Future tech has boundless opportunities. How do you choose the right direction for your business?

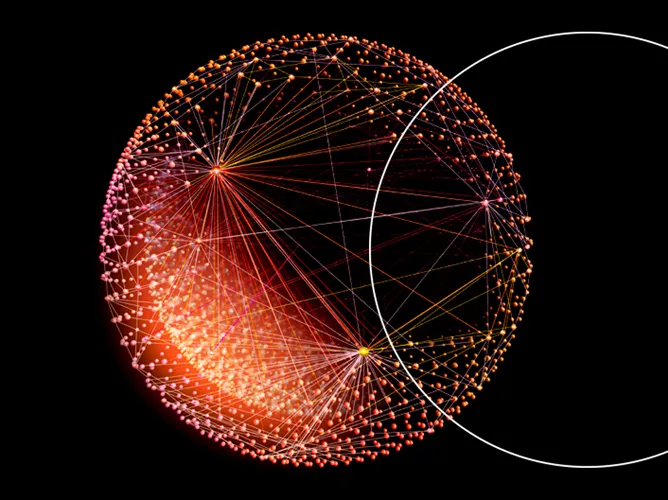

Today’s consumer constantly moves between the digital and physical worlds. They expect banks to do the same, seamlessly creating a cohesive financial customer journey. Using the latest technologies—including augmented, mixed and virtual realities, AI, Web 3, 5G and beyond—we drive value and mitigate risk so you can reach new heights, markets and audiences.

- Cutting-edge expertise. We have a diverse team of futurists, technologists, developers, programmers and user experience designers who provide creativity and entrepreneurial experience.

- Mastercard’s global network. Get support from vast insights, resources, and experience with access to the latest technological advances.

- Our experience. We understand your needs and aspirations based on our work with global banks, fintech companies, governments and corporations.

Empowering clients with technology solutions.

Mastercard’s team helps clients unlock the potential of cutting-edge technology with strategy, advisory and build services, creating virtual and physical environments where customers can explore, discover and engage. Our team works across five innovation cores.

PrivatBank, the largest commercial bank in Ukraine, wanted to reimagine its branches to respond to evolving consumer preferences during the Covid-19 pandemic. The goal was to create a new service model where PrivatBank could seamlessly connect customers with their digital banking services. Mastercard developed detailed personas and agile service attribution to ensure branch experiences and financial products aligned with PrivatBank's customers’ needs and expectations. Virtual reality technology was then used to design a digital-first retail banking experience.

Our team of Future Tech experts.

Related resources