Turning data into effective journey analytics solutions

Today’s customer journey is more complex than ever. Consumers interact with financial institutions at multiple online and offline touchpoints—sometimes several times a day. A person might walk past a bank branch, receive an email newsletter from that same bank, and then encounter an advertisement for the bank in their social media feed.

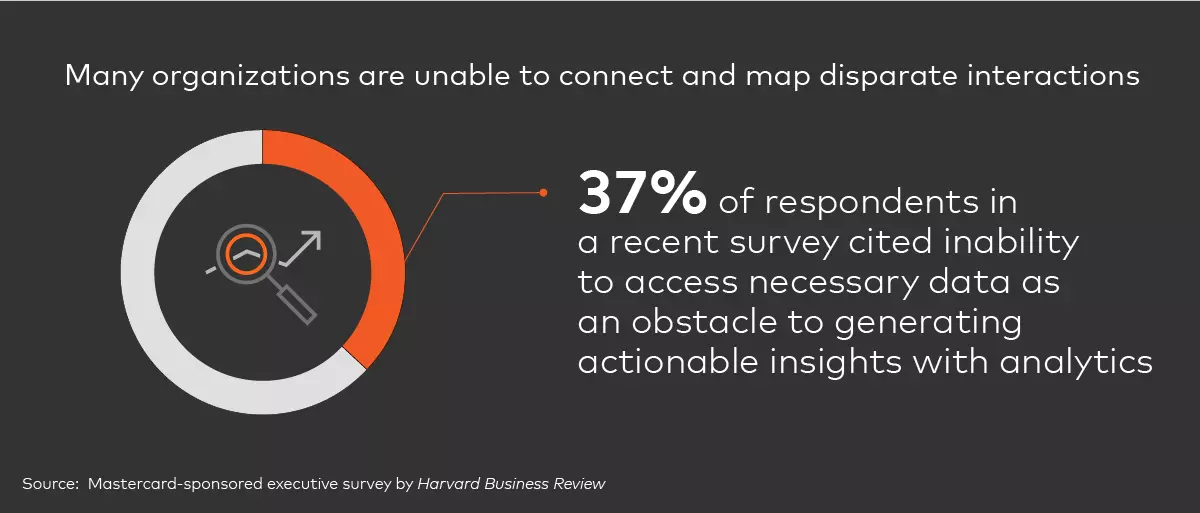

Financial institutions may be missing the opportunity to attract and delight consumers, as many of them are unable to connect and map these disparate interactions. According to a recent Mastercard-sponsored executive survey by Harvard Business Review, 37% of respondents cited inability to access necessary data as an obstacle to generating actionable insights with analytics. A clear mapping of customer journey data is key to acquiring and retaining customers. Previously thought of as a simple funnel, the customer acquisition and retention journey is now a much more complex route with multiple, non-linear touch points. Each interaction influences consumers' perceptions of brands and guides decision-making around a financial institution's products and services.

To address the challenge, banks are using sophisticated customer journey analytics platforms to gain a clear picture of their customers’ experience. By pulling together these journeys, banks can hypothesize, test and analyze ways to improve engagement. They can identify the journeys that lead to the best outcomes and understand how the outcomes themselves can be improved. Additionally they can discover and remediate journey paths that lead to low customer satisfaction and churn.

Turning Data into Action

Despite the complexity and difficulty of measuring and mapping out consumer journey data, gathering journey data is only the start. Banks must take action to glean useful insights and gain value from the data.

For example, a bank might discover that its users are engaging with new account offers through a mobile banking app but aren’t actually opening new accounts. The bank can then design and test campaigns across channels, or even develop new journey paths to spur these customers to action.

In this scenario, after discovering customer action, or inaction across different touchpoints, the bank forms a hypothesis, tests it and measures the results. These results, in turn, inform the bank's next steps. Should it send emails to customers who engage with new account offers on the app but don't follow through? Or, should it form another hypothesis and test a different strategy?

Perhaps a bank wants to migrate its customers from branches to more cost-effective digital channels, and trains financial advisors on how to discuss digital channels with high-value customers. While the bank may see an overall uplift in digital transactions, by using customer journey analytics the bank can identify the segments that are most likely to migrate to digital channels in response to financial advisor outreach, and prioritize reaching out to the right customer segments.

Together, customer journey analytics and business experimentation enable the development of effective, predictive models that understand which customer segments are most likely to respond to outreach and adopt the bank's digital platform.

Benefitting Customers

Customer journey analytics helps optimize investments and lower costs while delighting and retaining customers. Armed with a clear understanding of their customers’ journeys, banks can uncover frustrating points in the customer experience and find ways to fix these problems quickly.

For example, a bank might measure call center performance based on customer satisfaction scores, and may attribute low scores to the customer’s last touch point, which might be a call agent. With a clear view of the customer's full journey, it can see the customer previously interacted with the bank across the branch, website, mobile app and live chat. This customer journey map is key to identifying the true causes of low satisfaction scores.

Banks can also identify the customer journey maps that lead to high satisfaction scores and tailor outreach through the channels customers prefer most.

In another scenario, a customer journey analytics platform might alert a bank that high-value customers are having credit card transactions declined abroad, despite reporting their travel ahead of time. The bank may hypothesize that these declines will cause such customers to have lower future spend compared to travelers who didn't experience card declines. The bank can leverage business experimentation software to compare these customers against a representative control group of similar clients who reported their travel and did not have their credit cards declined. The bank can then accurately measure the reduction in spend caused by the decline, and identify the customer segments most at risk of decreasing spend.

The bank can quickly adjust approval authorization rates to minimize declines for customers most likely to reduce spend in response. Meanwhile, they can keep the affected customers happy by offering them rewards, such as cash back, a discount on fees during their next trip out of the country, or points they can use for travel booking.

Creating Value with Customer Journey Analytics Platforms and Business Experimentation

The key for any bank that wants to become truly analytics driven is to measure, connect and analyze customer journey data and follow up with a hypothesis and an informed plan of action. Financial institutions can maximize their investment in customer journey analytics by incorporating hypotheses and measuring results of business experiments compared to a group of unaffected customers. Together, customer journey analytics and business experimentation provide critical information that supports decisions to transform and improve the customer’s journey with the bank.