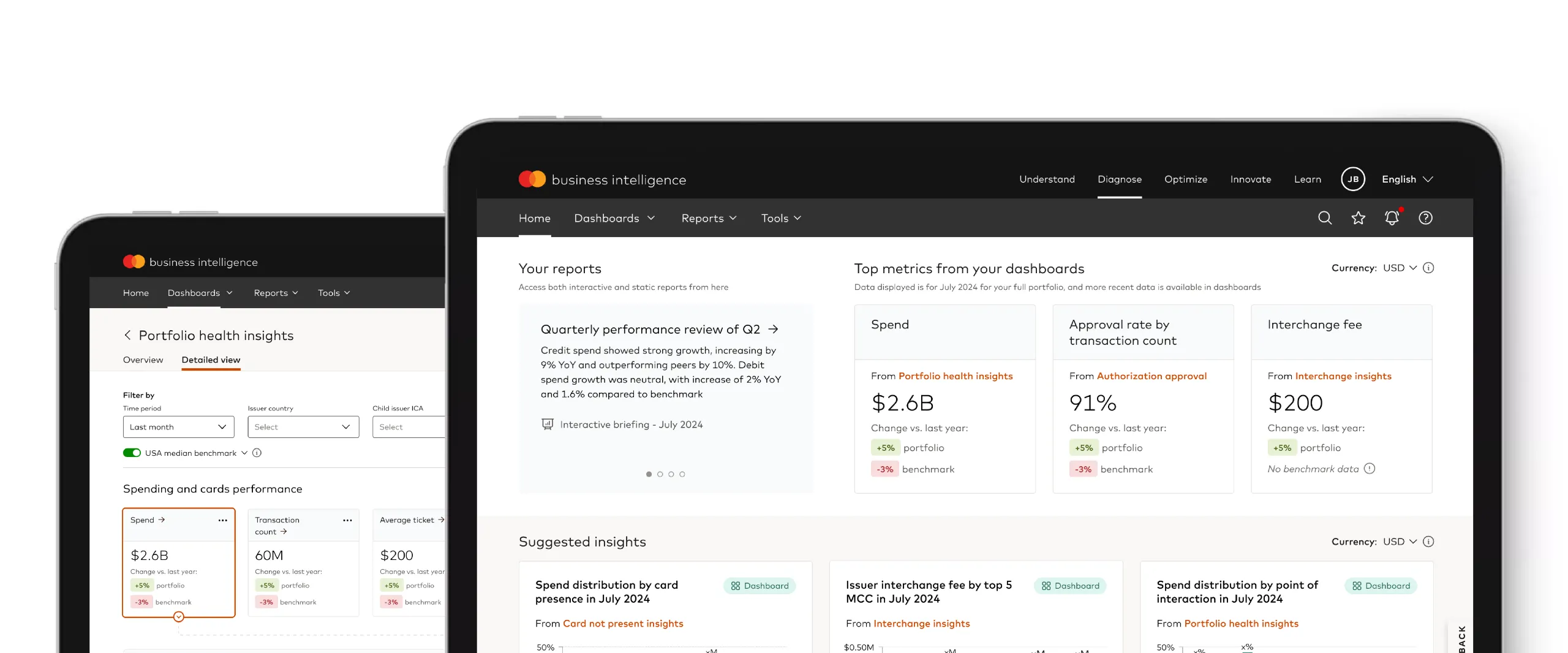

The Mastercard Intelligence Center1 (MIC) is a web-based, self-service analytics platform that empowers issuers with actionable portfolio insights for faster, data-driven decision-making.

MIC provides near real-time business intelligence through centralized payment analytics, actionable insights and competitive benchmarks .

MIC empowers issuers through the following:

A leading U.S. issuer noticed that spend in its largest co-brand portfolio was declining. It knew the merchant partner was experiencing overall sales declines and wanted to uncover if the portfolio decline was due to lower spend at the merchant or customer attrition. The issuer leveraged MIC to understand the causes of the decline and target underperforming segments with spend campaigns . MIC enabled the issuer to identify a specific industry and customer segment to reach with campaigns to increase spend levels.

Related resources