Low approval rates and high transaction declines?

Safety and security are table-stakes in payments, and Issuers need to make fast, intelligent decision to approve genuine transactions.

Issuers often face challenges when trying to optimize approval rates, including siloed and unstructured data, laborious monitoring and analysis, and constant change in authorization strategies.

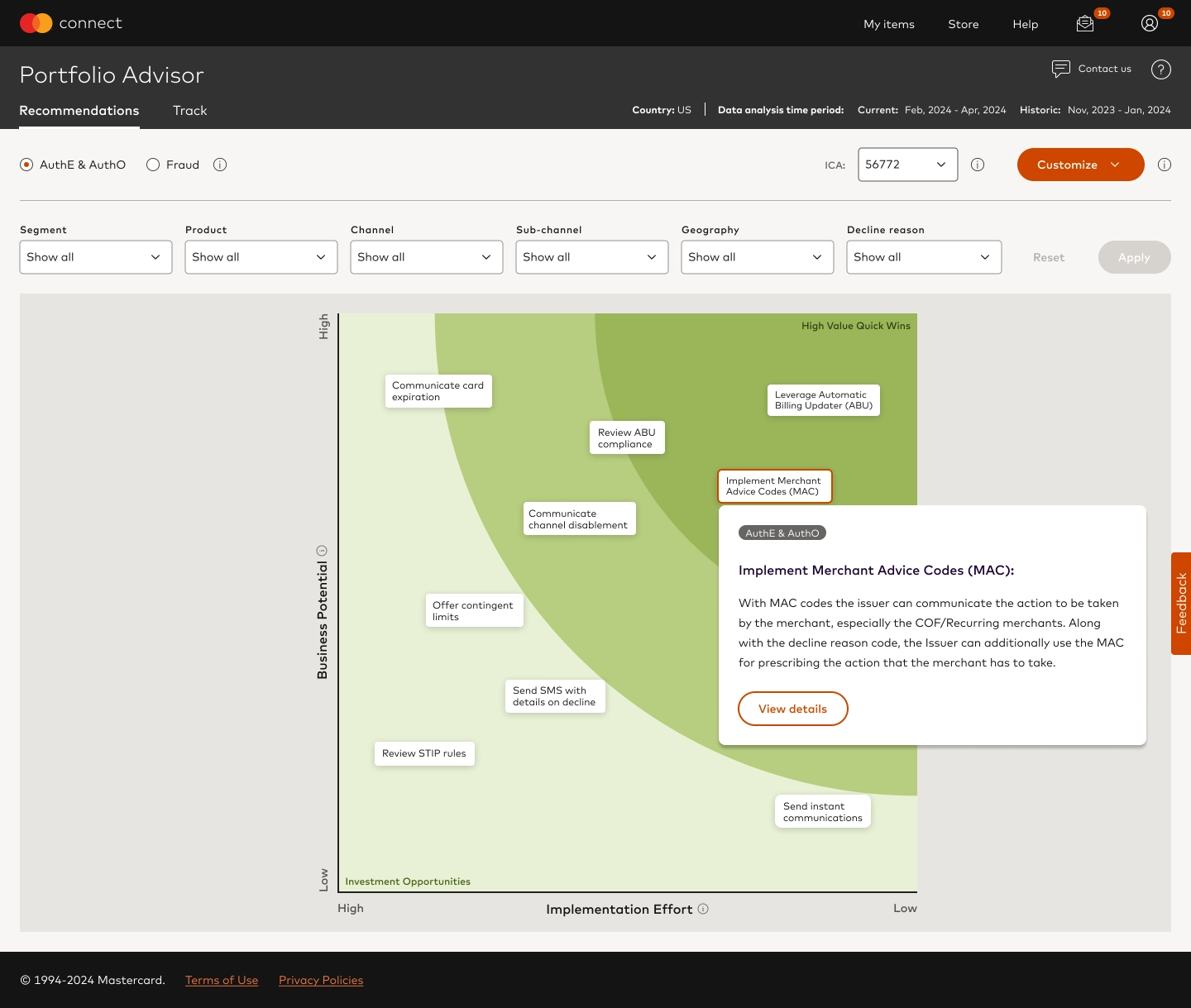

Leveraging expertise and experience from various consulting engagements, Mastercard Portfolio Advisor is a frictionless self-service platform, developed to provide timely and actionable recommendations based on competitive benchmarks and past performance.

Helping issuers address common industry pain points

I have never seen anything like this! It’s an aggregated view of your pain points as a fraud owner. It’s like standing on top of a hill and looking down over your fraud hotspots.

Key features of Mastercard Portfolio Advisor

Actionable recommendations

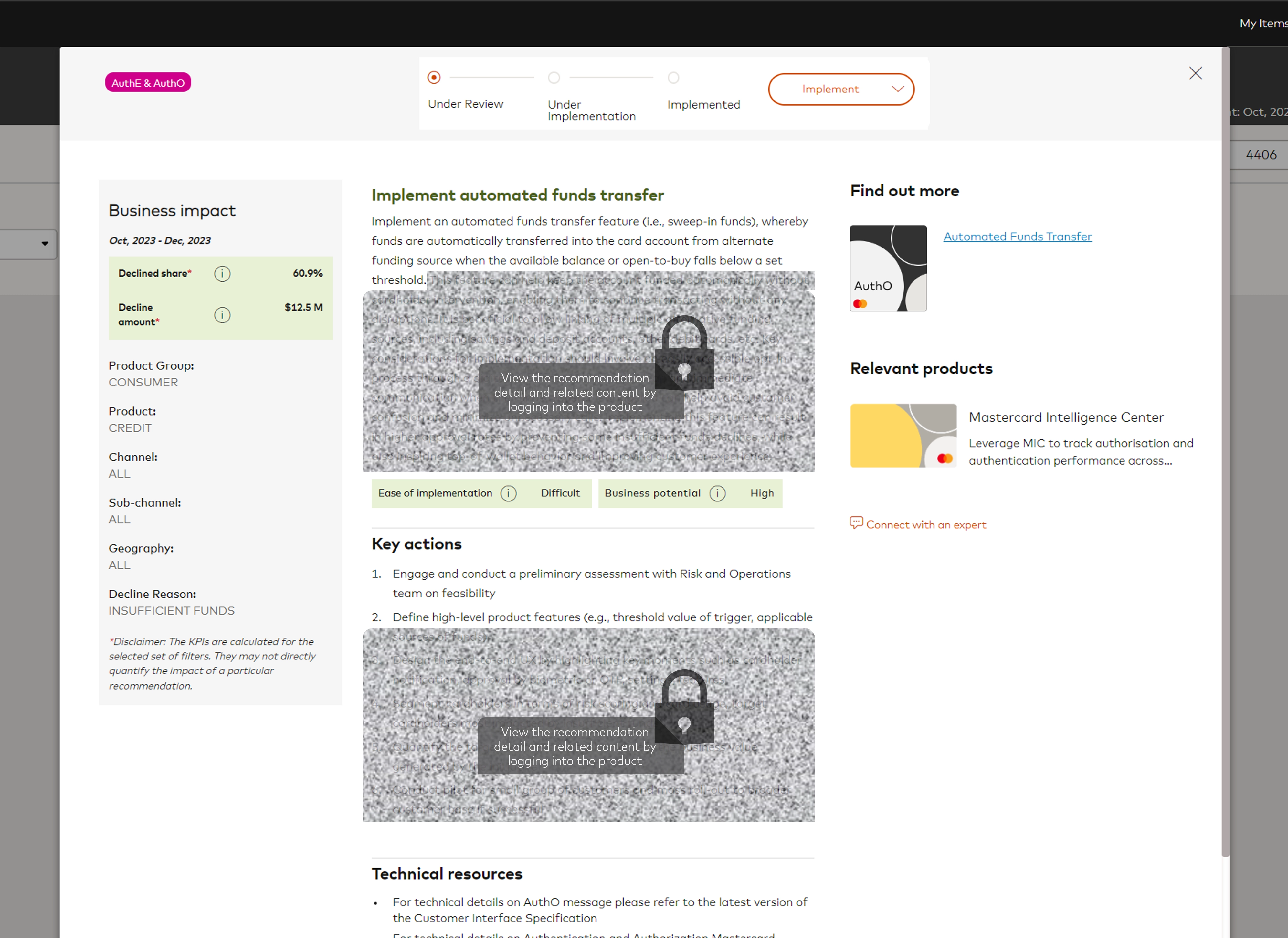

Access recommendations that are carefully curated by SMEs with unrivalled consulting experience in the authentication, authorization and fraud space.

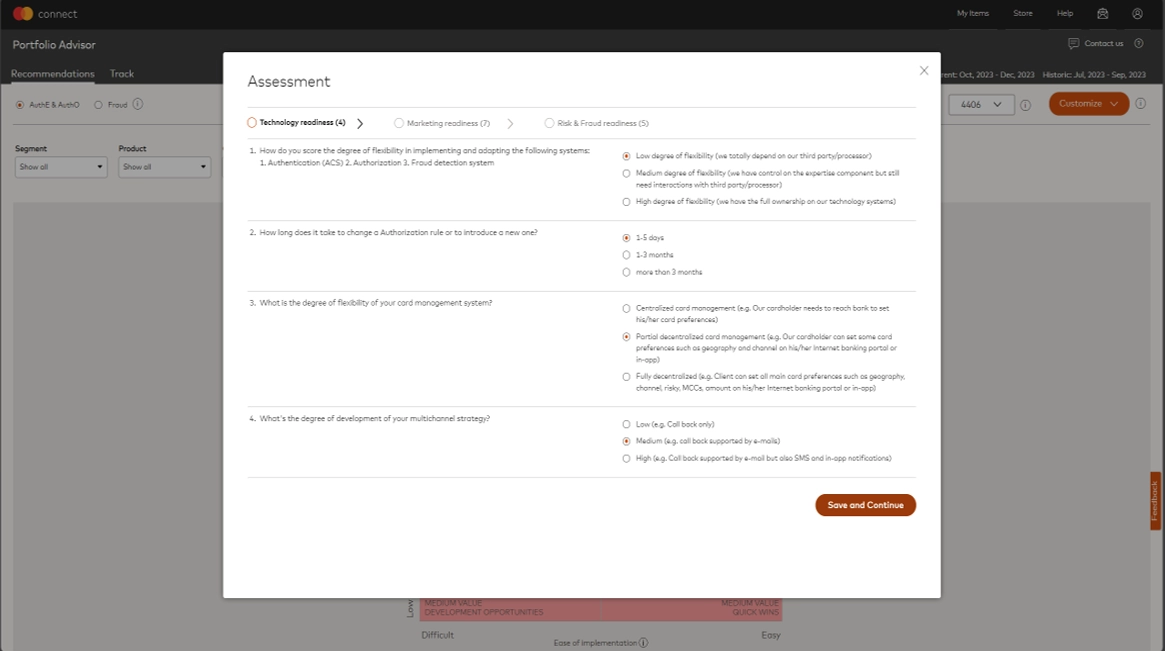

Advanced personalization

Build a readiness profile to obtain recommendations specific to the issuer’s business need.

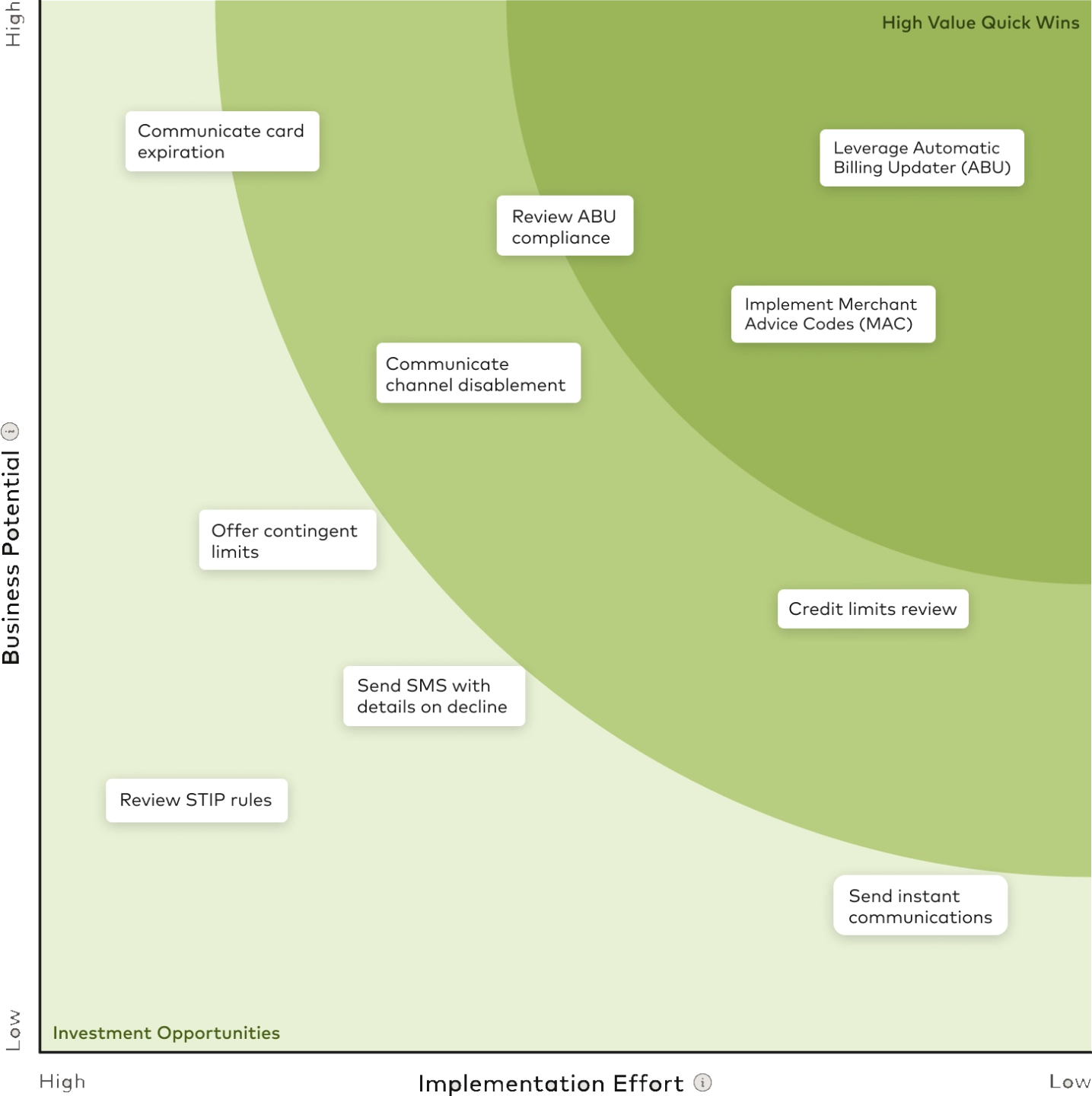

Strategic prioritization

Develop an actionable roadmap by prioritizing recommendations based on business impact and ease of implementation.

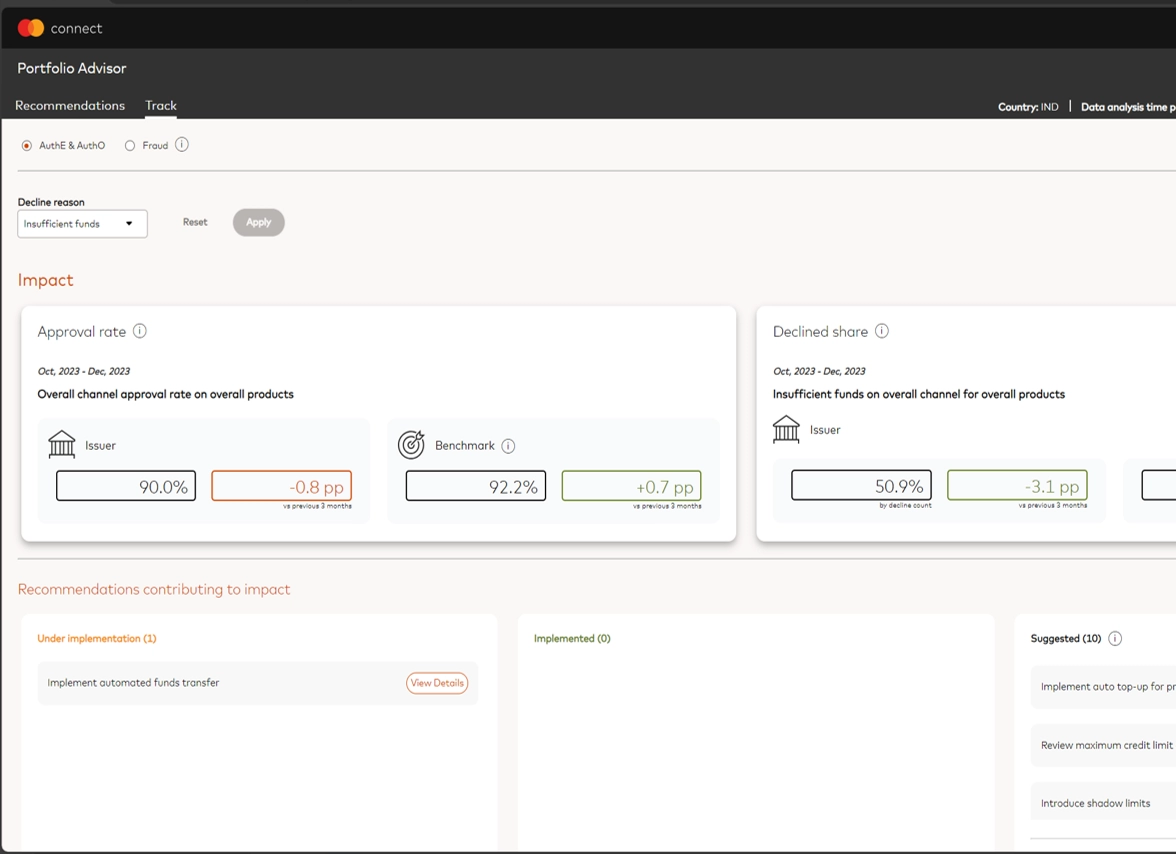

Performance tracking

Track quarter-on-quarter performance and compare against industry peers to identify opportunities for improvement.

Primary benefits and key differentiators:

All the relevant information in Recommendation Card is useful in preparing business cases and asking for budget from stakeholders.