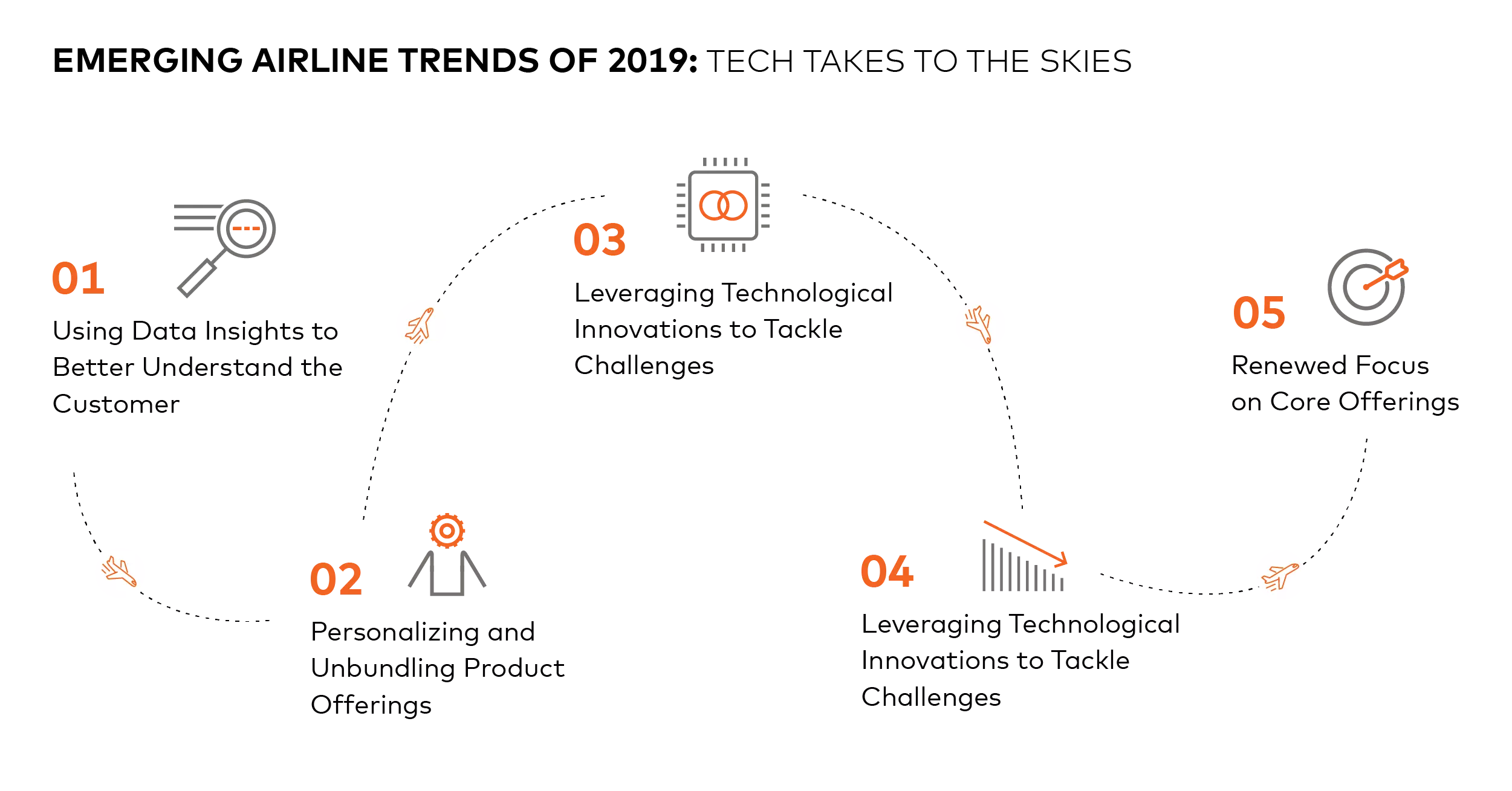

Emerging Airline Trends of 2019: Tech Takes to the Skies

Core offerings and operational improvements are the forces behind airline trends this year

More than ever before, airlines have doubled down on their commitment to deliver amazing in-flight experiences and capture customer loyalty. Almost all operators recognize the importance of improving customer touchpoints, services, and loyalty offerings. However, when it comes to what to expect in 2019 from airlines, players should work to bring their commitment to the guest experience to life.

Here's a look at what's in store for the travel industry this year.

Using Data Insights to Better Understand the Customer

The days of popping into the local travel agency to book your summer holiday are pretty much over, and as consumers move the research, booking and travel processes online, they're creating a mass of data insights on preferences and habits.

Airlines who understand the goldmine this represents are incorporating data insights into their strategy. Airline trends in 2019 demonstrate the many different ways these new data points can be leveraged to better understand customer behavior and how different actions—such as a promotional offer or a new service channel—impact not only short-term revenue but also long-term customer satisfaction and loyalty.

Yet gathering data and conducting analysis is not seamless, nor is it simple—just the sheer quantity of new data sources poses a huge challenge to airlines. Regulations, siloed data sets and lack of resources and knowledge all complicate efforts, too. Data collection is often fragmented, and the resulting data is not properly cleansed nor is it aggregated in a way that's easily accessible to decision-makers. There's also the question of interpreting the behavior of customer segments based on data insights—for example, did customers who cashed out of the loyalty program do so due to a bad experience, or is could they be looking for further engagement?

The airlines leading the way with data analysis are unifying large data sets to unlock significant value, particularly when using those insights to improve customer-facing initiatives. They know that near real-time data collection and analysis is critical to keep up with the market, and they know how to use the data insights to identify, capture and retain high-value customer segments.

Personalizing and Unbundling Product Offerings

Unbundling has been a tactic among airlines for years. By allowing passengers to pick and choose services, airlines provide the flexibility that customers want while benefiting from ancillary revenue and additional insights that can be used to inform their business strategy—and the race is on for the budget-conscious traveler.

In 2019, it's clear that customization is king. It's proving to be a winning strategy, especially for affluent travelers. Airlines have seen an increase in revenue coming from premium seat upsells, attributed to the sophisticated ways they can create traveler segments and deliver higher-quality products for those willing to pay more. But it's also appealing to the budget-conscious traveler. British Airways launched an unbundled long-haul economy fare in April 2018 that doesn't include checked baggage or a choice of seat, but passengers can pay to add those extras. Airlines are also personalizing the whole travel journey outside of the flight—services like fast tracks, priority boarding, lounge access, local transportation, and hotel or local partner services are becoming more common.

Customers now curate all aspects of their journey, and as a result, ancillaries are an increasing percentage of total revenue. The next step will be optimizing and updating management systems, such as total revenue based seat allocations, to put data insights to work. That way, airlines can understand what different customer segments want, and how and when they want it, and then leverage technology to offer personalization at all points to capitalize on those revenue opportunities.

Leveraging Technological Innovations to Tackle Challenges

Airlines have been quick in recent years to incorporate technology into customer service, but new technological developments in data collection, operations, platforms, and sales channels are now revolutionizing the travel industry.

Passengers see the change through amenities like access to free Wi-Fi on flights with Delta, enabling the use of personal devices instead of supplied screens for entertainment in-flight, or AI-enabled chatbots. But it's behind the scenes where a real revolution is underway.

The largest domestic airline in Russia, S7, has partnered with a regional bank to switch their ticketing system to a blockchain solution. JetBlue is using facial recognition at some destinations to match TSA and passport files, while Air New Zealand is testing the use of Microsoft HoloLens for training cabin crew. Even the aircrafts themselves are getting the high-tech treatment, with EasyJet using an AI-based simulation tool to help with day-to-day maintenance planning.

Travel companies have been investing in different technologies to try to gain a competitive edge, but the challenge lies in determining where investment should focus. What will add the most value operationally or experientially, and what is just a passing fad? Are customers more interested in new seats with extra legroom or an airline that remembers their drink, meal, and entertainment preferences? When considering which initiatives to prioritize, airlines must first understand the predicted impact by employing small-scale testing.

Emphasizing Cost Reduction Initiatives

All of this strategizing costs money, though, and airlines already face increasing fuel costs and mounting revenue pressures. Margins are squeezed and customers are becoming more demanding.

One way some global players are tackling this challenge is through targeting their bookings made through OTAs. British Airways has introduced fees for bookings "outside the system," with others close behind them. It's expected the industry-supported IATA New Distribution Capability will further drive the move to direct online booking, reducing distribution costs for airlines who must pay commission to OTAs. A report by IATA asserts that by 2021, "airline distribution will evolve from its current passive, rigid and technology-centric state to a more flexible, dynamic, and passenger-centric environment."

But these cost reduction initiatives don't just focus on distribution. Airlines are also looking into capacity adjustments, canceling or reducing the frequency of thin routes, and outsourcing services to reduce operational costs. While the focus remains on reducing controllable costs, airlines should also look to proactively manage costs with tracking and early warning tools. Likewise, a critical analysis of current fraud, declines, and chargeback levels compared to peer industries can help identify initiatives to reduce these costly events.

Renewed Focus on Core Offerings

Airlines are looking for ways to win consumer goodwill by redoubling efforts on core offerings. The focus for 2019, then, is the true function of an airline: getting people from A to B, safely and on time. Operations and reliability must be the primary concern, especially timely performance in congested markets.

To help EasyJet focus on its core strategy of loyalty, holidays, and business customers, it hired its first chief data officer this year after a pledge to become "the most data-driven airline in the world." Eastern European low-cost carrier Wizz Air continues to grow with its simple, no-frills offering, while others have heavily analyzed trends to retool capacity.

So while there is plenty of technology available to understand the customer and personalize their journey, tackle operational challenges, and reduce costs, none of this will matter if the core purpose of an airline is not in focus. By using strong, relevant analytics, testing and learning, and rigorously evaluating business performance, airlines can move through the coming year to improve business performance and build a better experience for passengers.