By Nathan Richter, vice president of program strategy and insights, Dynamic Yield, a Mastercard company

This article was originally published in Dynamic Yield's XP^2 Learning Center.

These days, personalization is key to driving great customer experiences. In fact, data from Forrester unveiled that 61% of customers are unlikely to return to a brand that does not provide a satisfactory experience. And banking is no exception, with 72% of consumers polled by Capco rating personalization as “highly important” in today’s financial services landscape. Further, 76% of banking customers expect an omnichannel experience.

It’s no surprise that our latest research found 92% of financial institutions shared a belief in personalization’s value and have already allocated resources to support it internally. But belief doesn’t manifest into meaningful implementation unless the right processes and methodologies are also prioritized.

With new and existing customers hanging in the balance, how can financial institutions deliver the timely, relevant, and personalized interactions that customers expect on every channel? In this post, we’ll outline the right audiences, relevant KPIs, and ideal communication channels to help teams align personalization throughout the customer lifecycle.

Aligning personalization to growth and retention strategies

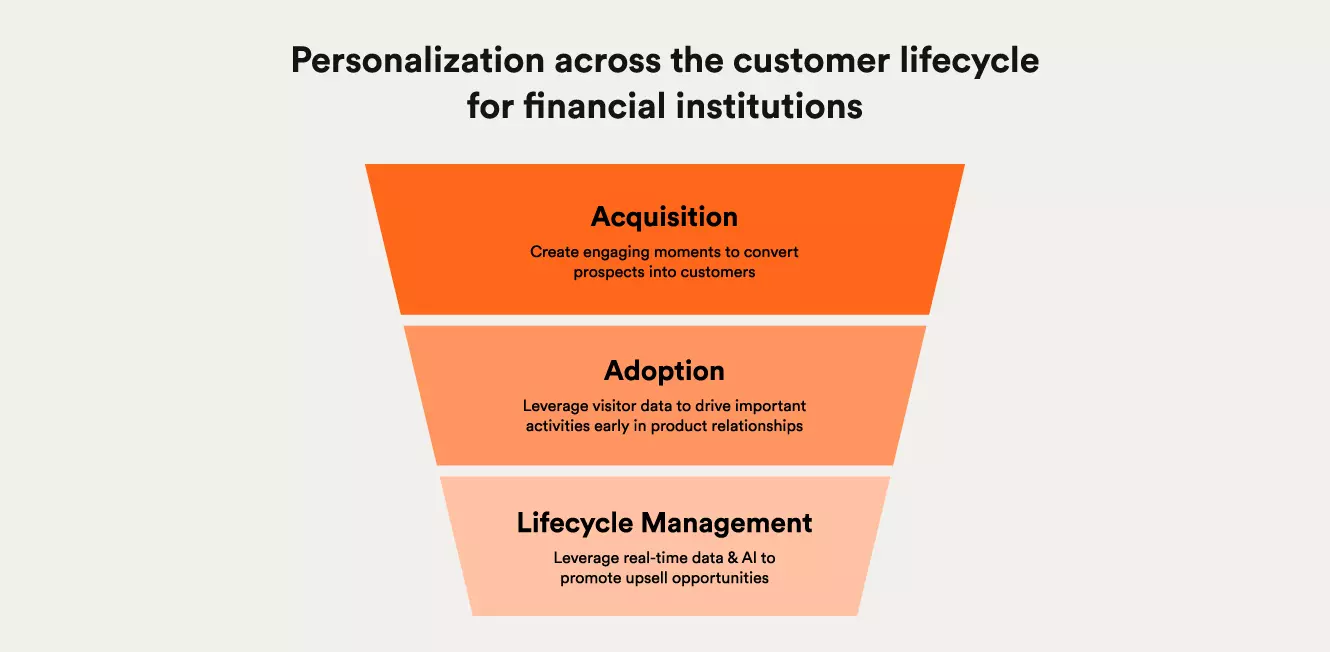

There are three main customer lifecycle stages that financial brands should think about when integrating personalization into the larger business strategy: acquisition, adoption, and lifecycle management.

When broken down at a high level:

Acquisition – Optimizing acquisition ROI (and reducing CAC) by leveraging available data to deliver relevant experiences from the very first pageview.

Adoption – Expediting activations, account setup, and early product usage with tailored experiences that promote key customer behaviors.

Lifecycle Management – Upselling, encouraging product and service usage, and driving customer lifetime value by infusing existing and real-time data into experience delivery with AI.

But how do teams get there, and what are the most important components to consider when thinking about how to apply personalization across the customer lifecycle?

Three important questions come to mind:

- Who are the most important audiences to target at each stage?

- What are the main KPIs to optimize towards within each stage?

- Which channels present the largest areas of opportunity in a given stage?

Now, let’s dive a bit deeper into each of these within the different stages and highlight some great use case examples.

STAGE 1:

Personalization’s influence on customer acquisition

Referring back to our first question above, the first step to driving acquisition (or improvement of any other funnel stage) through personalization is understanding your audiences.

And that starts with data.

Without going into analysis paralysis, a helpful way to get started is by bucketing your visitors’ behavior according to the level of intent:

- Low-intent – Characterized by limited data, they could be anonymous, first-time visitors or users who have yet to take action on your website.

- Medium-intent – Show signs of product interest or affinity, either visiting multiple pages, returning to the site, or converting on a download or on-site tool.

- High-intent – Have taken multiple actions across the site, completed several key customer behaviors, and their interests and affinities are well known.

The goal is to move low-intent prospects to medium intent, medium-intent prospects to high intent, and high-intent prospects to customers.

Now, what about our KPIs?

Within the customer acquisition phase, financial services brands most often seek to influence:

- Application submissions that collect vital information and move prospects further into the funnel

- Email | SMS capture create contacts for nurturing while discovering intent and product interest

- Downloads of educational content that helps determine a prospect’s affinity

- Onsite tool usage like loan and savings calculators or branch locators for identification of specific needs

- Service engagement that kicks off the customer onboarding process

From there, you can think about your main channels for delivering personalization.

These are best understood in two categories:

- Trigger (Inputs) – Take in data from prospective or existing customers

- Response (Outputs) – Mediums from which to use that data to launch campaigns

Each lifecycle stage utilizes different triggers and responses that correspond to their distinct audiences and KPIs. Within customer acquisition, those are:

| Trigger channels | Response channels |

|---|---|

| Performance marketing | Web |

| Social media | App |

| Referral (trusted sources) | Email (in some cases) |

| SMS (less often) | |

| Direct traffic | |

| Physical locations |

On to the most exciting part… the use cases.

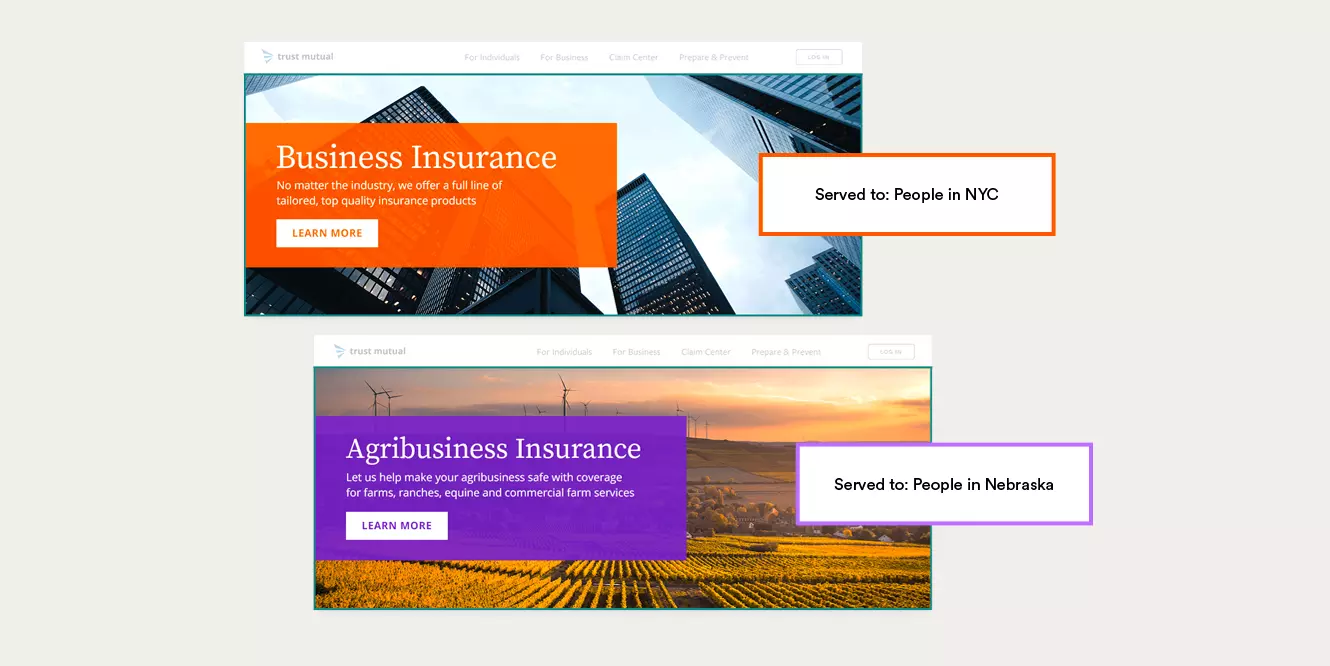

Using contextual data to tailor homepage content for new users

Let’s say after digging into our data, we find a large portion of visitors are coming directly to the site (trigger channel) from a few distinct locations (low-intent audience segment). We can then use that data to inform the personalization of web experiences (response channel), including the tailoring of welcome messages, homepage banners, email signup overlays, and more to influence key KPIs like application submissions or tool usage.

For example, one might serve a homepage hero banner promoting business insurance to people in New York City, and another version for agribusiness coverage in Nebraska. By doing so, teams can ensure greater relevance right out of the gate, a higher likelihood of continued engagement, and lower rates of site abandonment.

Other acquisition personalization use cases include:

- Offering service assistant messaging to prevent dropoffs upon form completion

- Harnessing guided selling to educate and convert

- Tailoring on-site welcome messages according to traffic source

- Enabling discovery for returning anonymous users

- Surfacing idleness-triggered reminder notifications on form completion pages

- Re-engaging customers with triggered, contextually relevant emails

Strive to ensure that every potential customer is met with the most relevant digital experience possible with the available data and you’ll enjoy higher returns from acquisition investments and lower customer acquisition cost (CAC).

STAGE 2:

Personalization’s influence on customer adoption

If you remember from the funnel slide at the beginning of this post, adoption is all about leveraging visitor data to drive important activities early in the product relationship.

But before you can optimize adoption efforts, you need to distinguish between your customers based on their level of engagement. This distinction comes back to data, which can be mined from direct, first-party data, engagement-level data from across digital properties, zero-party survey data, as well as 3rd party information to enrich customer profiles.

In a similar fashion, we can use a funnel to bucket customer behavior by low, medium, and high engagement, with the goal to move low-engagement customers to medium, medium to high, and to keep high-engagement customers where they are while serving relevant experiences designed to increase spending and cross-sell.

But how do you measure the success of personalization in the adoption phase?

The key metrics that are most relevant to customer adoption are:

- Account setup for new users to register their card, build their profiles, and set up functionality like auto-pay

- Key customer behaviors including first transaction, digital billing, and adding to mobile wallet to promote top-of-wallet behavior

- Card and account usage data helps to understand spending behavior and affinities for refinement of targeted promotions, content, and offers

- App downloads incorporate an additional messaging channel for engagement and communication (like push notifications)

- Product education facilitates future cross and upsell opportunities

As we go on to think about how to influence the KPIs above for the adoption phase, let’s consider our trigger and response channels, which both include:

| Trigger channels | Response channels |

|---|---|

| Mobile app | Mobile app |

| Website | Website |

| SMS (less often) | SMS (more often) |

Now, let’s take a look at personalization use cases within the adoption stage.

Using 3rd party data to enrich customer profiles for segmentation

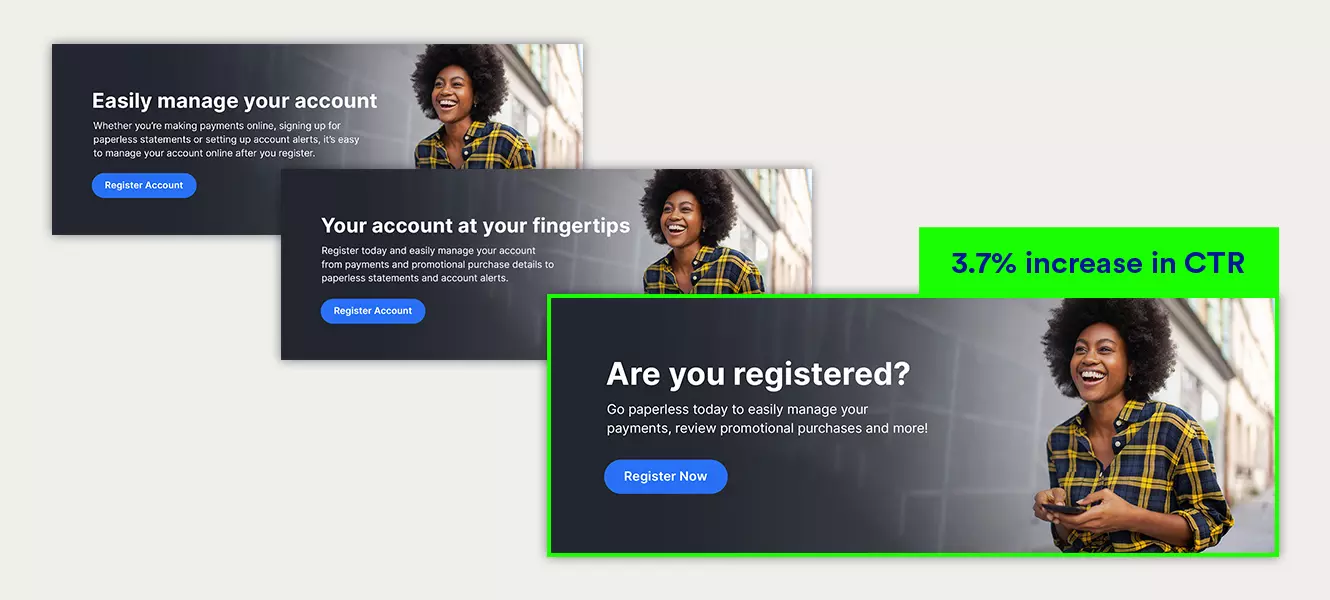

Consider a scenario in which a new customer who has not yet registered their card (low engagement customer) visits the site (trigger channel). Instead of receiving the generic homepage experience, a team could use the information to A/B test which messaging, content, product recommendations, promotions, and more on the site (response channel) is most effective at generating registrations (KPI).

Synchrony personalizes with LiveRamp data to create relevant experiences based on the type of credit card a site visitor has – another strong example of how to encourage key customer behavior based on available information during the adoption phase.

Other adoption personalization use cases include:

- Increasing engagement and app usage with personalized push notifications

- Running personalized retargeting display ads to re-engage users

- Delivering a continuous experience from ads to landing pages

- Communicating time-relevant offers to increase conversions from potential customers

- Creating hyper-personalized experiences with CRM and vital customer data

Every new customer is unique and has different needs, preferences, and reasons for their behaviors, meaning how they engage and when is distinct to the individual.

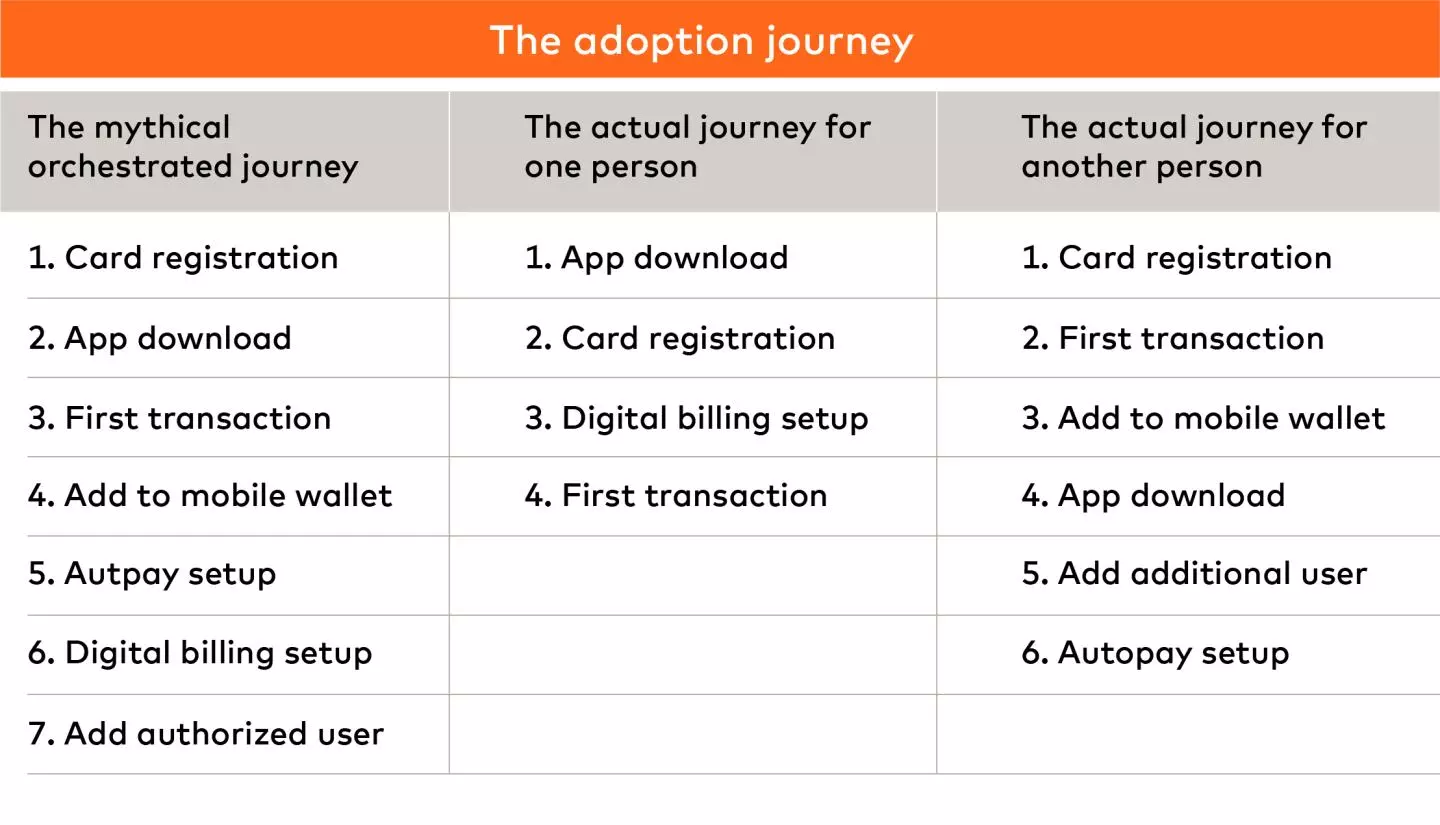

And while you might have mapped out an ideal, linear path for adoption, it’s not always an orchestrated journey.

Instead, adoption must be viewed as a series of engagements to be managed in real-time, using the available data and customer cues to adapt to the various journeys and encouraging the completion of the remaining, relevant key engagements.

STAGE 3:

Personalization’s influence on lifecycle management

Within the ongoing lifecycle management phase, it’s all about maintaining customer engagement and top-of-wallet behavior as well as increasing account and card usage.

Similar to adoption, customers within the lifecycle phase can be bucketed by their overall level of engagement, with the goal being to elevate each tier’s level of engagement with relevant content and offers. This means reinvigorating low-engagement customers to medium, pushing medium-engagement customers to high, and maintaining high-engagement customers while encouraging them to increase spend and expand their product usage.

Through this lens, you can start to tailor your personalization efforts for each audience, optimizing for the relevant KPIs.

These include:

- Overall spend to maximize business profits and identify potential opportunities for upsell and cross-sell with relevant experiences

- Cross-sell and upsell turns single-product users into loyal customers using multiple products with relevant recommendations

- Card and account usage creates greater stickiness and deepens the understanding of customer affinity and engagement

- Key customer behaviors drive engagement and customer longevity through actions like automatic deposit, multiple accounts, and mortgage loans

- Downloads further the customer journey through education about new or previously undiscovered products

Banking customers vary widely in their spending habits, card usage, and channel preferences. Financial institutions can use the available data from all available trigger channels to paint a clear picture of each customer and nudge them towards relevant products and services on whichever medium they prefer — with the ability to continue the conversation across all channels.

| Trigger channels | Response channels |

|---|---|

| Mobile app | Mobile app |

| Website | Website |

| SMS | |

| Paid and organic search | |

| Social | |

| Referral traffic (from trusted sources) | |

| Performance programs |

Here’s what personalization aligned with lifecycle management can look like:

Algorithmically recommend the most relevant content and services

Let’s say we have a new credit card user (low engagement customer) who visits the website (trigger channel) and sees recommendations and content that’s in line with their current situation (response channel) to drive their overall spend as well as their card and account usage (KPIs) rather than a generic experience.

As time goes on, the customer evolves into a homeowner (high engagement customer) and, with the help of AI, the website experience (response channel) changes to incorporate more cross-sell and upsell opportunities, encourage educational downloads for relevant but undiscovered products, and promote key customer behaviors like home loan applications or refinancing (KPIs).

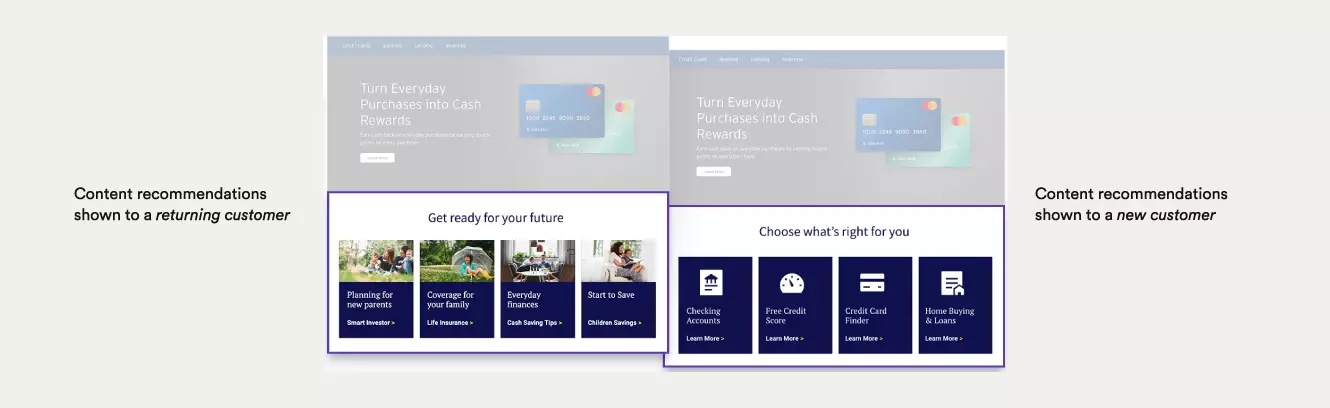

For example, the variation on the left incorporates web personalization to serve a tailored experience for a returning customer with specific, AI-powered content recommendations that correspond to the available customer data, whereas the experience on the right for a new customer showcases generic and broad resources in an effort to learn more about their needs and interests and to serve deeper, more relevant recommendations in the future.

Other adoption personalization use cases include:

- Displaying recommendations based on customers’ spending power and financial preferences

- Upselling customers with personalized complimentary offers and product recommendations

- Creating an omnichannel customer journey experience

- Recommending unexplored products and services to customers that are unfamiliar with them

With growing numbers of consumers turning to digital banking, there are more options available to them than ever before. With so much new competition, FIs need to stay top of mind with their customers throughout their individual journeys through the delivery of highly relevant experiences.

Foundational personalization across the lifecycle brings a jolt of much-needed agility to financial services

Acquiring, activating, and managing customers throughout the lifecycle is no longer predicated on a bank’s physical location or in-person service, but the timely, relevant, and personalized digital interactions that consumers expect every time they engage, no matter the channel.

Knowing which audiences, KPIs, channels, and types of experiences correspond best with the different lifecycle phases translates into greater agility and results. Use the information outlined in this post to launch experiences faster, more quickly understand what performed well, and refine campaigns at every step of the customer’s relationship with your company. Greater sophistication in your approach to the customer experience awaits, as do the exponential revenue gains.