Chronicles of the New Normal: Contactless Staying Power

Let us imagine we are in 2021, and the world has left behind the worst of Covid-19. No doubt, life has changed, and governments, companies and individuals are adapting to a “new normal.”

Our Chronicles series will help readers understand what is likely to be different in a post-Covid-19 world. We will also look at how players in the payments ecosystem are already adapting today to successfully emerge from this unprecedented shock to the economy and our daily lives.

This week we are focusing on contactless – “tap and pay” transactions where a shopper’s card, phone or smartwatch is enabled with RFID technology and waved over a chip-enabled reader to make a purchase.

This topic was front-of-mind before the pandemic as consumers sought speed and convenience to enhance their purchasing experience without sacrificing safety and security. The global spread of a virus with no cure or vaccine at present has raised the consciousness of personal hygiene to new levels, and that includes payment form factors. Consumers are thinking more about the things they touch, such as where the item has been, whether its surface can retain germs, and for how long.

We hypothesize that recent habits created by using contactless technology will persist, even after the virus wanes.

The Trend is Ubiquitous

Storylines emerged during the pandemic regarding how people completed purchases. Between February and March, contactless transactions grew twice as fast as non-contactless transactions in the grocery and drug store categories, according to a consumer poll conducted by Mastercard in April 2020 that studied changing behaviors among 17,000 consumers in 19 countries. And 79% of respondents worldwide say they are using contactless payments, citing safety and cleanliness.

In fact, 82% viewed contactless as the cleaner way to pay, and 74% said they would continue to use contactless payments post-pandemic. Furthermore, nearly half of respondents (46%) have swapped out their top-of-wallet card for one that offers contactless, climbing to 52% among people under age 35.

Much of the rise in contactless payments were new users. In another independent study of US consumers conducted by RTi Research in April 2020, 30% of responders used contactless payment methods for the first time after Covid-19 started, with 70% of those newer users indicating they will continue to use contactless methods after Covid-19 ends.

"No geographic region was immune from a reduction in consumer credit card purchase volume or a growing penetration of contactless share of volume."

While the timing and magnitude of the trends may vary, Mastercard data for April 2020 vs. 2019 suggests that no geographic region was immune from a reduction in consumer credit card purchase volume or a growing penetration of contactless share of volume.

The consumer shift towards contactless has impacted other payment forms like cash. This is not surprising since cash and contactless are typically used for smaller purchase amounts. Between the start and end of the confinement period, the Central Bank of France noted that ATM cash withdrawals saw a 50% decrease in transactions and a 40% decrease in value. And while the verdict is out whether this shift in consumer behavior will persist as French shops begin to reopen, ATM cash withdrawal value is still down 20% in transactions and 10% in value, according to the French Central Bank. This has been a trend in many other European countries, where cash use has declined significantly during the pandemic, according to the Financial Times.

Situational circumstances may also inform specific regional changes. For example, a case can be made that India’s 2016 demonetization is a bellwether for how change to current payment behaviors may transpire. Demonetization is arguably the event that stimulated the transition from a cash economy to a digitally enabled economy. This notion is based in part on an 84% spike in debit card usage in response to demonetization. Triple-digit increases occurred in both the number and value of transactions among existing but infrequent debit cardholders before demonetization.

The impacts of a global pandemic may have as profound an effect on payment behavior as India’s voluntary elimination of certain denominations of currency as an anti-fraud measure.

Several major US issuers began to rollout contactless in the second half of 2019, building on existing efforts to make the technology available to consumers since 2017.

Card networks are also contributing. Mastercard is raising payment limits on contactless purchases across markets on six continents. This includes 29 countries in Europe, including a 50% limit increase in the UK, a 200% increase in Hungary, a 250% increase in Croatia, and a 375%+ increase in Uzbekistan.

How Banks and Merchants Can Accelerate Contactless Adoption Post-Covid-19

Various approaches to accelerate contactless can be considered across the payments landscape.

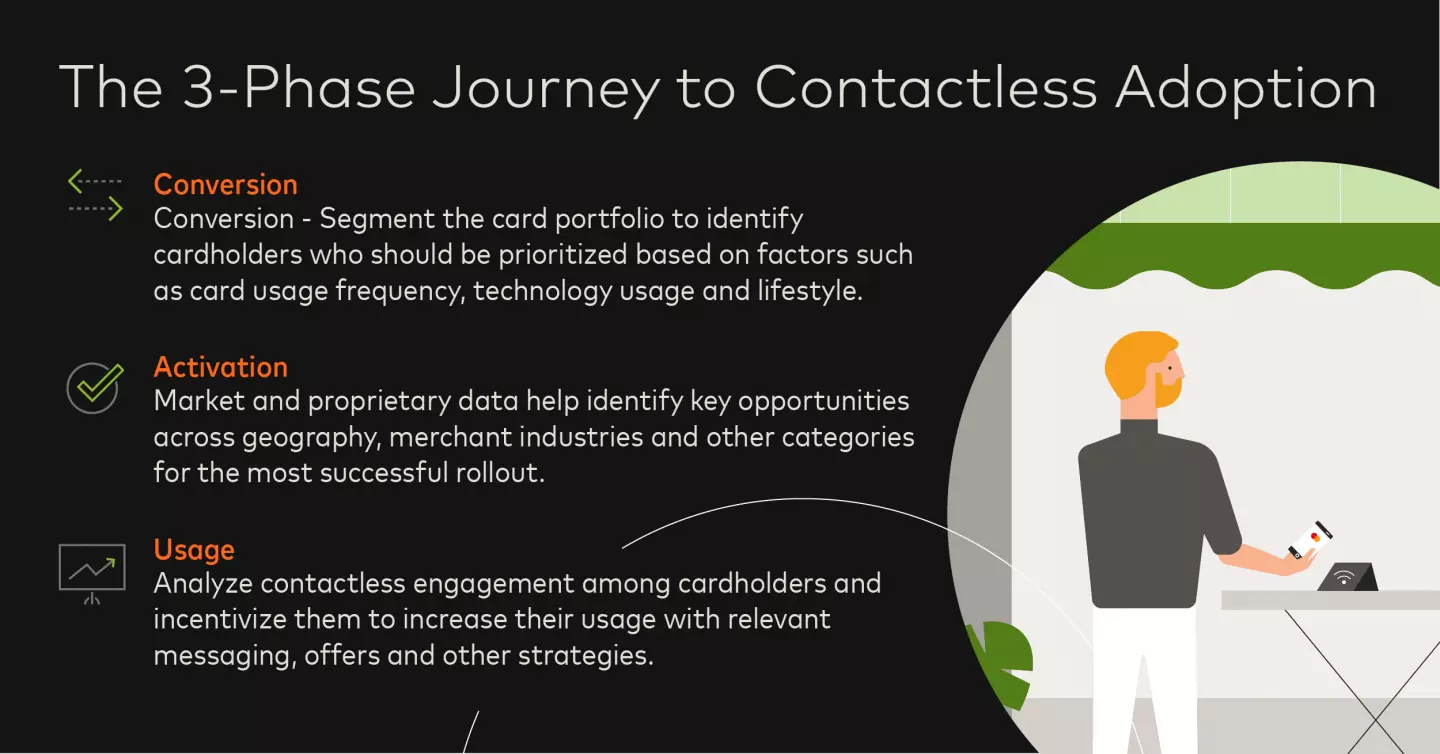

Issuers may undertake lifecycle marketing approaches by developing data-driven strategies for a contactless value proposition. The approach could include segmentation, targeting and messaging that are applied consistently across the card lifecycle from acquisition through retention.

Issuers can use a methodology to accelerate each cardholder’s progress to their highest potential level of contactless engagement, namely, to grow overall card usage. This approach ranges from people who have never used contactless to contactless devotees who tap anywhere and everywhere possible.

Additional levels of contactless use reside between these bookends. An optimization approach may begin by applying a portfolio segmentation strategy and extend to strategic development. Before campaign design, comes execution and measurement. Cardholders are more likely to conduct their first tap in everyday spend categories like grocery and quick-serve restaurants and transit where enabled.

Retail merchants without the capacity to build out new payments architecture may find support from tech companies that can develop APIs that can connect with mobile apps to enable retailers to offer app-based contactless payments. Additional solutions may support small business merchants looking to pivot from an in-store to an online sales model. Such solutions are available as off-the-shelf solutions for acquiring banks, who can white label and extend the service to small businesses to help them quickly transition to selling and accepting orders online.

The good news regarding contactless is that these payments are as safe and secure as other card-based payments, with the cards and terminals equipped with protective technology. Consumers should be adequately educated on new technologies that may require new behaviors. This will speed up their comfort level with new ways to pay.

For example, suppose an issuer was to establish limits for the frequency of contactless card use before requiring an occasional “reset” via the use of a PIN. In that case, it should actively communicate its rules and consider enhancing its account alerts through SMS or push notifications.

A closing word

Covid-19 is a tipping point, forcing consumers, issuers and many businesses to do things differently. By nature, consumers do not like change, but having change thrust upon consumers will force adoption of contactless among many. With positive outcomes stemming from the cleanliness, speed and convenience that contactless delivers, Covid-19 may have unexpectedly jump-started new payment behaviors among consumers, who would have opted for inertia over action under the old normal, pre-Covid-19 environment.

Every situation is different and every business different. For more guidance on contactless adoption, reach out to Fabrizio Burlando or Raul Escribano. Feel free to reach out to the Chronicles team with any other questions about the new normal.