By: Mark Drury, Ranjan Saha, Aditya Ray, Tushita Mittal and Kritika Nangia

Published: April 09, 2024 | Updated: October 29, 2025

Read time: 10 minutes

- Table of contents:

Introduction

As businesses run more digitally than ever -- from how they sell to how they interact with customers -- micro, small and medium-sized enterprises (MSMEs) have emerged as a prime focus of financial institutions for payment acceptance. Despite this segment’s size and significant economic contributions, MSMEs have historically not been the primary target for traditional acquirers.

Conservative risk underwriting policies, complex technical infrastructures, manual processes and relationship manager-focused support models have been long-standing commercial hurdles for traditional acquirers to establish the necessary business case for MSME-tailored products and service models. Instead, the primary small business go-to-market approach has been reverting to scaling down or price discounting of existing baseline solutions.

However, over the past decade, fintech companies and payment facilitators (PayFacs) have disrupted this space using their seamless and instantaneous digital merchant onboarding experience as a key differentiator.

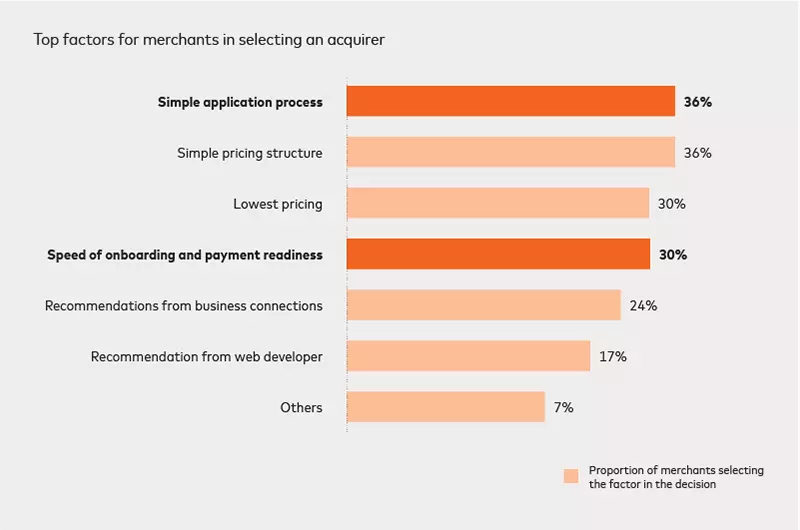

More importantly, they are simply responding to what MSMEs want in an onboarding experience. According to a survey conducted by Mastercard in Asia-Pacific in 2021, the onboarding experience is one of the top three factors MSMEs consider when determining their payment acceptance partner.

Fintech companies are attracting MSMEs as customers at a significant clip. Acquirers now realize the imminent danger of losing market share to these disruptors, risking revenue from merchant services and broader transaction banking and lending functions. Catching on to the MSME wave has become extremely important for acquirers. They now have an opportunity to attract and onboard MSMEs using a different approach from how they attract and onboard large enterprises.

Mastercard conducted independent research to understand how the merchant onboarding experience is evolving in the Asia-Pacific region.

- We interviewed more than 40 current and former employees across leading PayFacs and traditional acquirers to understand the state of merchant onboarding.

- We looked at what PayFacs and disruptive monoline acquirers are doing differently, and how their approaches impact the speed and cost of onboarding and needed technology.

- We also learned what it takes for traditional acquirers to revamp their onboarding process, including implementation in light of compliance and the technology investment required to rearchitect a host infrastructure.

The growing and digitally evolving MSME sector

MSMEs are the backbone of commerce worldwide, accounting for 90% of businesses, 60-70% of employment and 50% of GDP worldwide, according to the United Nations.

MSMEs globally faced tremendous survival challenges during Covid. Apart from supply chain disruptions, there was a massive demand shock with declining sales due to lockdowns. However, on the positive side, as MSMEs struggled to survive, it also led to an accelerated shift to do business digitally. Not only did existing MSMEs become digitally focused, but there was also a demonstrable surge in new online businesses.

The pandemic has also materially accelerated the digital maturity of consumers, including baby boomers and Gen Z, who are now equally reliant on the internet as millennials. Therefore, existing and new businesses had to evolve to survive and meet their growing audience and customer needs.

Impact on MSME businesses globally

How MSME’s select acquiring banks

As MSMEs evolve, so do their expectations of acquirers. They now expect instant payment enablement and superior onboarding experiences. In a Mastercard survey in Asia-Pacific, 30%-35% of merchants said onboarding time and a simple onboarding process were key considerations for selecting an acquirer.

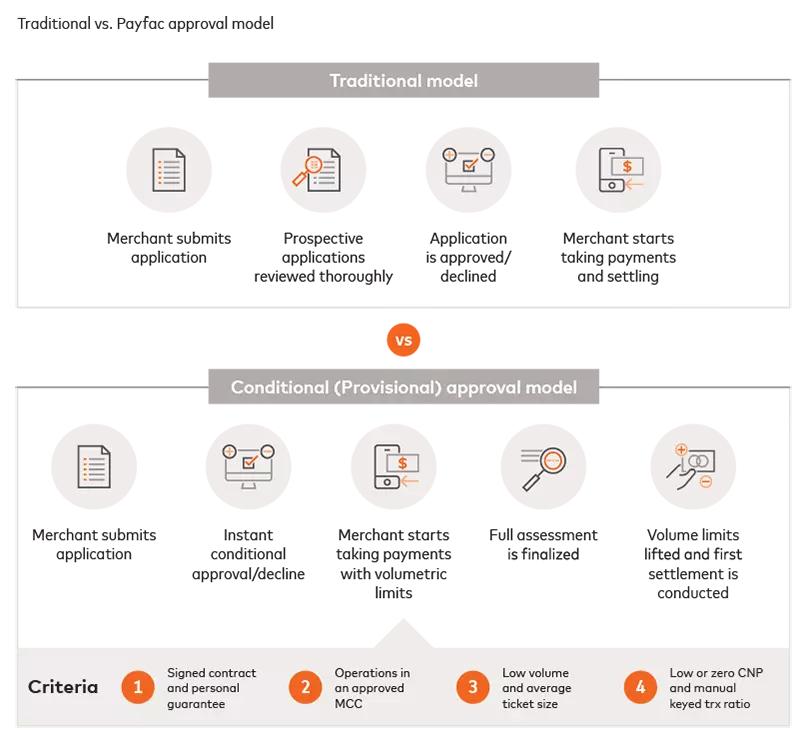

However, traditional acquirers still use legacy processes and systems for merchant onboarding. On average, it takes 3-7 days for a traditional acquirer to onboard a merchant, based on Mastercard’s study. Meanwhile, PayFacs offer onboarding in minutes (5-15 minutes), significantly faster than traditional acquirers, via automation and new point of interaction (POI) solutions.

How traditional acquirers onboard new merchants

Since the 1960s when electronic card payments were born, financial institutions globally have prioritized regulatory compliance and focused less on balancing the customer experience as the foundation of their merchant onboarding. Consequently, the high cost of customer acquisition and low-risk tolerance of traditional acquirers has:

- Made it challenging for MSMEs to offer electronic (card-based) payment acceptance

- Resulted in a journey of friction and extended delays (into weeks) before a merchant can commence trading

Most traditional acquirers’ merchant onboarding processes are manual, largely relying on phone interactions with merchants. About 80% of the applications flow through the IVR channel and bank enquiries. This process has significant friction, whereby the end-to-end process would typically require back-and-forth communication through emails, phone calls and potentially in-branch validation, adding to the complexity of the process.

On average, the process takes about 3-7 days for acquirers to complete. Some key elements complicating the onboarding process include the lack of a digital front-end portal and manual, often disconnected back-end systems/applications, including pricing calculations. Manual processes have an increased potential of human error.

Reliance on the signed contract agreement as the authority to perform necessary due diligence, and unclear messaging that application approvals are “conditional,” can often lead to suboptimal experiences. A merchant may think their merchant facility has been approved but then subsequently withdrawn, potentially permanently damaging a broader banking relationship as a consequence.

- Key steps in the merchant onboarding process

- Filling application

- Application should be designed to certain relevant fields

- Application flow should be seamless and document upload facility should be entirely digital

- Pre-screening

- Begin pre-screening process (sales)

- E-KYC and identify verification

- Verify identity of the business and its owners

- Authentication covers active and passive biometrics, document verification and new age practices such as video verification

- Merchant history check

- Merchant history check involves checking the track record of the business and its owners

- Business model analysis

- Analyze the merchant’s business model and operations

- Classify the business model into specific segments/risk categories

- Web content analysis

- Analyze merchant’s web presence

- Scan for red flags in the merchant’s web-based content

- Information security compliance

- Check that merchants comply with card network security requirements

- Risk underwriting

- Assess credit risk of merchants and score them based on their risk profiles

- Aim for automated underwriting for low-risk merchants and hybrid underwriting for medium-high risk merchants

- Account set-up/fulfillment

- Account set-up involves setting up accounts for accepting payments

- Set-up also involves POS terminal/GR set-up and downloading POS app for in-store businesses

- Fulfillment involves initiating data exchange with vendors and provisioning welcome collateral

Source: These insights are based on data obtained from websites of top acquires and Mastercard research conducted in 2022 to understand trends in merchant onboarding. The research methodology included conducting interviews with current and ex-employees of 4 acquirers and 6 PayFacs.

- Filling application

PayFacs have completely automated their merchant onboarding process

In the late 1990s to early 2000s, disruptors like PayPal, Square and Stripe surfaced. They focused on enabling the unserved needs of MSMEs by removing friction and resolving the economic viability challenges of traditional acquirers. The International Card Schemes (i.e., Mastercard and Visa) actively sought to maximize small-business inclusion and turbocharge this emerging ecosystem. They established the “Payment Facilitation Operating Model,” allowing for entities like Paypal, Square and Stripe, commonly called PayFacs.

PayFacs achieve a healthy trade-off between customer convenience and required due diligence, bringing down the onboarding time to 5-15 minutes for MSME merchants.

Starting with optimizing the application data entry for customers, they use a minimal upfront data collection approach. They move away from a “one-size-fits-all” approach and use decision-making rules to capture only the data that is necessary and appropriate through a dynamic and responsive application form for merchants.

The process runs on digital lines with minimal human interference, removing errors and subjectivity. Small merchants are assessed based on business information through well-established artificial intelligence/machine learning (AI/ML) rule engines and auto approvals. More than 80% of the applications are auto approved (with transaction volume limits), while manual intervention is only required for large, complex and high-risk merchants.

To perform downstream anti-money laundering (AML), know your customer (KYC) and compliance validation, PayFacs rely on enhanced due diligence and initial transaction monitoring. This allows them to conditionally approve an application and mitigate liability and exposure through dynamic mechanisms, such as delayed settlement for the first payout (7-14 days).

The risk assessment process is not limited to onboarding for PayFacs. They continuously monitor the merchants for unusual or fraudulent behavior via multiple data points post-onboarding. Based on a merchant’s performance, volumetric limits initially applied to the merchant may also be lifted.

Customer delight and customization are at the core of PayFacs. For example, recognizing that e-commerce consumers like to “try before they buy,” industry leaders instantly provide the business owner access to Test API Keys to immediately build their online experience. The integration progression is continually tracked to prompt at the right time. The application starts (if not already), avoiding delays in accepting payments.

With a significant dependency on AI/ML algorithms, the question is whether to build the capabilities in-house or partner with service providers. In the case of established PayFacs, most of the capabilities are built in-house as the key unique selling point (USP) and a key differentiator. However, for organizations graduating to a PayFac (e.g., an Independent Software Vendor embedding payment acceptance into the software solution), the need for platform-based, out-of-the-box “As a Service” models are increasing in demand.

Leading players onboard merchants in minutes using a fully digital process

The end-to-end workflow demonstrates the level of automation across the onboarding process that leading PayFacs use. On average, these players offer a sub-15-minute merchant onboarding experience. Sophisticated and propriety technology powers this experience, including a front-end portal to manage all merchant interactions and a powerful backend with advanced analytics and external database integrations.

Apart from enhancing the speed of onboarding, this process also considerably reduces the onboarding cost. While the average onboarding cost, including marketing and customer service, for a PayFac is $8, traditional acquirers need $250-350 on average to process an application.

As noted earlier, the speed of onboarding is not disregarding regulatory and scheme network rules compliance. However, there’s careful consideration (risk-based approach) for what and when data is captured. This application may vary and requires a balance between customer experience and due diligence drivers.

Traditional acquirers should consider building six core capability groups to offer an enhanced, more efficient merchant onboarding process. These include:

- Allowing merchants to seamlessly interact with their applications (application data entry)

- Rejecting merchants with bad credentials upfront (pre-screening)

- Automatically verifying merchant identity (identity verification)

- Automating credit risk decisions (credit risk underwriting)

- Accurately monitoring for AML and fraud (AML and fraud monitoring)

- Tracking merchant application status/KPIs (visual dashboards)

AI/ML-based algorithms enable instant verification and risk checks with minimal data input

1. Application data entry

A seamless front-end UI ensures data entry is one-time, minimal and customized. The information entered in the portal is scanned and instantly validated using AI/ML to highlight red flags. It enables instant risk assessment and, where required, solicits the applicant’s immediate approval of the mitigating strategy to underwrite the risk (e.g., delayed funding or rolling reserve).

Further, based on the user input, algorithms dynamically assess and identify key needs based on segment and industry type and then serve up tailored packaged services for immediate subscription as the final act of the onboarding process.

2. Pre-screening

Upfront risk assessment at the pre-screening stage is powered by advanced analytics, including device intelligence (real-time device identification), passive biometrics (analyzing inherent movements of a user, such as how they type, hold the device, move the mouse), and behavioral analytics (large behavioral networks with billions of merchant events monitored in a year). Acquirers mitigate cyber fraud via these mechanisms and enhance the user experience for returning application users.

3. Identity verification

Real-time verification and data integration-based KYC deliver speed and higher accuracy. Automated KYC integrates with third-party APIs (Equifax, Ekata), bureaus and government agencies to search creditworthiness and criminal records. These insights validate the merchant and their business.

4. Credit risk underwriting

AI-ML-based rule engines help generate risk scorecards for merchant applicants based on integrated data from multiple sources. These scorecards significantly reduce the efforts of credit risk decision managers and speed up the onboarding process.

5. AML and fraud monitoring

Transactional monitoring using real-time data to identify abnormal behavior patterns reviews AML compliance and prevents fraud from onboarded merchants. Pre-built adapters quicken integration between banks, third-party systems, credit bureaus and social media.

6. Visual dashboards

Interactive dashboards provide a dedicated engagement channel for merchants throughout their onboarding journey, and a dedicated acquirer view. It provides a holistic view of the merchant’s in-flight status across the onboarding funnel, and a deep-dive view of individual merchant KPIs and case management actions, such as human decisioning for complex and anomalous cases.

The way forward

Steps traditional acquirers can take to optimize their onboarding process

With the focus of acquirers shifting towards MSMEs and PayFacs catering to merchants with quick onboarding, traditional banks need to enhance their onboarding process by automating end-to-end wherever possible and reducing manual efforts.

This optimization journey for traditional banks starts with utilizing a dynamic application form, which enables a customized application data entry experience for merchants. At the backend, this form should be linked with systems that perform KYC/ AML validation and risk assessment and recommend appropriate bundled subscription services to merchants in real-time. Risk assessment continues throughout the merchant lifecycle via transaction monitoring and other sources, such as social media.

Data science and highly sophisticated AI/ML neural networks underpin automation in the onboarding process. This requires an end-to-end assessment to inform whether achieving the optimized target state requires a wholesale replacement of the existing process or a subset of the specific modular parts (noting the six key functional elements of the onboarding flow). The secondary decision considers the build/buy/partner pathway, driven by existing internal capabilities, investment appetite and go-to-market timelines.

Mastercard Services can help acquirers enhance their digital merchant onboarding through a complete end-to-end managed solution or a hybrid model for selected niche services embedded to optimize existing workflows. To learn more, please reach out to your Mastercard representative or contact us directly.