December 2022

As an evolving term, Banking as a Service (BaaS) can be challenging to pin down.

Overly broad descriptions risk sacrificing preciseness for longevity. Too much detail can have the opposite effect.

Yet when almost any company has the potential to become a fintech company via BaaS, some terminological clarity is needed.

Instead of an alphabetical arrangement, we have opted for a thematic arrangement to show the evolution of BaaS through its various guises. More details may be found in our report Open, embedded, modular, and on a platform: The opportunities of Banking as a Service.

We begin with the term itself.

Banking as a Service (BaaS)

A recent buzzword in the anything “as a service” trend. BaaS may be neatly defined as the opening up of banking capabilities to third parties.

The concept is not new. White-label partnerships between banks and public-facing consumer brands go back more than a decade. But they were expensive to deploy until application programming interfaces (APIs) allowed banks to easily connect with third parties.

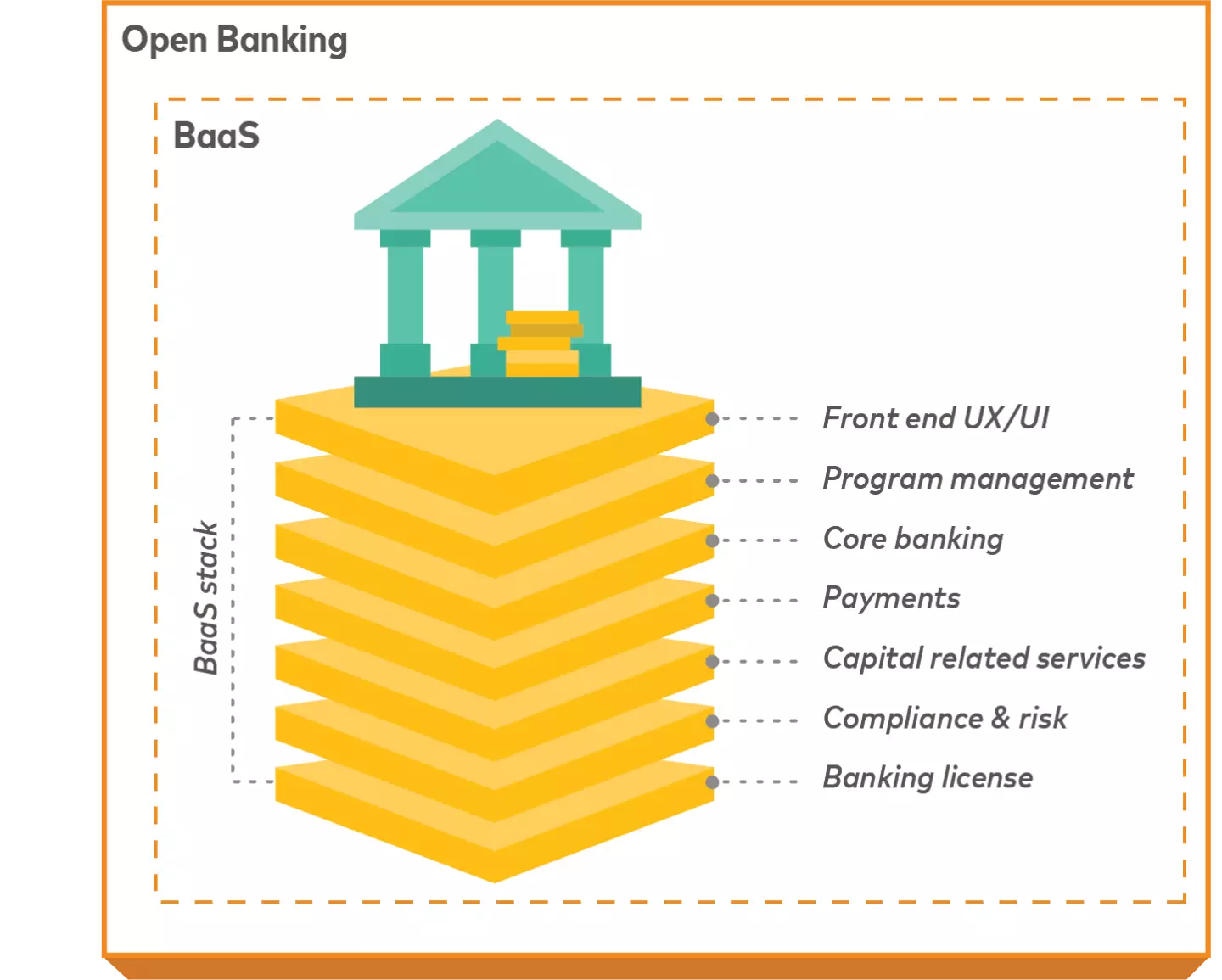

Open banking

One definition of open banking is the permissioned opening up of access to account data and services via APIs. That compares with BaaS as the opening up of banking capabilities.

Yet any data sharing is usually tied to other banking capabilities to create an effective value proposition. The relationship technically keeps BaaS as a subset of open banking, but it effectively accords almost all activity to BaaS.

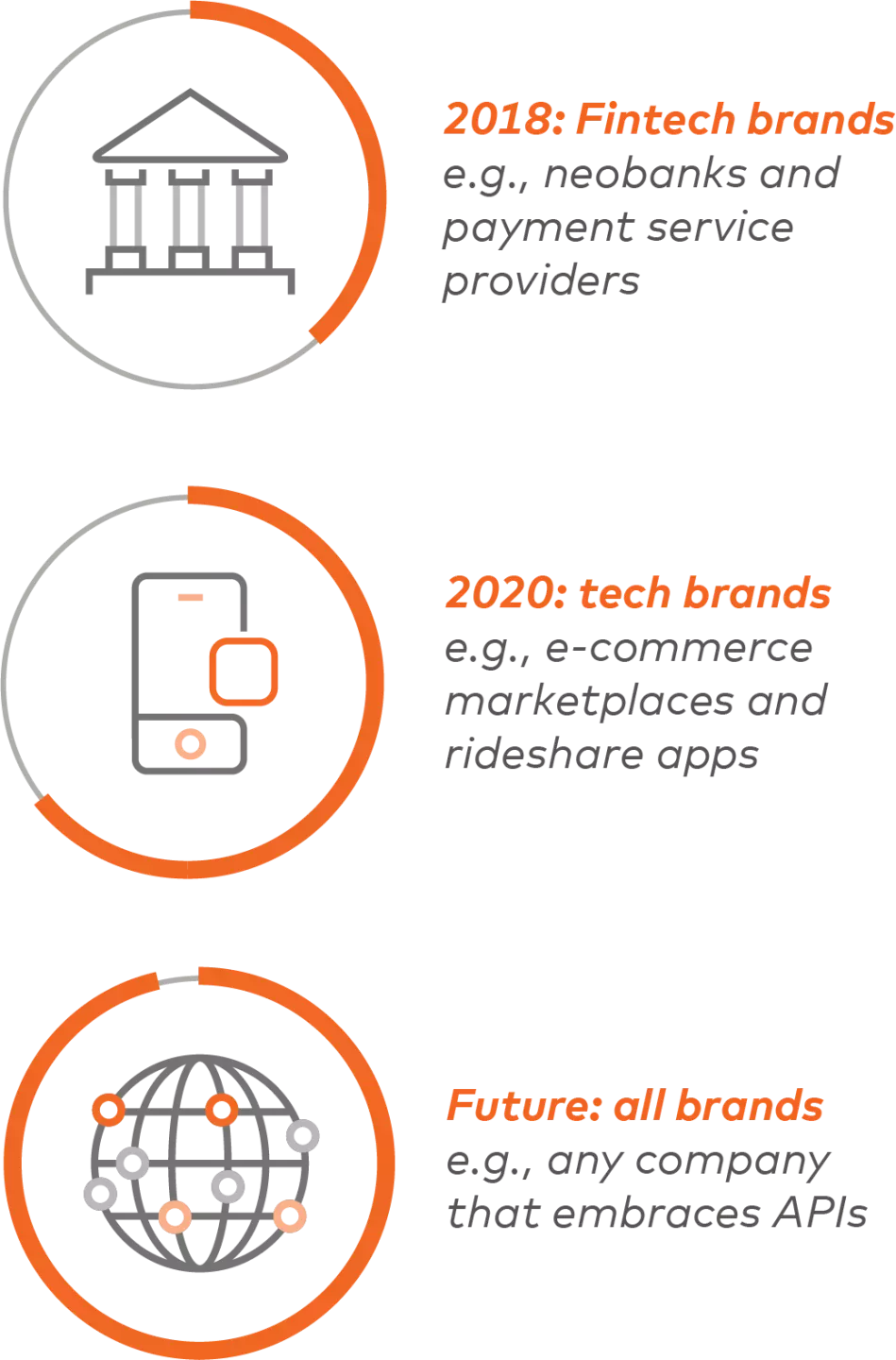

"API first"

As “API first” becomes the rallying cry to replace “digital first,” a proliferation of BaaS will result.

Initial BaaS partnerships were between banks and API-first fintech companies. More recently, API-first tech companies are entering into BaaS partnerships. These partnerships will potentially extend to all companies in the future that adopt API-based business models.

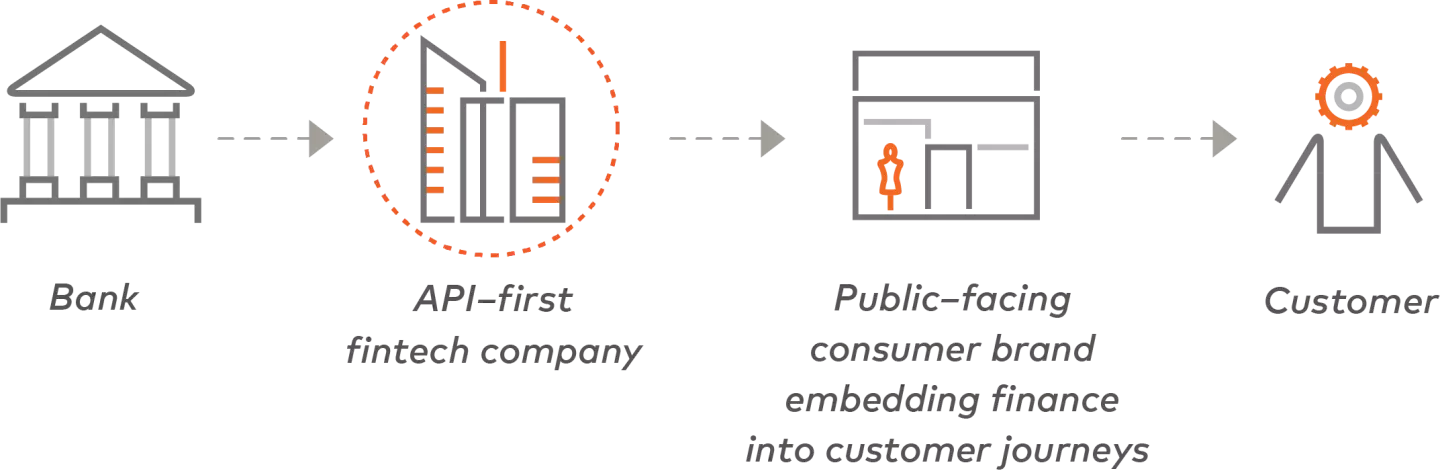

Embedded finance

BaaS is known as embedded finance when it is inserted into customer journeys as financial products. Providers may be banks, or they may be fintech companies acting as distributors with banks on the backend.

The term embedded finance reflects the evolution of open banking into open finance, which represents more than just open banking with a broader scope.

Modular banking

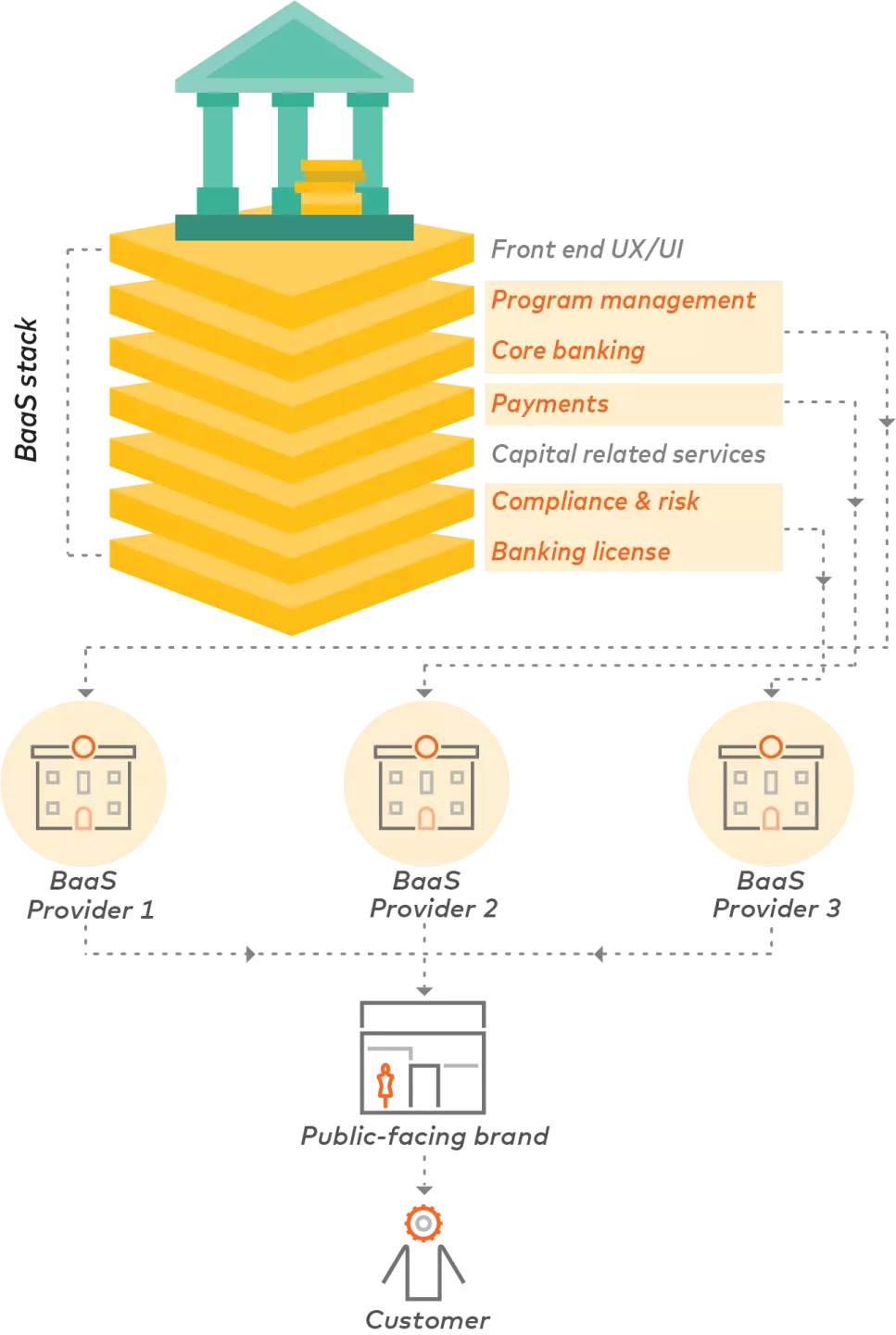

The broad applicability of BaaS across all brands caters to a variety of needs. Modular banking allows brands to source only the modules of the BaaS stack that are applicable to their needs.

Those modules can come from different providers, whether directly from banks or indirectly via intermediary fintech companies.

BaaS Marketplace

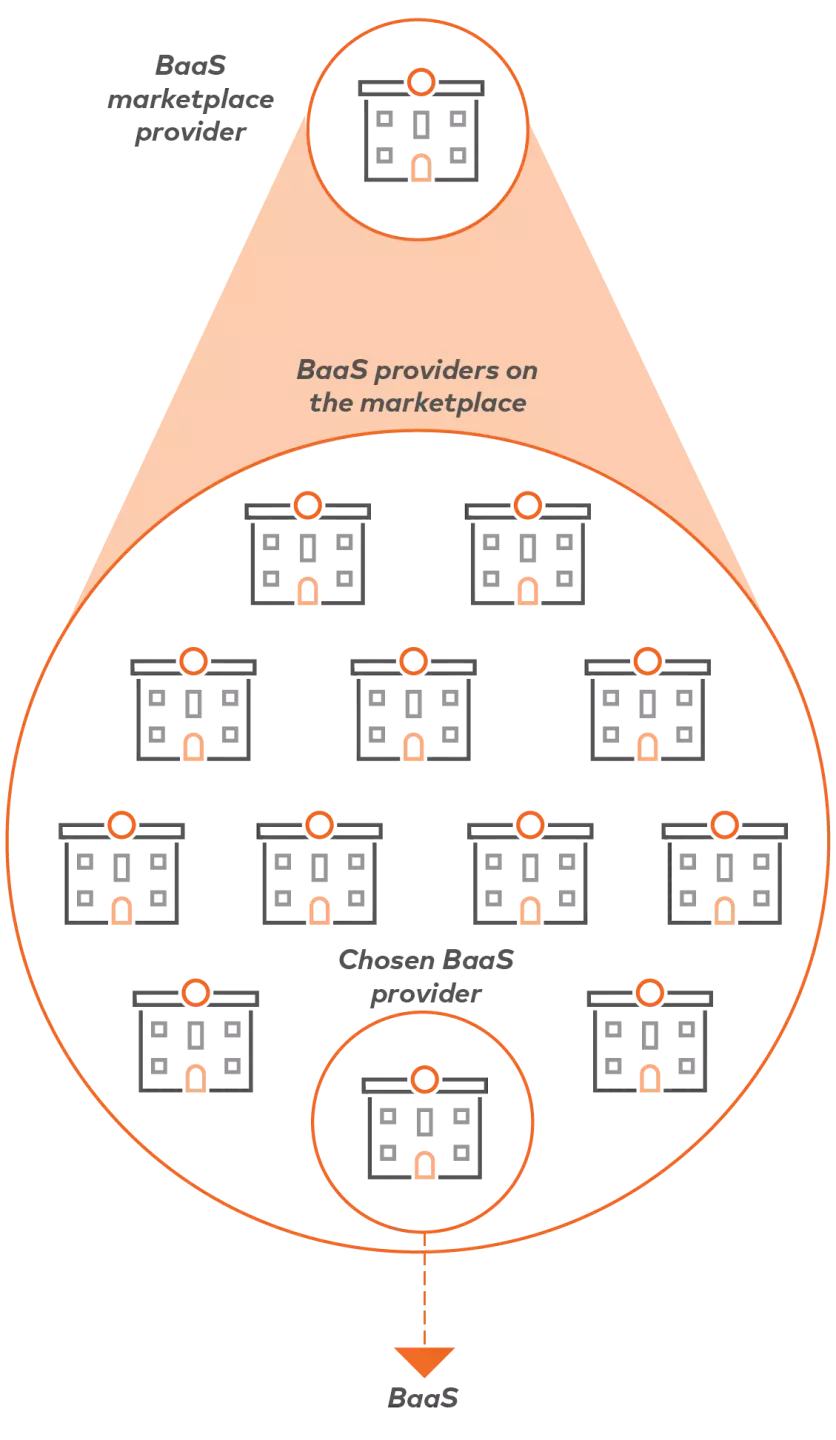

Modular banking creates marketplaces where BaaS providers compete to offer the best solutions at the best prices. Providers can host these marketplaces by including solutions from their partners to increase brand loyalty.

The possible further inclusion of competitors’ solutions seems counterintuitive in the short term, but it can boost brand trust in the long term by positioning hosts as sources of reliable and accurate information.

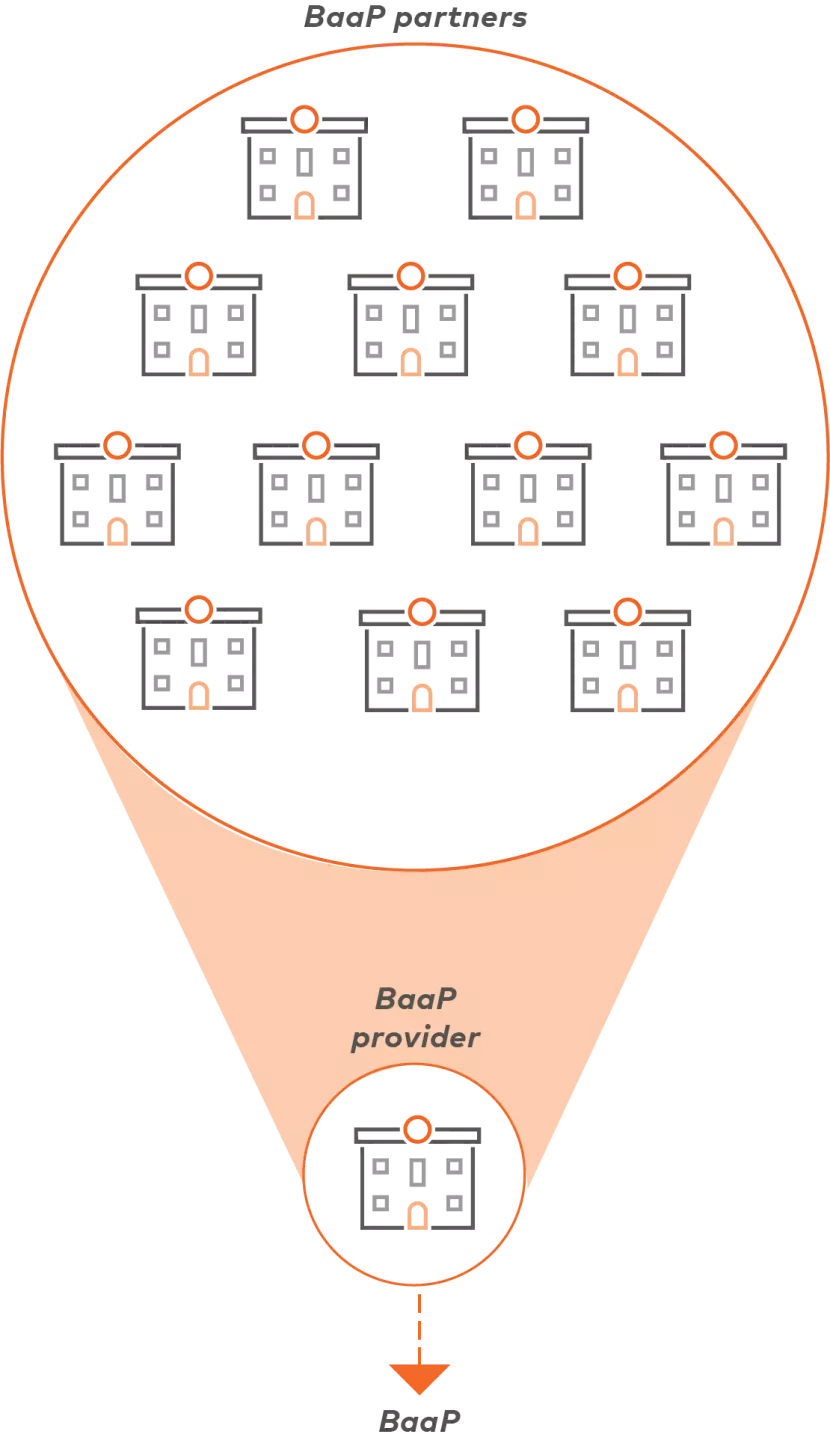

Banking as a Platform (BaaP)

A more precise term might be “bank platform as a service.” Providers host collaborative ecosystems on shared platforms where fintech and other API-first partners collaborate to create enhanced or new products and services.

Providers can white label the products and services that result, or they may take them to market themselves. A powerful combination results from offering the fruits of BaaP on modular BaaS marketplaces.