For today’s traveler, the economy's mixed signals create a complex backdrop for leisure and business travel, shaping travel preferences and spending habits for the remainder of the year. There is resilience and strength in consumer spending and travel demand globally, especially in Europe with excess savings of over €1 trillion. Leisure travel from Europe, North America, the Middle East, and Latin America remain robust, while flight bookings in Asia Pacific, where travelers’ have years of pent-up demand, are surging to hot locations like Germany and France.

The Mastercard Economic Institute’s fourth-annual travel report, Travel Industry Trends 2023, explores key themes facing travel recovery in 2023 and beyond. Below, we highlight today’s travel-related decisions related to destinations and corridors, business travel and tourist spending in Europe.

Factors that contribute to the evolving economic and travel landscape:

Elevated inflation

Elevated interest rates

Rising mortgage payments

Declining asset prices

The tightening of credit lending conditions

New travel rules and routes

Consumer preference for experience over things

Mainland China's reopening

European travelers are embracing cooler adventures

Emerging travel corridors are fueled by regional economic trends. Unsurprisingly, cosmopolitan cities and beautiful beaches remain popular stops. As a leading destination for all regions of the world, tourism-driven European countries like France, Italy, Spain, Portugal, and Greece look to disproportionately benefit from resilient global tourist arrivals.

At the same time, European tourism itself is trending towards a growing desire to venture away from home. Driven by weather patterns, in the summer, travelers avoiding heatwaves and wildfires are exploring the north of the continent, including the U.K., Scandinavia, the Netherlands, Switzerland and Germany. The U.S., a top 10 destination for European travelers in 2022, has moved up the list, further highlighting the desire to venture farther away as well as take advantage of a weaker dollar.

In early 2023, Europe’s top 3 international travel destinations include: the United Kingdom, Spain and the United States.

Leisure flight bookings in the United Kingdom were up 75% in March 2023 compared to March 2019

Leisure flight bookings in France were up 21% in March 2023 compared to March 2019

Leisure flight bookings in Germany were down -19% in March 2023 compared to March 2019

Leisure flight bookings in Norway were up 49% in March 2023 compared to March 2019

Leisure flight bookings in Poland were up 34% in March 2023 compared to March 2019

Europe helps sets the pace for business travel recovery

Due to remote work and the uncertain macroeconomic environment, the recovery of business travel lags in comparison to leisure travel. Despite these challenges, demand for in-person business meetings remains robust, with commercial flight bookings well above pre-pandemic levels. From 2021 through March 2023, countries where more people returned to their offices outperformed commercial flight bookings by a wide margin compared to their more remote-minded counterparts.

Europe is one of the world’s leading regions in corporate travel and entertainment recovery between January 2023 and March 2023, trailing only Asia Pacific.

Europe looks to trade down, but is still seeking authentic travel experiences

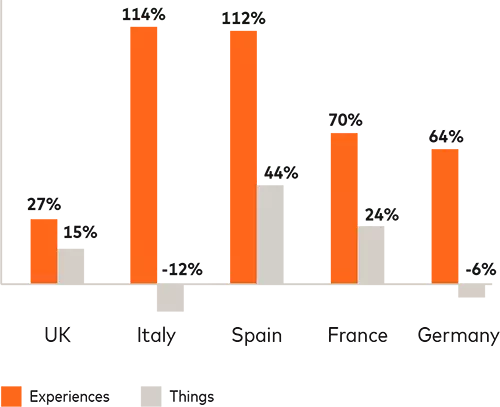

Globally, a notable shift in preference emerged following the Covid-19 lockdowns, with travelers increasingly valuing experiences over material possessions. In Europe, experiences-focused spending remains the outperformer, suggesting that travelers are increasingly seeking authentic experiences in destinations across the world.

Because Europe is generally an area with negative or sluggish wage growth, it may see a rise in budget-conscious trading down travelers seeking value-for-money options. Today, we’re seeing European consumers trading down more in their discretionary spending, such as cheaper grocery brands and restaurants. In the travel sector in 2022, low-cost carriers have outperformed flagship carriers in passenger numbers as Europeans also shopped for airfare bargains.

Tourism spending on experiences outpaced things in major European locations in March 2023:

For an in-depth look and to learn more about the current state of global travel, click here to get access to Travel Industry Trends 2023.