By: Sheridan Stavac, Christian Hylander and Gustavo Bruno Giannetti

Published: June 10, 2024 | Updated: October 29, 2025

Read time: 8 minutes

- Table of contents

What are ancillaries in the airline industry?

Seats with additional legroom. Extra baggage. Lounge access. Trip insurance.

Ancillaries are additional products and services that airlines offer beyond the base airfare. More than an “extra,” ancillaries have become a significant source of revenue for airlines. This approach gives the airlines healthier margins and has become strategically important.

Rising leasing costs for aircraft, increasing training costs for pilots and crews and fluctuating fuel prices have put pressure on airlines to find ways to grow revenues without incurring additional costs. Ever since lower-cost airlines such as Southwest and Ryanair disrupted the market with their unbundled fares, traditional carriers have followed suit, looking to stay competitive and investing in New Distribution Capability (NDC).

A shift is under way, and it promises a better, more personalized customer experience, along with potential for new revenue streams. However, there are also challenges that airlines face in offering ancillary services. Customer satisfaction and loyalty can be affected if customers perceive ancillaries as hidden fees or unfair charges.

How can airlines capitalize on the revenue opportunity and enhance the customer experience? Let’s start by looking at the current landscape for ancillaries and how they’re growing globally.

The ancillary landscape and key metrics

As the travel industry recovers, it’s looking for new and different revenue drivers. For their part, travelers are looking for ways to enhance their travel experience and take more control. Ancillaries play a key role in those goals and over the past several years, ancillary revenues have rebounded. In late 2023, travel industry firms CarTrawler and The IdeaWorks Company projected that airline ancillary revenue would increase to $117.9 billion worldwide for 2023. That would represent a 275% increase over ancillary revenues in 2013, which were $31.5 billion.

While ancillaries are growing overall, ancillaries per passenger ticked down in 2023 significantly. In 2024 and beyond, airlines will focus on maximizing ancillaries per person. Although other factors such as increases in average ticket price can influence customer behavior, it’s important to keep a special focus on ancillaries.

As they progress in the journey to ancillary services maturity, airlines will look to define new products, determine prices by service and customer behavior and balance revenue opportunity with the customer experience. They’ll ask:

- What are the right price points?

- How can we reach various customer segments?

- How can we market our ancillaries in the most appealing way to travelers?

A laundry list of add-ons isn’t enough. Airlines will look to balance revenue opportunity and the customer experience.

Trends toward enhanced personalization, digitalization and a connected cabin experience can be addressed by offering the right ancillaries at the right prices through the right channels. Everyone is competing to own the customer journey and ancillary services can drive loyalty. By incorporating discounts, point redemption and accelerated points accrual, airlines can appeal to cost-conscious customers with ancillary purchases for enhanced loyalty.

But challenges are part of the ancillaries landscape, too. They include complex data management, effectively targeting customer segments and ensuring cost efficiency.

Stages of maturity

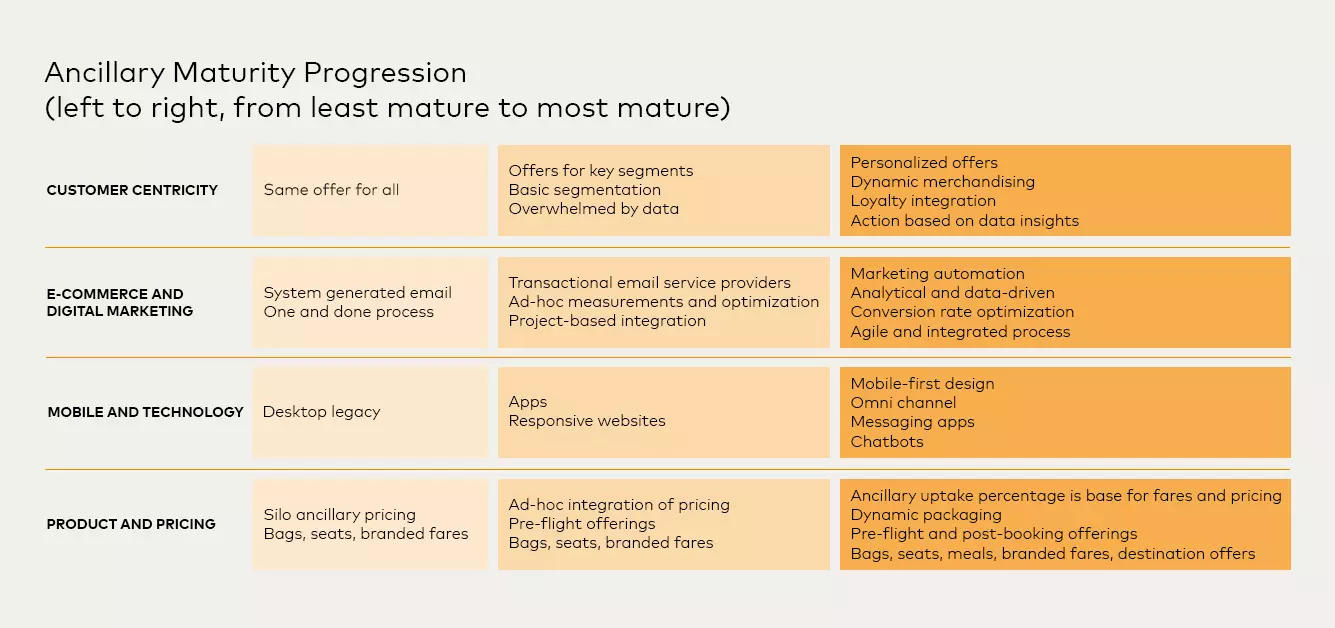

There are well-defined differences in the ancillary maturity levels of airlines. Using the drivers of success, we can see a progression from the early stages to middle stages and finally, the advanced stages.

Airlines in earlier stages are still working on segmenting audiences for offers, managing data or developing an app. Solutions that can contribute to improving capabilities so they can achieve next levels, including external data expertise, can be a game changer in the process. But no matter what stage airlines are in, the essential first step is to understand where they stand. That way, the next steps forward will be clear, enabling them to optimize the drive to increase revenue along with improving the customer experience.

The four drivers of success

Ancillaries are a viable way for airlines to add another revenue stream – but only if it’s done right. What airlines offer must match the customer’s expectations. If airlines don’t deliver on the experience, they risk losing out to competitors the next time. Here’s how you can deliver on the promise of your ancillaries. To succeed, airlines must master these four drivers.

Customer centricity

Customers are seeking more personalized interactions and ancillary services are directly aligned with that desire. Ancillaries allow travelers to customize their travel experience. Customers take more control over pricing by only paying for what they value most. For example, seat selection, in-flight meals and travel insurance provide added convenience and peace of mind. The ability of the airline organization to understand customers’ situations, perceptions and expectations will help in anticipating the customer’s wants and needs.

Product and pricing

What’s on your menu of ancillary options and are you pricing them optimally? Airlines are looking to understand customer needs and get to the market first with innovative offers. By focusing on the needs and preferences of the customer, airlines can build lasting relationships and drive growth. Beyond the standard ancillaries such as extra baggage, seat upgrades and meals, airlines want to offer options to surprise and delight customers.

Japan Airlines is piloting a new service, “Any Wear, Anywhere,” for passengers to rent the clothes they need for their trip. Passengers order clothing for delivery to their hotel or vacation rental. Clothes are picked up for laundering when they leave. Passengers get to enjoy traveling lighter and the airline improves sustainability when they cut their carbon emissions by carrying less passenger baggage. Hungary-based Wizz Air is innovating by partnering with Breeze to offer “Wizz eSIM” mobile data bundles. Passengers can enjoy competitively priced data packages, with data access wherever they travel. And Frontier Airlines is using a subscription model that offers flyers exclusive discounts and benefits such as Kids Fly Free and costs $59.99 a year.

Successful pricing centers on not only knowing the direct and indirect costs of providing your ancillaries but on your customers’ perception of their value. Only once airlines have a good grasp on cost factors such as materials and labor plus an understanding of the customer’s perception of convenience, quality and the potential demand can pricing be done successfully. Intelligent test-and-learn experimentation can help to identify winning products and the right price points to ensure a positive outcome.

- What’s the role of “freemium” products and services?

Airlines might see “free” as a competitive advantage, but they need to be clear on what’s pure give-away and what “freemium” offerings would give them an edge. Using business experimentation can support airlines’ efforts by enabling them to test in small portions and see how the offering performs. If the result is positive, then it makes sense to scale. If it’s negative, then it’s best to revert to the original offering.

Let’s take Wi-Fi as another example. Airlines might give free Wi-Fi for messaging only or restrict it for part of the flight or to some specific data usage. For example, a Taiwan-based airline has provided 30 minutes of free Wi-Fi for all cabin classes. But Singapore Airlines has given free Wi-Fi for Suites, First Class and Business Class (as well as PPS Club members and supplementary cardholders and KrisFlyer members).

Once the airline has customers using its Wi-Fi, the customer will still feel restricted when compared to how they typically use their smartphone, creating an opportunity to upsell for other Wi-Fi plans like unlimited data access (beyond message or full flight duration). Which one is more profitable in the short-term? And which one is more profitable in the longer term? Customer-centricity is part of the equation, but airlines are also looking to stimulate the usage of other plans, aiming for greater profitability around that passenger.

- Customer story: Bid for upgrade

Opportunity

- A large global airline lowered the minimum bid price for business class upgrades for premium economy ticketholders in a subset of eligible flights.

Results

- Mastercard Test & Learn® found that there was no significant impact to revenue overall, as the increase in bid volume was offset by a decrease in average bid amount.

- However, segmenting the results, the software discovered the program drove a positive impact for flights with a higher percentage of business travelers and those not originating from a hub airport.

- Combining these drivers into a predictive model, Test & Learn identified the 30% of eligible flights for which the change would be profitable.

Direct sales and merchandising

How do you display ancillaries to the right customers, via the right sales channels? While you may be displaying the ancillaries in the booking direct sale, can you also recommend the right ancillaries at the right moment in your customer’s path to purchase?

Dynamic merchandising and pricing, the inclusion of third-party content and the use of recommendation engines and predictive analysis to enhance the customer experience are essential to getting the right offers to the right customers. For example, rather than offering Unaccompanied Travel Service to a 30-year-old solo traveler, what if the airline offered booking flexibility?

Some airlines are expanding ancillary offerings to go beyond the flight to include every step in the customer travel experience, from airport ground transportation to hotel bookings. Air France offers its customers preferred parking at competitive rates, along with additional services such as valet, car wash and car maintenance.

The importance of direct channels, user experience and the role of digital touchpoints in engaging customers cannot be overstated. Rather than displaying a laundry list of ever-expanding offerings, website optimization and personalization enable airlines to show the most relevant offerings to the right customer based on preferences they have shared with the website. The direct channel of the checkout experience is also a key touchpoint for optimizing ancillaries as this is the time the customer is planning their flight. By understanding important customer touchpoints, airlines can offer relevant and compelling ancillaries that enhance the travel experience.

Omnichannel strategy

Customers switch seamlessly between multiple channels including email, mobile and in-app communications, SMS and in-person channels. Are you meeting customers with the right messages at the right time? Deploying omnichannel strategies will enable you to deliver the right message via the right channel with the right timing. The importance of customer communication across the customer journey in a way that feels personal, natural and connected.

The mobile channel is being leveraged by more airlines to deliver ancillary products and services, such as in-flight meal ordering via a mobile app. Or, when a passenger is in the airport prior to the flight or even at the check-in kiosk, airlines are using mobile app notifications permissioned by the customer to offer them ancillaries. A passenger who checks in three hours before a flight is known to be more likely to buy a pass to the lounge than someone who checks in 90 minutes before their flight. If the app has user-permissioned geolocated the early-arriving passenger, there is an opportunity to offer the option of lounge access.

- Customer story: Optimizing excess luggage fees

Opportunity

- An airline looking to increase their ancillary revenue tested two different excess luggage pricing strategies: a light discount and a heavy discount.

Results

- Mastercard Test & Learn® revealed that overall, the light discount drove an 18% decrease in excess luggage revenue as the increase in quantity did not offset the depth of the price discount.

- In contrast, the heavy discount drove a 38% sustained increase in excess luggage revenue.

- Diving deeper, the software identified that flights with lower previous check-in satisfaction scores and percentage prepaid luggage purchases responded best to the heavy discount.

- Test & Learn used these drivers to build a model and target the discounts to only the flights expected to respond profitably, generating $3MM in incremental excess luggage revenue.

Conclusion

While airlines seek to increase revenues and remain competitive, the customer experience and value proposition must remain front and center. Airlines can maximize their ancillary revenues offering customer value, personalizing the product offering and the timing of the messaging and carefully considering the right price points. The potential of ancillaries is great and those who succeed will be the ones who master the four drivers of success: product and pricing, direct channel and digital marketing, mobile and technology and customer centricity. Each airline is at its own stage of development with ancillaries and the future is bright for those who continue down the road to maturity.

- Report contributors

Greg Chi, Casper Hsieh, Paaras Kantaria