A regional spinoff from Economic Outlook 2023.

February 2023 | By David Mann and Anushri Bansal

Bungee jumping has close ties with the Asia Pacific region. It hails commercially from New Zealand in the 1980s, and the most storied location worldwide for a jump is in Macau off the coast of mainland China at a vertigo-inducing 233 meters.

Now, after Covid-19 forced the world’s economies to collectively jump in 2020, what is the status of the Asia Pacific region in 2023?

After an initial rebound, a bungee jumper enters a disorienting bouncing phase when it is unclear if the trajectory is groundward or skyward. An analogy exists in the opposing economic forces that the world has been experiencing simultaneously: the release of pent-up savings and strong labor markets versus high inflation and rising interest rates.

Western economies generally removed covid restrictions earlier and have moved beyond the euphoria of reopening. They will likely see limited growth in 2023 after a relatively strong 2021 and 2022. Meanwhile, the slower reopening of eastern economies, particularly in northeast Asia and most notably mainland China (henceforth “China”), presents a different cycle that anticipates stronger growth in 2023.

A longer bungee cord for a shifted economic cycle

China’s size means that its relatively sudden, albeit anticipated, loosening of covid restrictions will have a significant impact on other economies in the region. Based on the release of pent-up demand elsewhere, Chinese consumers will want to catch up on the in-person experiences they have been missing, including in-person retail and cross-border travel. The impact on the region will unfold in two key exports from other Asian countries: tourism and trade.

Mastercard’s inbound cross-border travel spend volume into China in Q4 2022 was at approximately 20% of pre-pandemic Q4 2019 levels. Mastercard’s outbound cross-border travel volume from China was at 50% of Q4 2019 levels in Q4 2022.1 A full recovery of China’s outbound tourism flows will likely be slowed by logistical challenges around the availability of planes, landing slots, pilots, engineers and flight attendants. Such bottlenecks are familiar to other regions: demand flips back, while supply struggles to keep up. They also mean that the benefits to the Asia Pacific region will take some time to play out.

In terms of trade, exports to mainland China were equivalent to 74% of Hong Kong’s nominal domestic GDP in 2019, albeit mostly as re-exports; Vietnam and Singapore followed at 16% and 14%.2 Yet, although China’s borders were not closed to trade between 2020 and 2022, domestic demand only grew 1.1% in 2022. Many Asian economies may now resume their pre-Covid economic drift from the US toward China as the Chinese economy regains its appetite. One caveat is that weak demand from the West will likely soften imports of intermediate goods for final outbound products from China.

Tourism or trade, China’s shifted economic cycle accounts for faster regional growth projections now than elsewhere because of its delayed rebound. But it does not account for the projected sustainability of its cycle and that of the Asia Pacific region in general, which calls for a separate explanation.

A less stiff bungee cord for a less tight monetary policy

China and the Asia Pacific region’s longer plunge comes against the backdrop of relatively manageable inflation. Low pre-pandemic inflation levels—epitomized, albeit somewhat exceptionally, by prolonged deflation in Japan—helped going into the jump, but they are hardly sufficient to account for the region’s rosier outlook.

Despite many European economies skirting under the European Central Bank’s target year-over-year inflation rate of 2% in the lead up to the pandemic, Europe still ended up as the region most struggling to find its bearings. Meanwhile, Asia has not been immune from inflation either. At the upper end, Singapore’s and Australia’s average year-over-year inflation levels each jumped from 0.5% and 1.8% between 2017 and 2019 to around 7% in late 2022.3

Part of the explanation comes from recent external factors. Inflation in Asia is largely stemming from global supply issues and commodity price rises. Those impacts are likely temporary since key commodity prices of metals, energy and goods peaked in mid-2022. The region is also less exposed than Europe to energy price risks. So, most of the explanation for stronger projected growth in Asia can be found in prolonged internal considerations, such as later reopening and less restrictive monetary policies, rather than in recent external influences.

China’s reopening in early 2023 is leading to some short-term economic disruption due to spikes in Covid infections, but it was economically anticipated. Limited economic stimulus measures relative to other advanced economies and weak domestic demand kept Chinese inflation relatively contained compared to the West. Notwithstanding marginal upside risks associated with China’s reopening, consumer price inflation in late 2023 will likely only be modestly higher than the 2% year-over-year average seen between 2013 to 2019, according to the Economic Outlook 2023 report.

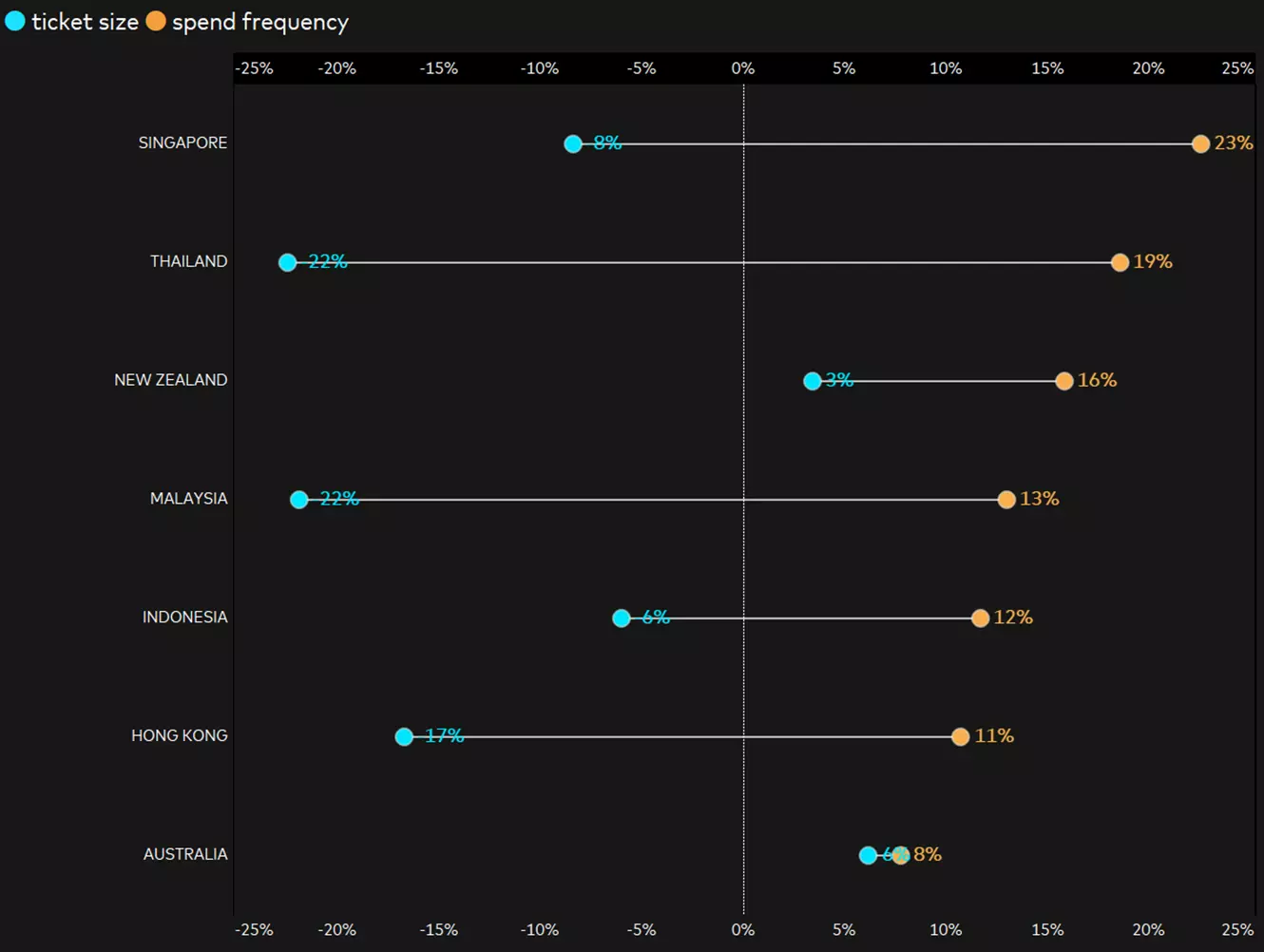

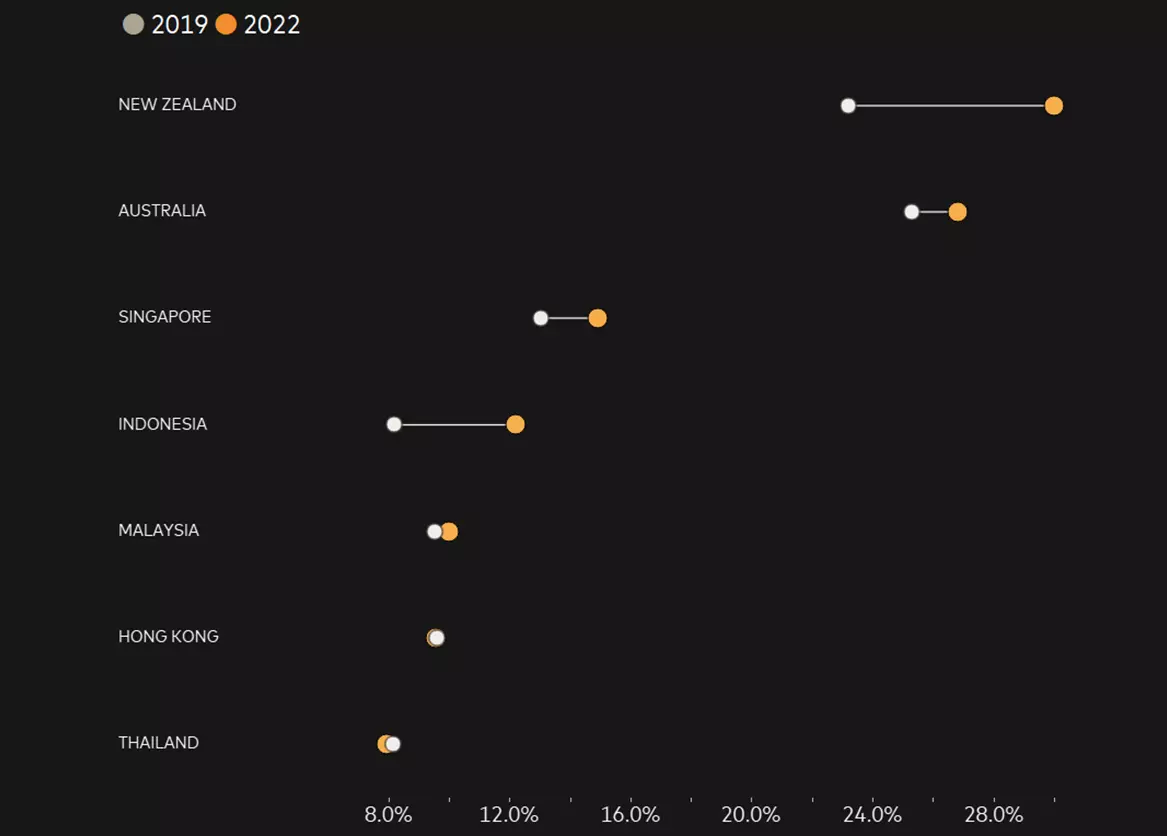

Consumer proclivities add a further dimension. Worldwide, many consumers are spending less on groceries per visit while increasing the frequency of visits to ensure they only buy what they need. The trend is common across the Asia Pacific region, but Australia is an exception. Spending on durable goods and experiences there remains strong despite the rise in cost of essentials (figure 1).

Where Australia is not an exception is in the high prices of essentials, such as food and fuel, that are shifting household budgets away from discretionary goods (figure 2). Meanwhile, discretionary services are showing resilience as consumers juggle finances to participate in activities restricted during Covid. Economies reliant on tourism, such as Thailand, or economies with subsidized fuel, such as Malaysia, have already returned to pre-pandemic levels of discretionary spend, which will likely increase further as China reopens.

The omnichannel approach adopted by many businesses worldwide during the pandemic continues to provide consumers with flexibility to handle the rising costs of living and borrowing. The difference in Asia is that the impact of the rises is less acute. The challenge with increasing interest rates to suppress demand is not to tip an economy into recession as consumers then purchase less and employers hire less. A mild winter may be all that came between Europe and recession in the face of elevated fuel prices in late 2022.

Reducing whiplash

When assessing the stiffness of a bungee cord to account for different body masses, a key consideration is the effect of g-forces on the jumper. An assessment of the outlook for China and the Asia Pacific region might consider the effects of inflationary forces on their economies in a similar manner.

A less restrictive monetary policy avoids the delayed impact of aggressive interest rate hikes that can send economies reeling. In other words, a less stiff bungee cord in China and the Asia Pacific region has so far avoided the economic whiplash associated with tighter bungee cords in Europe and elsewhere. As increases in interest rates successfully tame inflation and as Chinese demand returns in 2023, the Asia Pacific region can expect to replace bouncing with buoyancy.

2 IMF, CEIC

3 Bloomberg

| David MannChief Economist — Asia Pacific, Middle East & Africa | |

| Anushri BansalEconomist — South Asia | |