Acquirer Analytics: Strategic Insights for Strong Performance

Merchants are increasing their investment in online channels as consumer demand for e-commerce reaches new highs with the onset of COVID-19. This growth within the industry also means payments have become considerably more complex. Acquirers are navigating new risks and opportunities introduced by technologies like 3-D Secure to make card-not-present transactions safer, as well as tokenization, card-on-file transactions and mobile wallets.

Decisions around these solutions and other emerging business challenges are high stakes and can directly impact the bottom line. To make informed choices, access to data is critical to understanding the viability of new technologies and where investments will best serve client needs. Better data visibility also allows acquirers to conduct more accurate analytics that drive better business decisions and performance.

Analytics Roadblocks

Harnessing data is easier said than done. Data is often siloed in different platforms across the organization that don’t talk to one another. At the same time, it takes significant funding to build a custom solution that will link all of an organization’s internal and third-party data. Once data is wrangled, it can still take time for even a highly skilled analytics team to interpret, communicate and apply insights towards better business decisions.

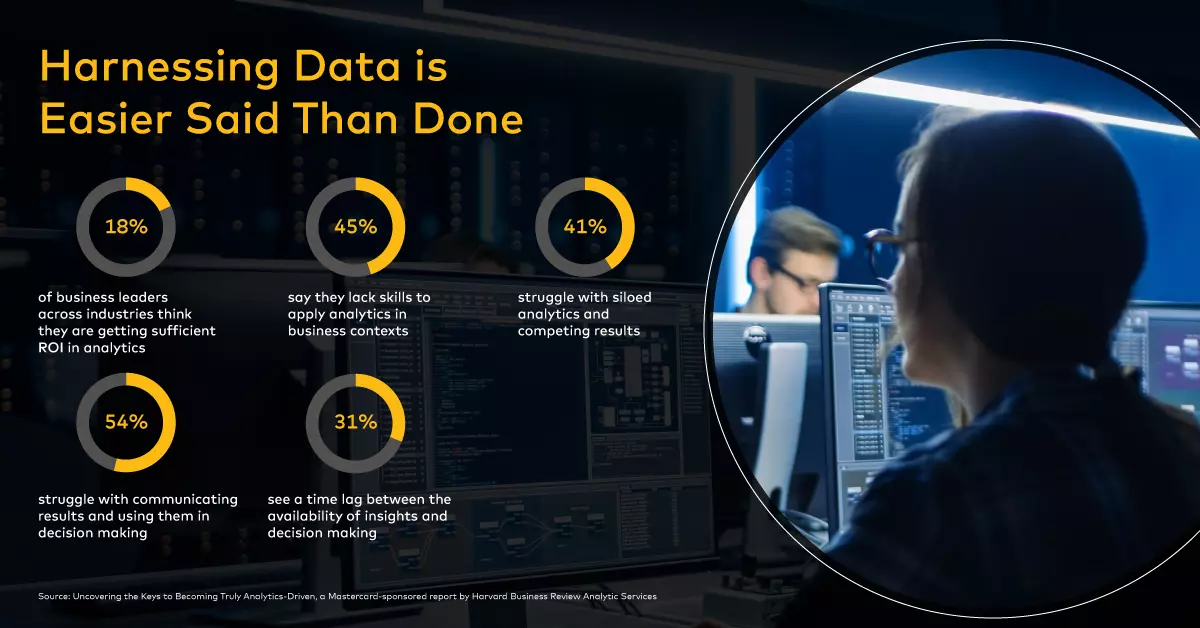

Facing these challenges, it’s no wonder fewer than one in five (18%) business leaders across industries think they are getting a sufficient ROI in analytics. Nearly half (45%) say they lack the skills to interpret and apply analytics in business contexts, while 41% struggle with siloed analytics and competing results. More than half (54%) encounter difficulty with communicating results and integration into decision making, while 31% see time lag between the availability of insights and decision making.

For acquirers, it’s vital to overcome these roadblocks to see across key performance indicators, and identify opportunities to optimize the portfolio, mitigate against attrition and grow the business.

Breaking Down Data Barriers

Solutions for breaking down data and analytics barriers should address four key challenges.

Resolve fragmentation across multiple platforms and data sources to ensure decisions are made consistently based on a single source of truth.

Data must be granular enough to identify trends in specific transaction types.

Speed is paramount – access to near real-time data must be simplified and streamlined.

Data should be translated into action to create meaningful business insights.

When these challenges are met, organizations are empowered to identify strategic areas of growth even as new competition, consolidation and regulatory pressures tighten the market. By understanding the competitive landscape, acquirers can differentiate themselves to clients and prospects. Better processing and cost optimization enable acquirers to optimize their portfolio across authorization, fraud, chargeback and interchange. With real-time insights, they can strengthen merchant relationships by taking proactive measures that cut attrition.

Data-Driven Decisions

Actionable insights into portfolio performance that the non-data scientist can understand is key to Mastercard’s Acquirer Intelligence Center (AIC). More than 120 configurable data attributes allow acquirers to analyze the data and uncover relevant insights through rich visualizations.

The platform analyzes over 200 billion anonymized and aggregated transactions and 20 trillion pieces of data in real-time. It holds three years of historical data and is refreshed weekly. Set alerts to identify risk and opportunity, as well as real-time analysis, help organizations make critical data-driven decisions.

Operations, Optimization, Strategy & Growth

When teams across the organization access the same real-time data to make decisions, operations become more streamlined. Acquirers can monitor portfolio KPIs in near real-time while benchmarking business performance against competitors. Granular and localized insight into merchant performance, new payment flow transactions (3-D Secure and card-on-file) and revenue-generating transactions (dynamic currency conversion) ensure the business is operating at maximum performance.

Looking towards new areas for growth, acquirers should have insight into geographic variances and high-risk categories so they can better understand where to expand and where to take a more measured approach. It also helps businesses understand merchant category concentration to mitigate risk and understand critical opportunities, identify fast- and slow-growing categories and align sales efforts.

Moving Forward with Data

Today’s highly competitive market presents a rich opportunity for acquirers who tackle data and analytics challenges proactively. Optimizing costs and portfolio performance is arguably more important than ever before, but so is strengthening merchant relationships and investing in business development.

Acquirers who have a growth-centric mindset and leverage data to understand their risks and opportunities will stay ahead of the competition.

Want to learn more? Listen to our recent webinar on Strategic Insights into Acquirer Performance or reach out to your Mastercard Account Representative.

TJ Sharkey is Senior Vice President of Financial Institutions, Acquirers and Processors and Daniel Anthony is Director of Information Services Products.