For today’s traveler, the economy's mixed signals create a complex backdrop for leisure and business travel, shaping travel preferences and spending habits for the remainder of the year. But there is resilience and strength in travel demand globally. Leisure travel from the Middle East, Africa, Europe, North America, and Latin America remain robust.

The Mastercard Economic Institute’s fourth-annual travel report, Travel Industry Trends 2023, explores key themes facing travel recovery in 2023 and beyond. Below, we highlight today’s travel-related decisions related to destinations and corridors, business travel and tourist spending in the Middle Eastern and African regions.

Factors that contribute to the evolving economic and travel landscape:

Elevated inflation

Elevated interest rates

Rising mortgage payments

Declining asset prices

The tightening of credit lending conditions

New travel rules and routes

Consumer preference for experience over things

Mainland China's reopening

Middle Eastern and African travelers are exploring closer destinations

Emerging travel corridors are fueled by regional economic trends. While the top three outbound destinations are not in the region, in a new dynamic not seen in 2022, travelers are exploring destinations closer to home. This highlights diversification in the Middle East’s economy — in particular Saudi Arabia and Egypt — who made the top 10 ranking this year after not appearing in 2022.

This is thanks to a variety of factors, including: increased tourism investment efforts, development of leisure and cultural tourism offerings, expansion of air routes and strategic marketing campaigns.

In early 2023, the Middle East & Africa’s top 3 international travel destinations include the United Kingdom, the United States and the United Arab Emirates.

Leisure flight bookings in the United Arab Emirates were up 12% in March 2023 compared to March 2019

Leisure flight bookings in Israel were up 75% in March 2023 compared to March 2019

Business travel is recovering in the Middle East and Africa

Due to remote work and the uncertain macroeconomic environment, the recovery of business travel lags in comparison to leisure travel. Despite these challenges, demand for in-person business meetings remains robust with commercial flight bookings well above pre-pandemic levels. From 2021 through March 2023, countries where more people returned to their offices outperformed commercial flight bookings by a wide margin compared to their more remote-minded counterparts.

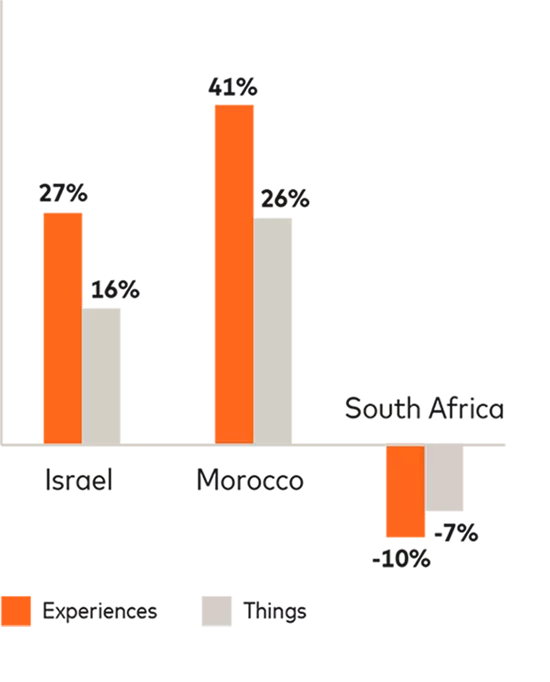

The Middle East and Africa looks to follow the rest of the world in experience-driven spending

Globally, a notable shift in preference emerged following the Covid-19 lockdowns, with travelers increasingly valuing experiences over material possessions. In the region, experiences-focused spending remains the outperformer — as seen in Israel and Morocco — suggesting that travelers are increasingly seeking authentic experiences in destinations across the world.

For an in-depth look and to learn more about the current state of global travel, click here to get access to Travel Industry Trends 2023.