By: Apurv Bhatnagar, Daniel Varkonyi and David Baron

Published: June 03, 2024 | Updated: June 05, 2024

Read time: 2 minutes

Tap on Phone has the potential to transform the acceptance landscape for both merchants and acquirers.

The technology – otherwise known as software-based point-of-sale, or SoftPOS – enables businesses to accept contactless payments quickly and securely on NFC-enabled smart devices, such as smartphones and tablets. By leveraging software-based solutions, businesses can streamline operations, enhance customer experiences and unlock new avenues for growth.

Read the latest Market Trends report to learn what sets winning Tap on Phone solutions apart.

Evolution of acceptance landscape

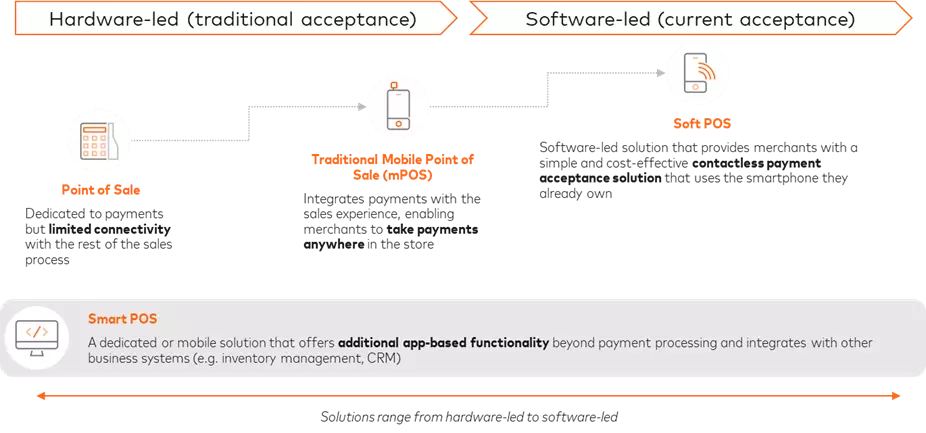

Over the past decade, the acceptance landscape has evolved rapidly, enabling greater convenience, lower costs and additional services.

Although dedicated Point of Sale (POS) is still the leading form of acceptance…

- >2/3rds of total installed digital acceptance solutions in 2023 were POS terminals

…adoption of software-based acceptance solutions has accelerated, disrupting traditional models

- 33% growth in number of smartphones globally using Tap on Phone between 2023 and 2024*

- >50% growth in global transaction value processed through Tap on Phone between 2023 and 2024*

- 71% of surveyed merchants think that Tap on Phone will become a leading form of acceptance in the future

Tap on Phone benefits and use cases

Tap on Phone acceptance solutions enable a range of new and enhanced benefits for all players in the payments ecosystem…

Acquirers

- Better merchant experience

- Reach untapped segments

- Transaction efficiency and lower cost

Merchants

- Provide customers choice at checkout

- Potential for more sales and revenues

- Quick & easy set-up and deployment of solutions

Customers

- More product and payment options

- Convenience and transparency

- Safer and more secure payment experience

…and empower merchants of all sizes with new use cases, including:

Making Tap on Phone deployments a success

A Mastercard Advisors analysis of more than 100 Tap on Phone design and deployment engagements identified four key success factors.

- Identifying the right problem to solve

- Validating the value proposition

- Designing an effective go-to-market strategy

- Securing critical mass of participation from merchants and consumers

- Ensuring easy onboarding and merchant education

- Creating streamlined and user-friendly merchant onboarding experience

- Avoiding the execution gap

- Ensuring investment and commitment to effective deployment

Read the full Tap on Phone report to access all the insights from the Mastercard Advisors’ latest analysis and key tips for success.