Minimize the impact of authorization issues

MEDI is designed to help network participants minimize the business and cardholder impact of authorization issues by facilitating faster detection and investigation of processing anomalies.

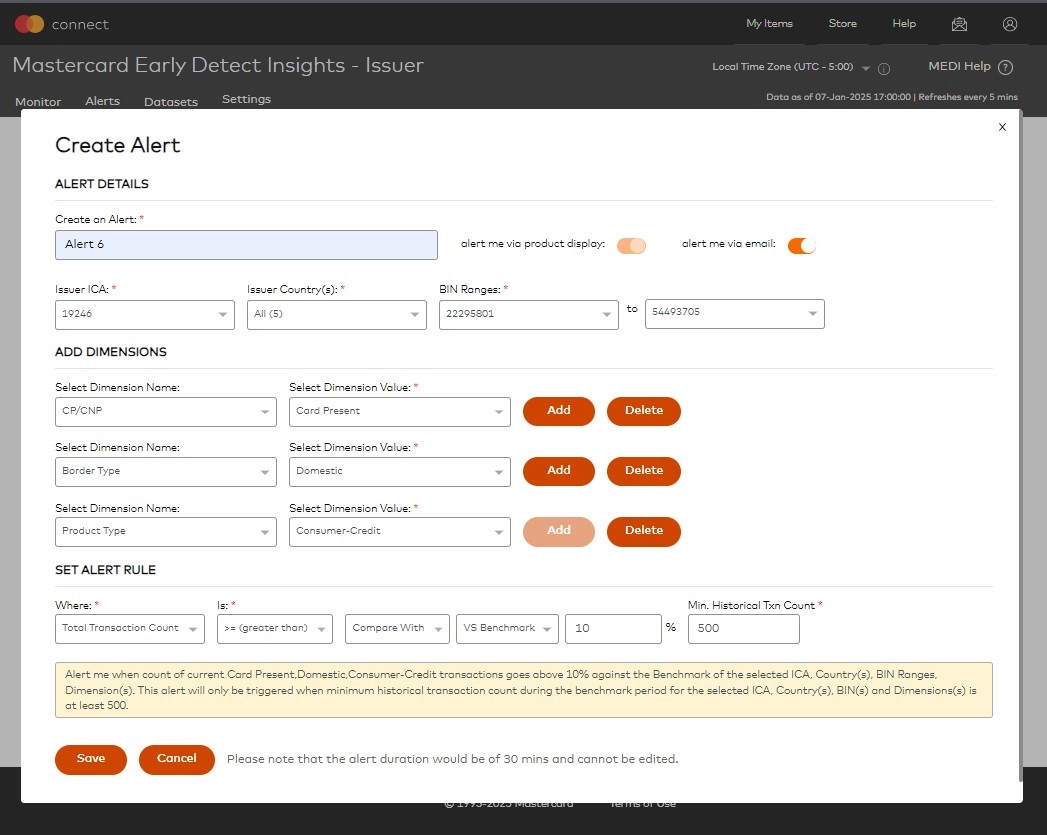

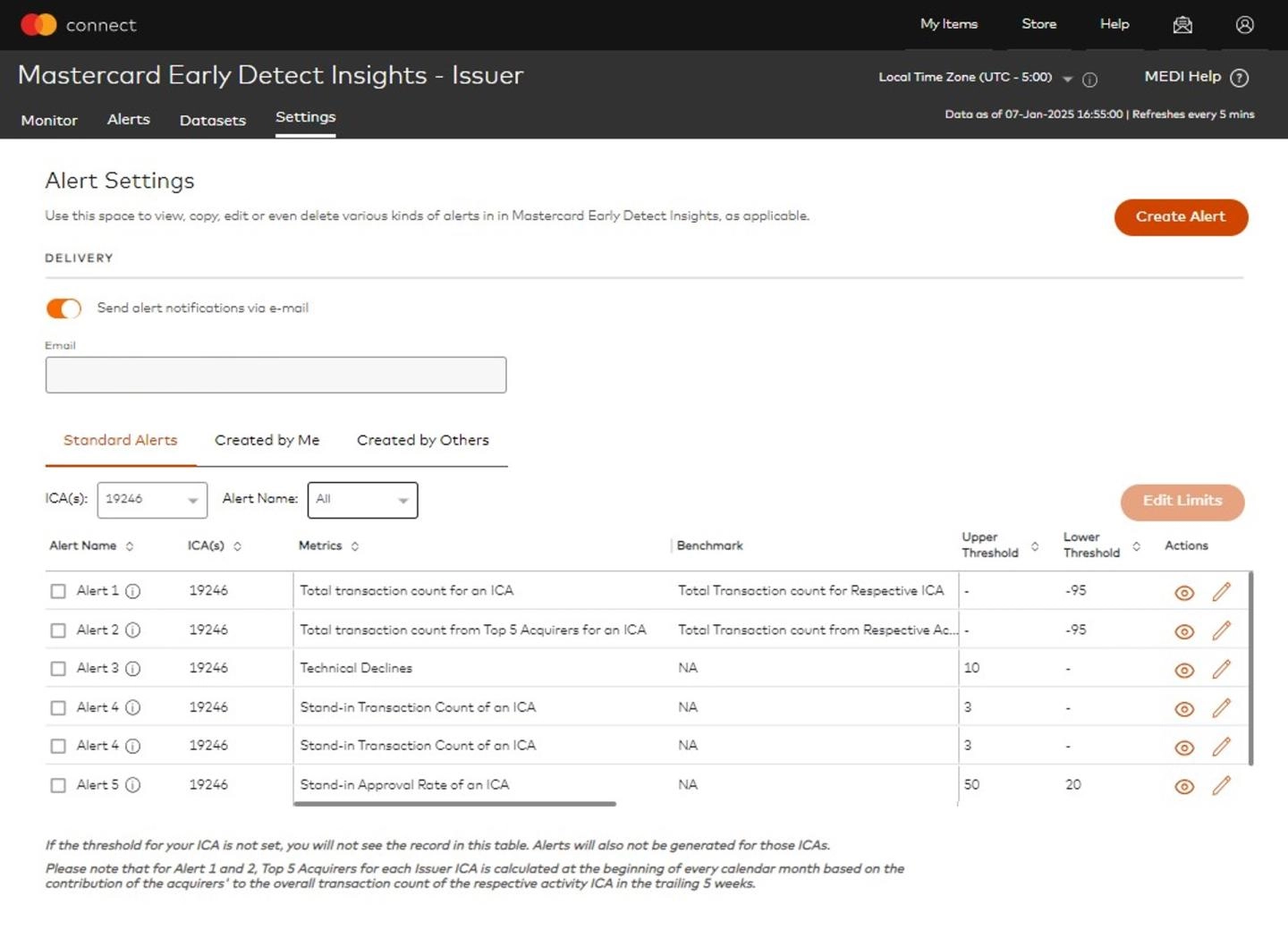

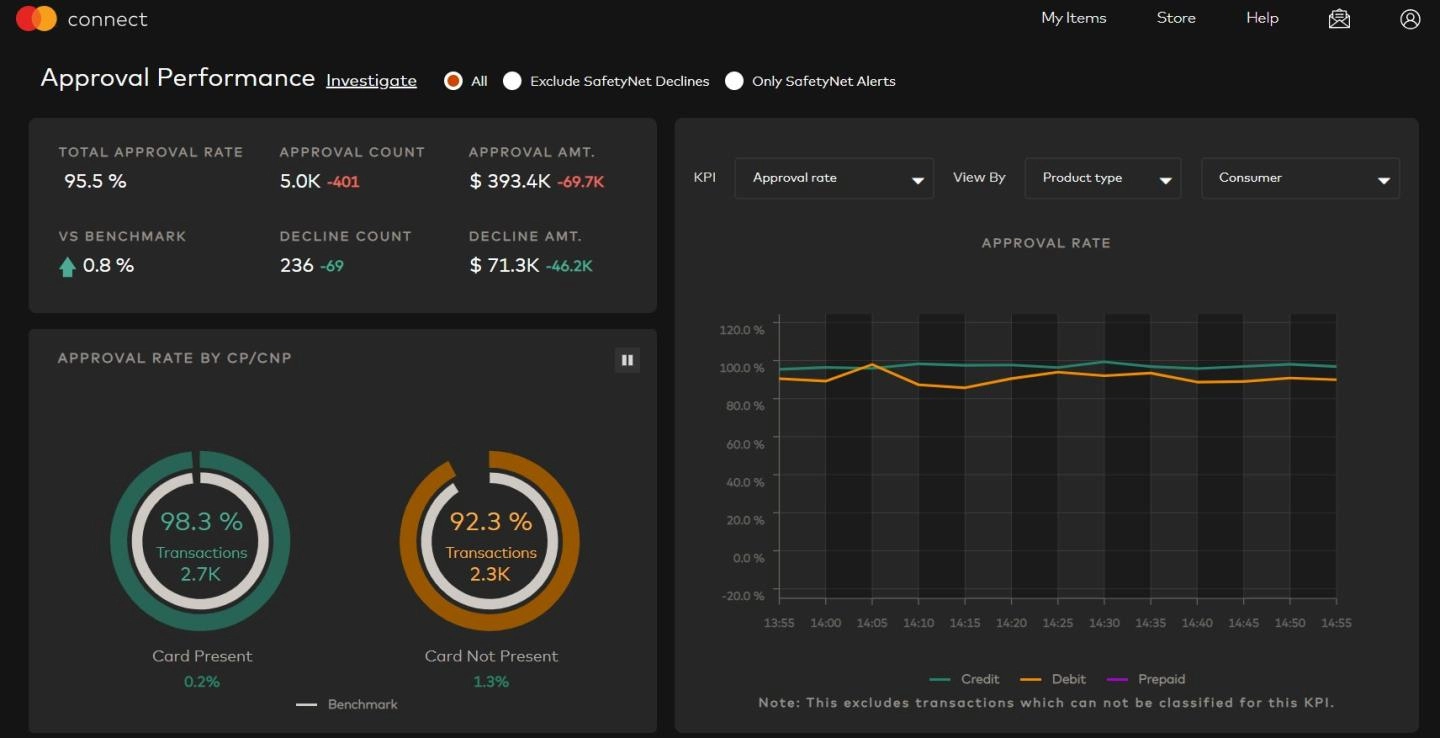

Alerts identifying critical issues ensure prompt investigation through MEDI, while interactive data visualization of authorization and approval-rate performance shortens the time to determine the root cause of avoidable declines. Within alerts, there is additional capability to ‘Create Your Own Alert’, available alongside the standard Mastercard designed alerts, giving you flexibility and opportunities for personalized investigation.

Faster visibility

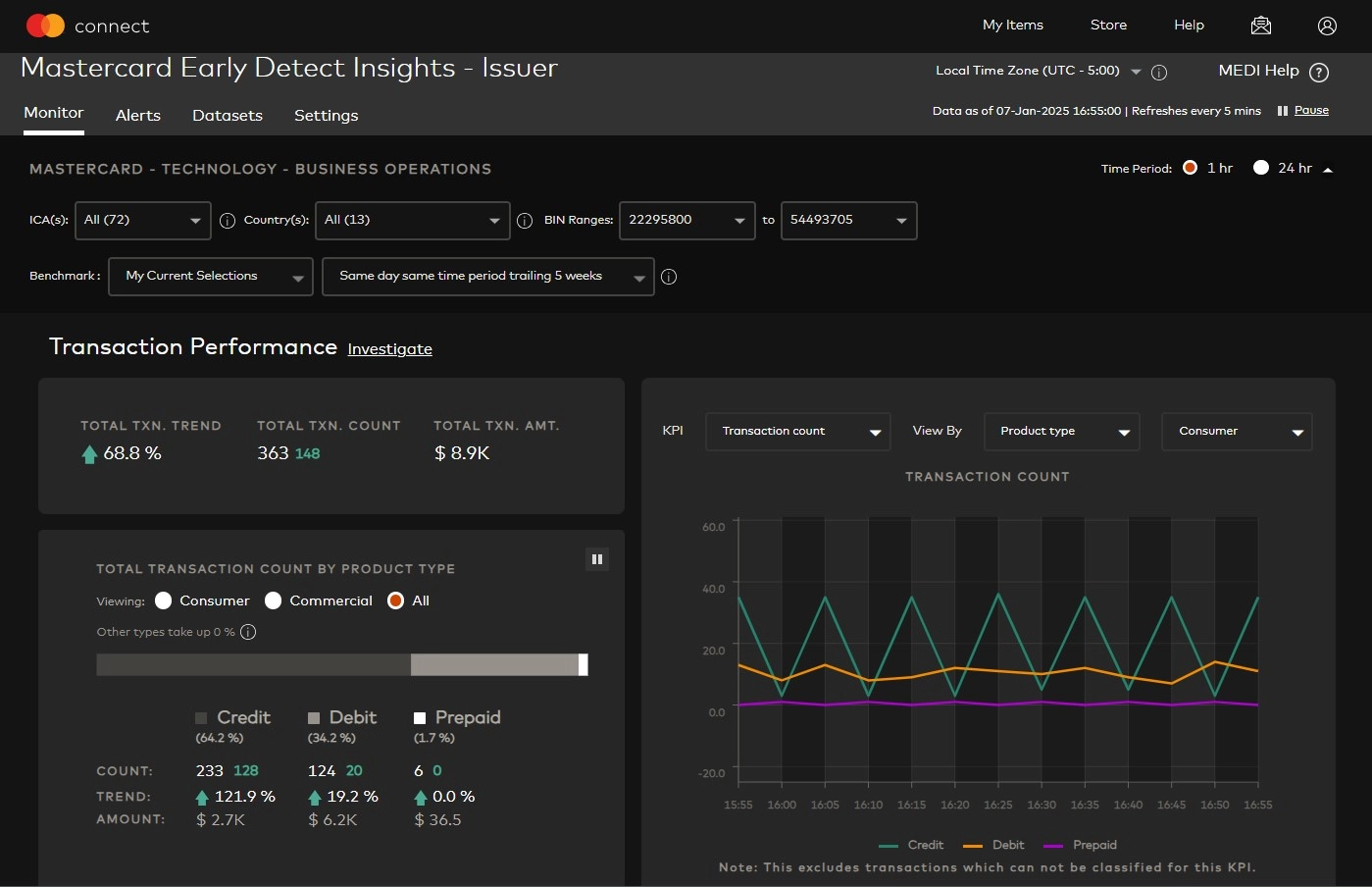

MEDI enables Mastercard customers to detect problems as they occur thanks to near real-time alerts and data visualization. Customers can track their aggregated performance results and performance over time, reducing ambiguity and enabling faster coordination with relevant stakeholders.

- Alerts to identify critical issues are sent via email to ensure rapid investigation, notifying the user of critical incidents such as spikes in technical declines or sudden drops in transactions. Alerts include attributes such as the reason code (e.g. do not honor, technical declines, etc.)

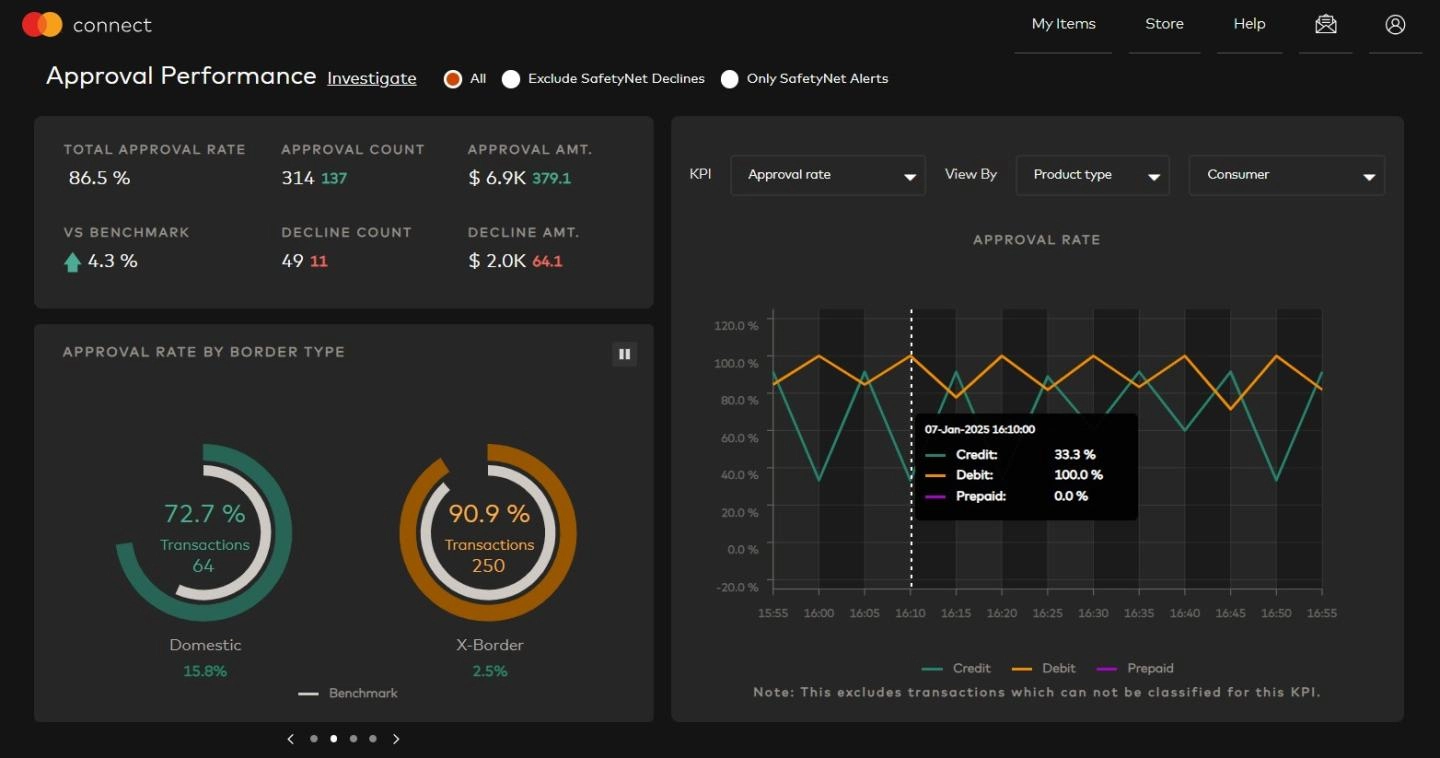

- Users can track KPIs against relevant factors such as card-present (CP) vs card-not-present (CNP), with/without SafetyNet transactions, Responder Type (e.g., Standin), Product Type and 3DS, allowing the user to diagnose problems as they occur

Improved approval rates

MEDI's issue identification and research capabilities allow customers to rapidly act on errors and limit unintended declines by providing:

- Near real time interactive visualization of authorization volume and approval rate performance

- Access to granular data on transactions to enable root cause analysis

Increased cost efficiency

Reduce manual investigation and customer service follow-ups with MEDI’s data view, which allows customers to identify issues and access transaction-level data in just two clicks.

- Instead of extensive hands-on monitoring of authorization issues, MEDI will notify users via email and in-product alerts when a critical issue occurs

- Users can configure alerts or change the thresholds to suit business needs

- Mastercard support teams work proactively with clients, using the same view to facilitate communication, helping clients to understand the root cause and rapidly resolve issues.

Positive brand impact

MEDI's anomaly identification and investigation capabilities leads to faster issue resolution, creating a seamless payment experience whilst improving brand image for payment players and cardholders.

Access real-time data backed by Mastercard's global network

Minimize unintended declines with rich data and actionable insights delivered in near real time, backed by comprehensive Mastercard support. Make alerts relevant to your business by tailoring them with customizable alerts.

Exclusive data

- High data fidelity from the network/source

- Built-in capability to research transactions in the moment when an issue occurs

- Near real-time visibility into unique Mastercard data such as standin and safety net transactions

Global footprint

- Relevant actionable insights based on network-wide intelligence

- Market/region-based benchmarks e.g. country average (currently on roadmap)

Seamless experience

- Interactive data visualization without IT integration required

- Strong customizable Mastercard support model for customer inquiries

- For authorization issues, Mastercard technical support teams have access to the same data set as the client