Chronicles of the New Normal: Managing Disputes

Let us imagine we are in 2021 and the world has left behind the worst of the COVID-19 pandemic. No doubt life has changed, and governments, companies and individuals are adapting to a “new normal.” Our Chronicles of the New Normal series will help readers understand what is likely to be different in a post-COVID-19 world. We look at how players in the payments ecosystem are already adapting today to successfully emerge from this unprecedented shock to the economy and our daily lives.

This week we are focusing on managing disputes and chargebacks. This topic has been front of mind with consumers having to suddenly change their plans over the past months, mainly due to cancelled travel. Where merchants are unable to resolve this to consumers’ satisfaction, consumers may file disputes with their card issuer. This has operational and cost implications for issuers and poses a potential risk to their relationships with their customers.

With this in mind, issuers should plan on managing disputes as an integral part of their business.

Why Disputes are Rising

Even before COVID-19, disputes were increasing, according to Aite Group. It estimates that globally, chargeback disputes will climb from $23 billion in 2018 to $35 billion in 2021.1

"Chargeback disputes will climb from $23 billion in 2018 to $35 billion in 2021"

-Aite Group

Approximately 80 percent of chargebacks are fraud-related, where a card is compromised (online or offline), and is used fraudulently in a card-not-present (CNP) transaction. CNP fraud in the US will rise from $4.4 billion in 2018 to $6.4 billion in 2021, according to Aite Group predictions.2

We see a mix of temporary and longer-term structural drivers impacting dispute volumes during COVID-19:

During the onset of the pandemic, increases in chargebacks were driven primarily by travel-related cancellations. Cardholders were either not offered future alternative travel plans or credits for future use. Or they simply wanted their money back. We believe issuers haven’t yet seen the full impact of chargebacks. Disputes usually follow a delay of several months from the purchase date for various reasons, including lengthy call center wait times. As the volume of calls has increased, many companies are operating at a reduced capacity.

2 Aite Group, 2018.

Although the volume of claims and disputes will progressively diminish, how issuers manage the customer experience may have a long-lasting effect on their relationship with impacted customers. On average, 17 percent of cardholders will stop using their card or use it less after an unfavorable disputed charge experience, according to Mastercard analysis.

As the volume of claims and disputes drops, how issuers manage the customer experience can affect their relationship with those impacted customers for the long-term.

With many people staying in their homes, spending has also shifted to online, CNP transactions. In April 2020, CNP transactions represented 50 percent of Mastercard switched volumes, a jump from 40 percent last year. We expect online transactions to continue rising even post-pandemic because some consumers will enjoy the additional choice, convenience and security. Consumers may also be reluctant to rush back to brick and mortar retail.

CNP transactions are more susceptible to cardholder disputes due to the risk of friendly fraud. An individual forgets they have authorized a purchase and initiates the dispute. CNP transactions are also more common because of the consumer’s inability to view physical goods beforehand, as well as greater potential for damage to the product while in transit.

Additionally, some consumers could suffer financially from the economic downturn if they lose their income and then struggle to make payments on installment-based purchases and subscriptions. Individuals are also being duped into buying phony COVID-19 merchandise, such as fake virus testing kits

All of these factors are likely to increase the number of chargebacks issuers process, with significant implications for costs, operational teams and customer experience.

Before it Becomes a Dispute: Understand and Communicate

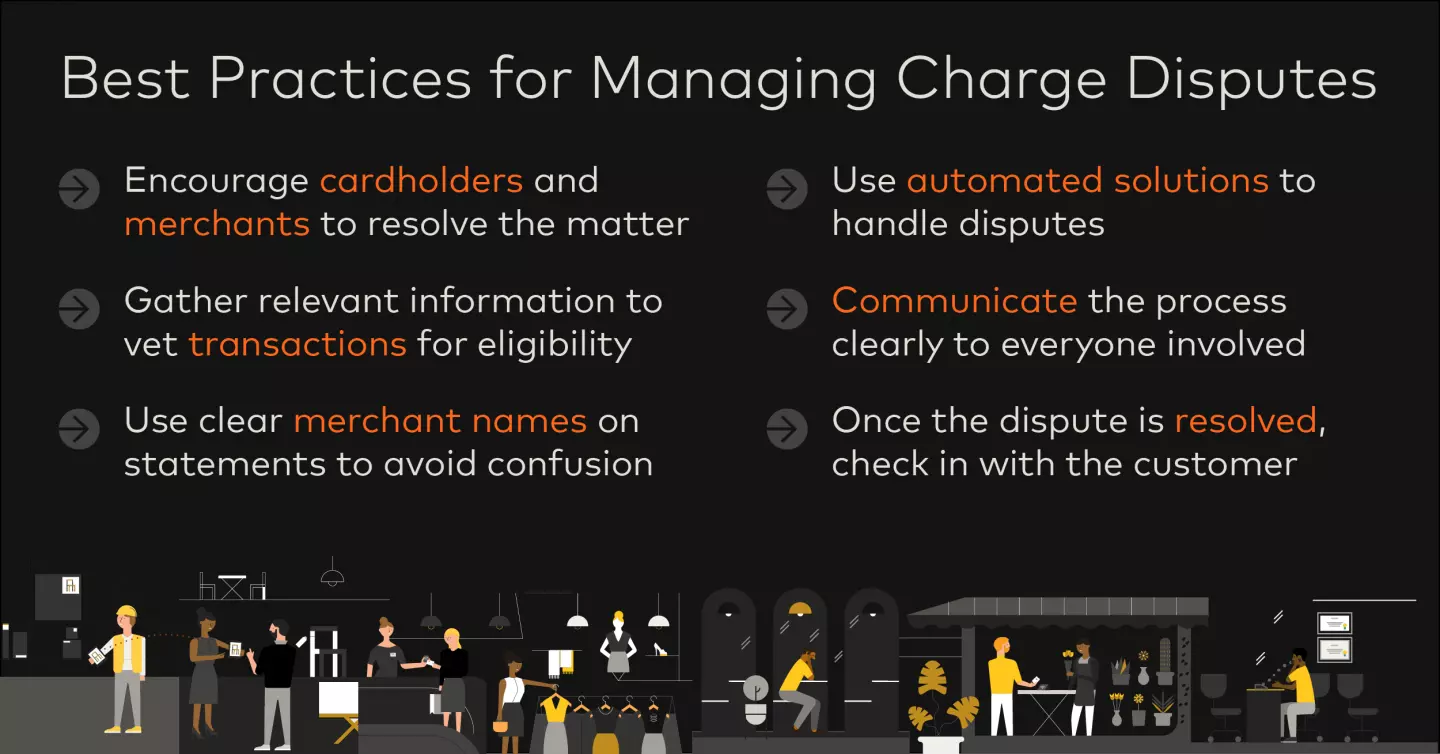

Prevention remains the best approach. Mastercard estimates that card issuers and merchants alike incur $15-$70 in operational costs for every dispute,3 so there are strong incentives to avoid this. Several best practices can help reduce the likelihood of disputes:

Urge cardholders to work directly with merchants to avoid a formal chargeback. Doing so is quicker for all parties. Merchants can clear up any misunderstandings and offer acceptable alternatives when a product has not met expectations. This “friendly” resolution is also supported by network solutions like “Mastercom collaboration” and Ethoca, a Mastercard company, that enable these conversations between banks and merchants to expedite the process and reduce the associated costs.

Thoroughly vet transactions with cardholders for eligibility through a fine-tuned recognition script and collect the relevant terms and conditions at the outset. This will minimize unnecessary merchant disputes, remove false claims (“friendly fraud”) and ensure consumers have the right information to proceed if necessary.

Reduce the unnecessary confusion that often prompts consumers to raise a dispute by using clear merchant names on statements and making clear what situations are eligible.

Managing a Dispute: Do and Tell

If the dispute moves forward, the process should be as painless as possible for everyone involved.

Use automated solutions to handle chargeback disputes. The current situation presents an opportunity for issuers to evaluate the need for more advanced claims management technology, offering straight-through processing of chargebacks and easing the current resource pressures. Rules-based decisions can implement pre-arbitration rules and even block invalid chargebacks from the network.

Communicate clearly. Ensure customers and merchants understand the process, any information required of them, and communicate realistic timelines.

After a Dispute: Restore Trust

Finally, once there is a dispute outcome, remember the overall relationship.

Check in with the customer. Disputes can lead to unhappy consumers, merchants and issuers, if handled poorly, so use this as a chance to demonstrate compassion.

A Closing Word

COVID-19 is a catalyst for many businesses to do things differently. Issuers should be prepared to efficiently manage customer disputes by having the appropriate tools and strategies to mitigate and manage them in the best interest of the consumer and their business. This is critical to keeping customers happy and loyal, reducing costs and stopping fraud.

Of course, these recommendations are broad, and every challenge and every organization is different. For more guidance on managing disputes within your business, reach out to Fabrizio Burlando or Raul Escribano. Have a question or suggestion for the Chronicles from the New Normal team? Please send us a note.