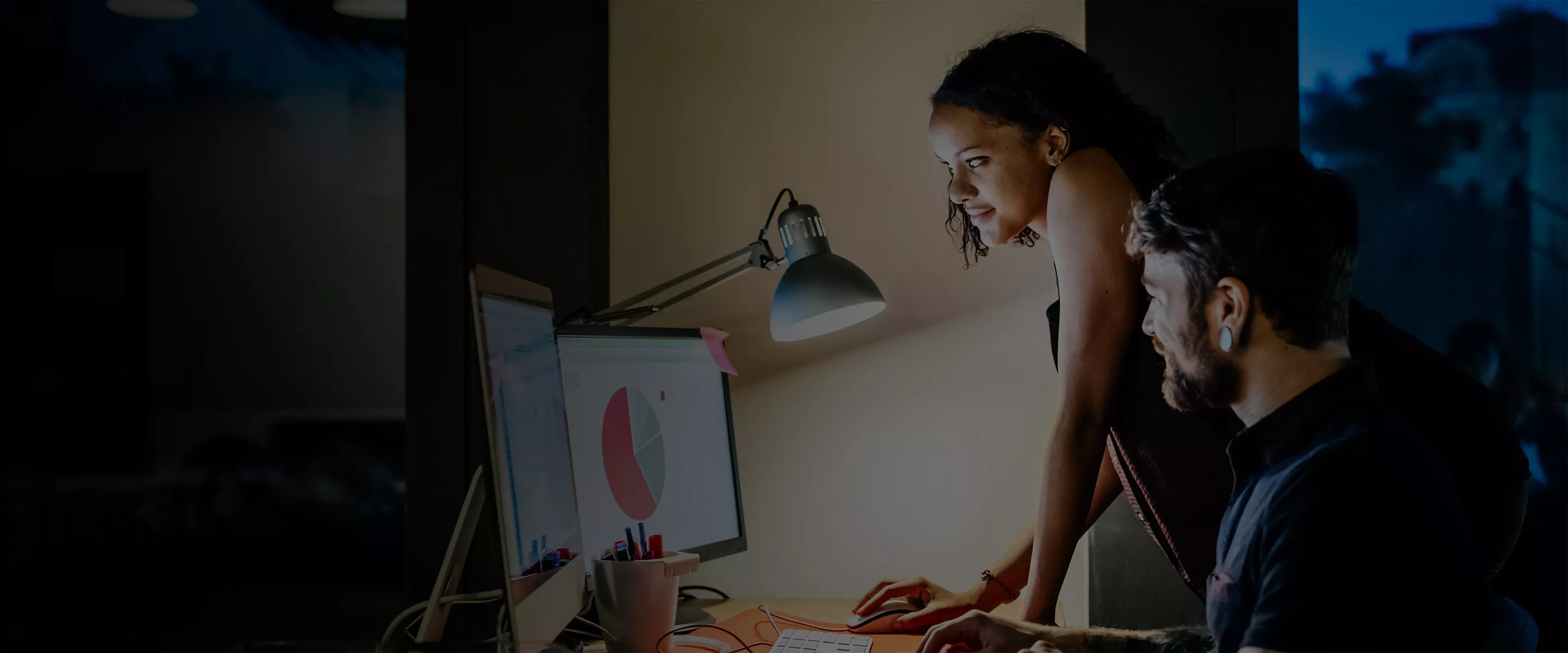

Access near real-time aggregated sales and benchmarking metrics that have the ability to better assess a small business’ performance and creditworthiness with the consent of the small business

Mastercard Small Business Credit Analytics (SBCA) is an API that provides organizations enhanced insights into a small business’ health and retail sales across all stages of underwriting and performance monitoring. These data driven insights help organizations reduce underwriting time, better manage risk and improve relationships with their small business customers.

Power better business decisions

Request more information

Let one of our specialists show you how Mastercard Data & Services can enhance your

business performance, elevate consumer experiences and enable innovation.

The lack of easy access to 360-degree insights prevents lenders from building a clear understanding of the cash flow and character of the small business

46%

of small business owners believe a lack of credit and loan history is a major problem when applying for a loan.

Source: Mastercard for Small Business – Quantitative Research Findings, 2022

Source: Mastercard for Small Business – Quantitative Research Findings, 2022

86%

of small businesses say they’re looking for faster and easier access to capital for their business.

Source: Mastercard NAM Insights Open Banking Thought Leadership, 2022

Source: Mastercard NAM Insights Open Banking Thought Leadership, 2022

77%

of US-based small businesses would share business performance data with financial institutions if it meant they didn’t have to rely as much on credit scores for loans.

Source: Mastercard NAM Insights Open Banking Thought Leadership, 2022

Source: Mastercard NAM Insights Open Banking Thought Leadership, 2022

Mastercard Consulting

Partner with our consulting experts to optimize your credit decisioning process.