By Hakan Eroglu, Global Open Banking Lead—Advisors

Industry pundits have been bandying the term open finance about for a while. Many countries, such as Australia or South Korea, already incorporate aspects of open finance within their open banking approaches. Their progressive regulations are designed to prepare for the future and then usher it in.

Meanwhile Europe—the region that pioneered a regulatory approach to open banking—is now moving towards formal open finance regulations. The UK’s Financial Conduct Authority (FCA) published the results of an open finance consultation in March 2021, and the European Commission’s digital finance strategy promises a legislative proposal on an open finance framework by mid-2022 with a framework in place by 2024.

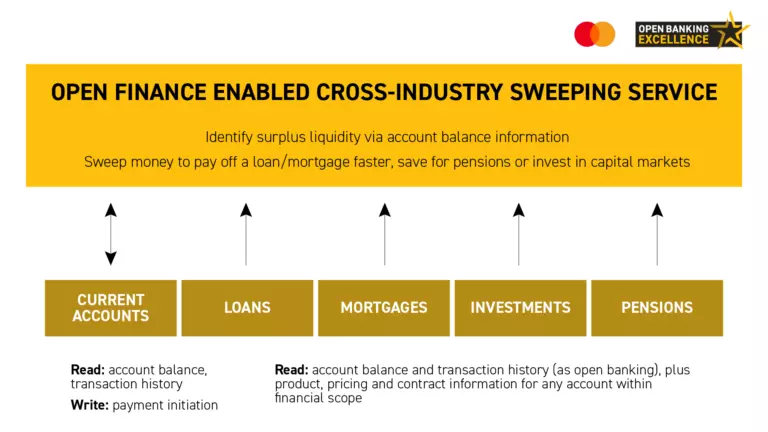

The scope of open finance is broader than open banking. It goes beyond payment accounts to include entire financial footprints such as savings accounts, mortgages, pensions, insurance, loans, investments and stocks. Yet it would be a mistake to assume that open finance is just open banking with a broader scope. The real difference comes from layering shared functionality on top of all the data. Where open banking connects application programming interfaces (APIs) across a shared framework to stimulate innovation around new product and services, open finance connects those products and services across a shared framework as well (figure 1).

Degrees of openess

Talk of the progression from open banking to open finance inevitably brings up the notion of open data. The FCA and European Commission couch their discussions of open finance in such terms, and the European strategy for data specifically identifies a common European financial data space. But a focus on scope risks distracting from the main role of open finance to provide shared frameworks across products and services. Before going into detail on how such a framework should work, some clarity around the evolution of open banking in Europe is in order.

Denmark, Norway and Sweden lead the 10 European countries included in Mastercard’s 2021 open banking readiness index. Their frontrunner status comes from established digital ID authentication systems, recently launched pan-Nordic know-your-customer (KYC) services, and an imminent P27 cross-Nordic payment infrastructure. The three Nordic nations are closely followed by the UK with 216 third-party providers registered there versus 312 across the rest of Europe, according to the Q3 2021 open banking tracker. As of October 2020, around 50% of small businesses in the UK claim to use open banking, according to the Open Banking Implementation Entity (OBIE).

Still, regardless of country, account information services rather than payment initiation services continue to dominate API calls. That situation is changing, however: the 0.53 million successful payment initiation calls made in the UK in September 2020 nearly quintupled to 2.59 million in September 2021, according to the OBIE. And Lloyds Bank and Tesco Bank now offer account-to-account payments in certain environments without the need for passwords or account information. A growth in payment—or, more broadly, transaction—initiation services through an open finance framework might finally quell the irony that PSD2 is a payments regulation at heart.

A shared framework

Request to Pay (R2P) is a messaging system in the UK that allows a payee, such as a mortgage provider or utility company, to send a payment request to a payer irrespective of banking app and with all payment information pre-confirmed. It exists independently of open banking but can thrive on push payments made through transaction initiation services enabled by open banking. The shared framework that R2P provides to otherwise independent transaction initiations combines the same functionality across all participants in what is verging on open finance.

Success for R2P, along the lines of what’s emerging with its counterpart Request for Payment (RfP) in the US, will depend on broad industry uptake. Outside the UK, the European Payments Council published its implementation guidelines for a request-to-pay framework in the Single Euro Payments Area (SEPA) in June 2021 under the acronym SRTP. One distinction is a possible application within the retail space—a concept not dissimilar to the request-to-pay functionality built into Thailand’s PromptPay real-time payment network. Open banking need not—and, in the case of Thailand, does not currently—play a role. But, as with the UK, real potential lies in combining open banking functionality across the shared framework.

A fully-fledged example of a shared open finance framework in the UK is the application of variable recurring payments (VRPs) to sweeping money between accounts to improve liquidity. Those accounts may run the gamut of open finance by extending beyond the current accounts of open banking to include loan, mortgage, investment and pension accounts. VRPs then take pre-confirmed account details and automate regular payments when triggers occur, such as meeting a balance threshold. The sweeping occurs at the behest of the customer, who can revoke permission at any time, and doesn’t require repeated strong customer authentication (SCA) each time a transaction is made.

Figure 1: An example of sweeping through an open finance framework

The deadline for VRP implementation prescribed by the CMA to the UK’s nine major banks is July 2022. Meanwhile, the Berlin Group—a pan-European payment standards consortium—includes recurring payments as one example of extended payment initiation services. Other possible extensions include the reservation of funds to defer an account-to-account payment in the manner of a credit card. Another form of credit proposed by the Berlin Group is Pay by Loan, which is based on a unified framework around point-of-sale loans instead of bilateral arrangements between retailers and lenders. The group concluded a series of consultations in September 2021; implementation standards and guidelines are pending.

A wrapper for open banking

Open banking continues to evolve as new APIs emerge to support new products and services. Yet challenges persist in areas such as payee confirmations, SCA, customer reauthentication and dispute management. Solutions require standardized approaches that go beyond purely technological considerations to also focus on user experiences. Open finance provides that consistency across banking and other financial sectors through centralized branding that operates irrespective of specific service providers.

The FCA’s open finance feedback statement and the European Commission’s digital finance strategy note that an open banking regulatory framework is insufficient for open finance. That’s true, but a more sufficient framework is not necessarily a more stringent framework. Regulators around the world have seen how open banking innovation can be stifled by both too much and too little regulation. The need now is for more considered regulation based on what the end deliverable is for users. Connected APIs only really matter if the products and services that result are similarly connected too.