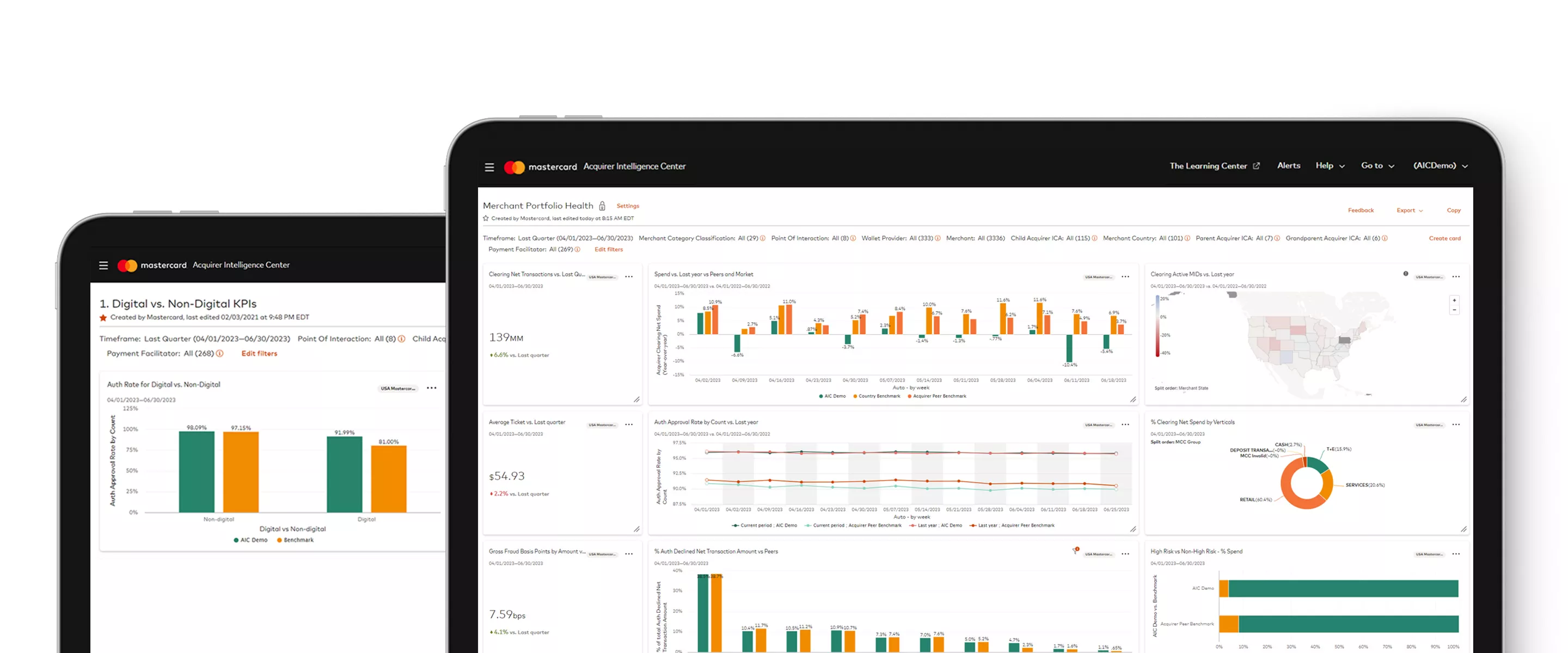

The Acquirer Intelligence Center1 (AIC) is a web-based, self-service payment analytics platform that provides acquirers, merchant services providers and payment facilitators with actionable insights into merchant portfolio performance.

By enabling near real-time analysis of rapidly refreshed data, AIC provides the transaction data analytics and insights necessary for better decision-making.

AIC empowers acquirers through the following:

A leading U.S. acquirer needed to boost overall authorization spending and enhance their approval rates, but they struggled to pinpoint reasons for decline rates. The acquirer used Mastercard’s Acquirer Intelligence Center to identify and understand the reasons for declines.

By working with merchants struggling with card-not-present authorization performance and identifying fraudulent activity causing declines, the acquirer saved $121,000 in fraud and transaction processing costs and increased quarterly net approved spend by $6.8 million.

I am really excited for the AIC tool, and all the data we can obtain from it. I think the platform is brilliant, and quite powerful.

Related resources