How can you seize the opportunities technological shifts, customer behavior and competition?

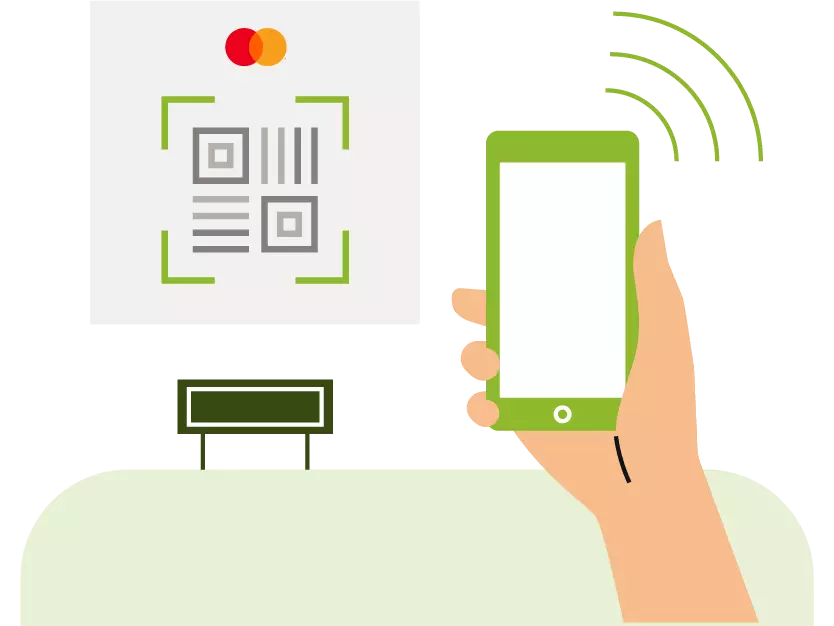

Financial institutions, merchants and technology providers are responding to these shifts with differentiated solutions to meet consumer demand.

Mastercard Advisors makes it easier with:

- Vast experience. We provide clients with deep expertise across the entire payment’s ecosystem from thousands of real-world engagements with financial institutions, fintech companies and merchants.

- Payments leadership. We have perspectives and solutions for the future of commerce tailored to our clients’ needs.

- Integrated solutions. We help clients tackle future challenges in the broader payments ecosystem with solutions that leverage our extensive global payments knowledge and generate valuable strategies across the value chain.

HOW WE HELP

We provide our clients with deep expertise across the entire payments spectrum, the right strategies to address these challenges and guidance to seize commercial opportunities.

FEATURED SOLUTIONS

An automated electronic clearing house in Latin America wanted to better compete with card-based and closed-loop competitors. It partnered with Mastercard payments consultants to implement a payments strategy that included four key phases: analysis of the operating models, exploration of global best practices, prioritization of opportunities and design of a detailed implementation plan. As a result, an additional $5 million in revenue was generated for the clearing house and 3B+ additional transactions in 5 years.

Customer story

Our team of Payments experts.

Peter Weitzel Senior vice president, Global Payments

Krishnan Ramdas Senior principal, Advisors Client Services

Related resources