Brick-and-mortar retail is adapting to a new role alongside a growing e-commerce market

In recent years, the term "retail apocalypse" surfaced in the media, quickly becoming so prevalent that a movement of industry leaders emerged, dedicated to debunking it.

While admittedly sensational, the ominous retail headlines seemed to have some basis in fact. The high-profile demise of several incumbent retail industry players in 2018 accounted for the closing of thousands of stores. Meanwhile, strategic closures by numerous department store giants and shopping mall staples continue to drive the total number of closures upward.

In contrast, online transactions represented 13% of total retail sales volume and 49.4% of its total growth in 2017. Many observers have attributed this growth to the relentless pressure online retailers have created in terms of price, product selection and compelling shopping experiences.

However, the dramatic growth of online sales does not mean physical retail is dead. While there has been a record number of store closures, there has also been a record number of store openings. Taking into account reported plans of e-commerce institutions to open physical locations, as well as the boom in discount retail, it is clear that there is something more complex and dynamic happening with brick-and-mortar retail.

Brick-and-Mortar by the Numbers

When surveyed, 47% of retail executives reported significant competition from online-only businesses, and 37% indicated moderate competition. About 60% noted that they've been forced to close physical stores due to the competition, and only a third of those affected have been able to leverage online transactions to recover more than 25% of lost sales.

For the most part, though, executives have a clear-eyed view of the causes behind these trends, citing pricing, delivery speed, marketing and brand recognition as factors that give e-commerce businesses an edge.

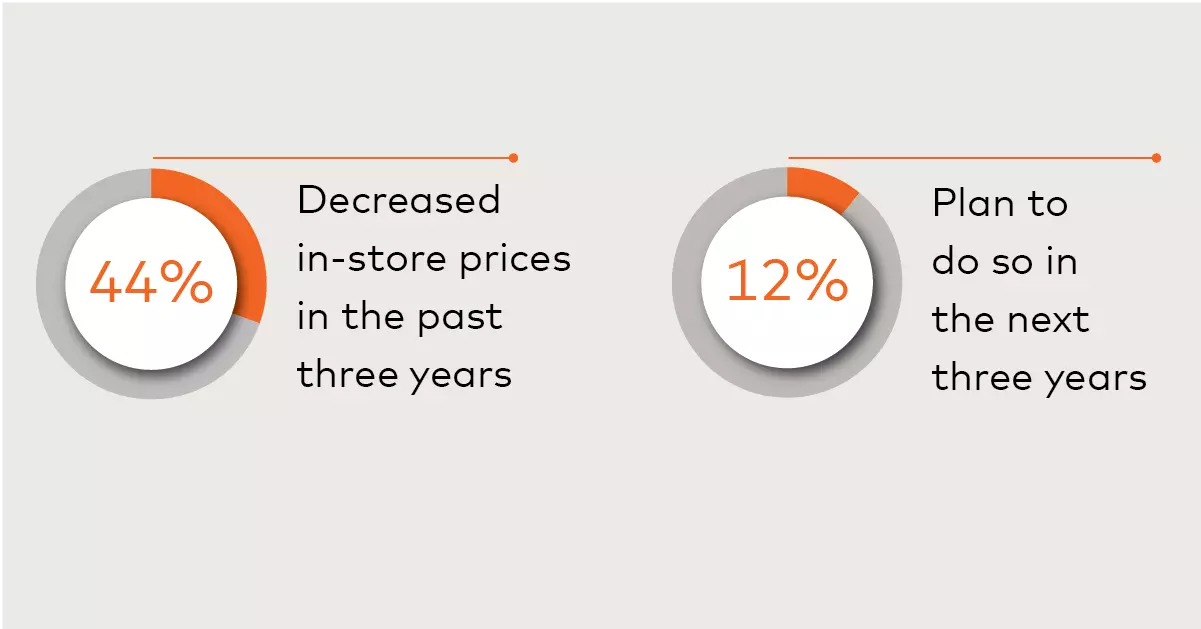

In response to the growing online threat, retailers are pushing to address these challenges with reduced prices, an enhanced omnichannel presence, and a stronger in-store experience. Three-quarters of those surveyed have increased their investment in online channels and 44% have decreased in-store prices in the past three years, with another 12% planning to do so in the next three years. Respondents also report investing significantly in staff training (70%), increasing their product range (68%) and simplifying checkout (61%).

In addition to these changes, physical retailers are also leveraging their brick-and-mortar advantage over pure-play e-commerce sites by offering cross-channel shopping experiences — such as buy-online-pickup-in-store and buy-online-return-in-store — as a way to drive more in-store traffic. The store is no longer just a channel for buying and selling — it's a fulfillment center, an experience and an incredible touchpoint between customer and brand.

A Bright Future for Physical Retail Stores

Physical retail is not dead — only physical retail that does not strategically evolve in the face of changing shopper preferences and new technologies are on the decline. Those that recognize the importance of innovating the customer experience across channels are not just surviving in the evolving retail landscape. They're thriving.

Moving forward, it's important that retailers recognize physical and digital stores as symbiotic components of a singular retail enterprise. In fact, many often see increases in e-commerce business after opening physical stores in a particular geography. On the flip side, a strong online presence can drive traffic in-store, as customers seek to try before they buy.

Still, retailers are in a new era for the physical store, facing difficult decisions on which stores to close, and where and how to open new ones. As the role of physical stores continues to change, it's important that retailers re-evaluate and optimize their networks.

My colleague Kamal Parida and I, co-authors of the white paper "Critical Network Strategy Decisions: How to Drive Value with Analytics," argue that large retailers must now also take into account the impact of store openings and closures on their digital channels, as well as on customer retention and acquisition. Other key areas of managerial concern include:

Identifying stores that are top candidates for closure in each market, based on total network profitability and customer success metrics

Defining marketing strategies to successfully retain customers of closed stores

Defining strategies to win over customers from competitors who close stores nearby

Above all, a data-driven approach that considers traditional data sources, such as store sales performance, in combination with anonymized, aggregated transaction data and advanced analytical solutions, is imperative when making decisions like whether or not to close a store. Take the time to run the numbers and go through them with a fine-tooth comb. Data insights can give retailers the confidence to make strategic decisions that drive traffic, support growth, and not only survive, but thrive with brick-and-mortar.