Transform complex supplier data into actionable insights

Teams across financial functions are increasingly tasked with synthesizing rich and complex data sets, analyzing potential supplier investments and managing risks.

Mastercard Global Treasury Intelligence analyzes payments data to deliver quantified insights for building and implementing B2B payment strategies. With Global Treasury Intelligence, corporate finance and treasury teams unlock clear, actionable recommendations to improve working capital, manage contract compliance risk, achieve ESG goals and drive operational efficiency.

Request a demo

Let one of our specialists show you how Global Treasury Intelligence

can achieve your corporate treasury goals.

Enhance your payments strategy with full visibility into your B2B payments

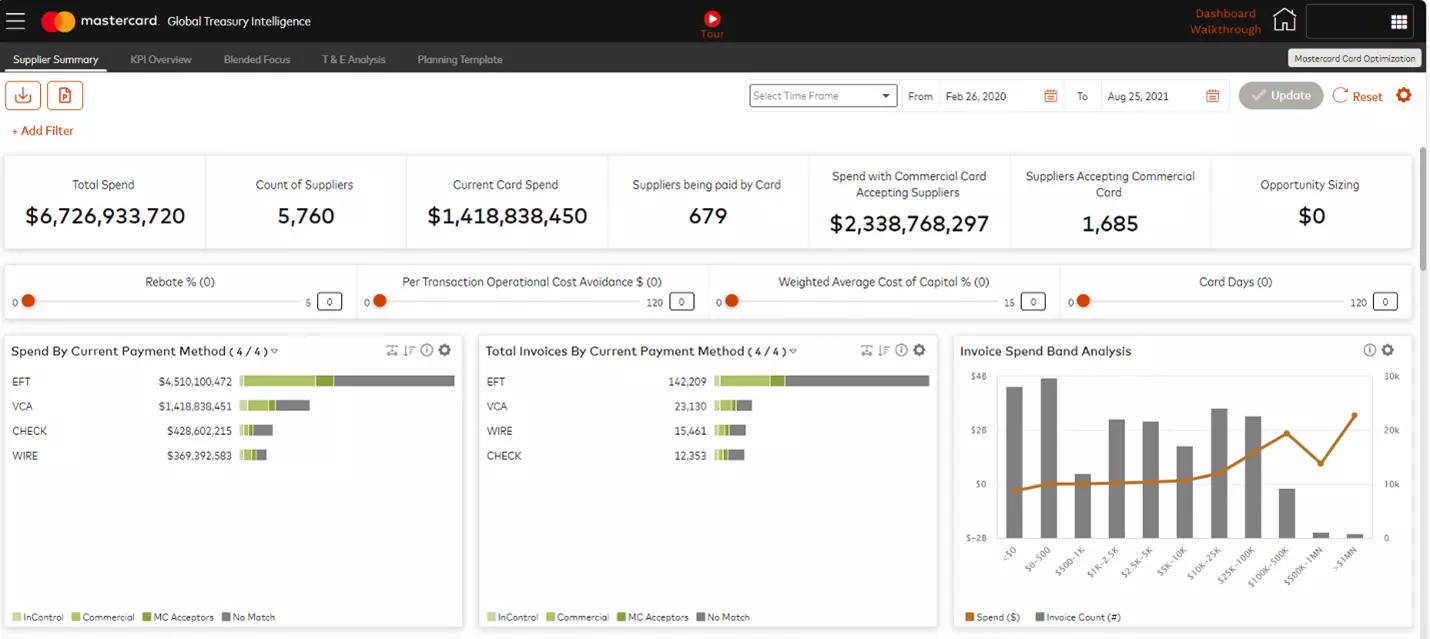

Improve working capital

Compare current performance against goals for payment channel usage and quantify the working capital impact of changing payment practices.

- Identify opportunities to move spend to cards and more advanced solutions, like straight-through-processing (STP)

- Track payment method splits and key metrics within a self-service dashboard

- Measure spend by payment method at the business-unit level

- Identify the financial and process cost impact of shifting payments to cards

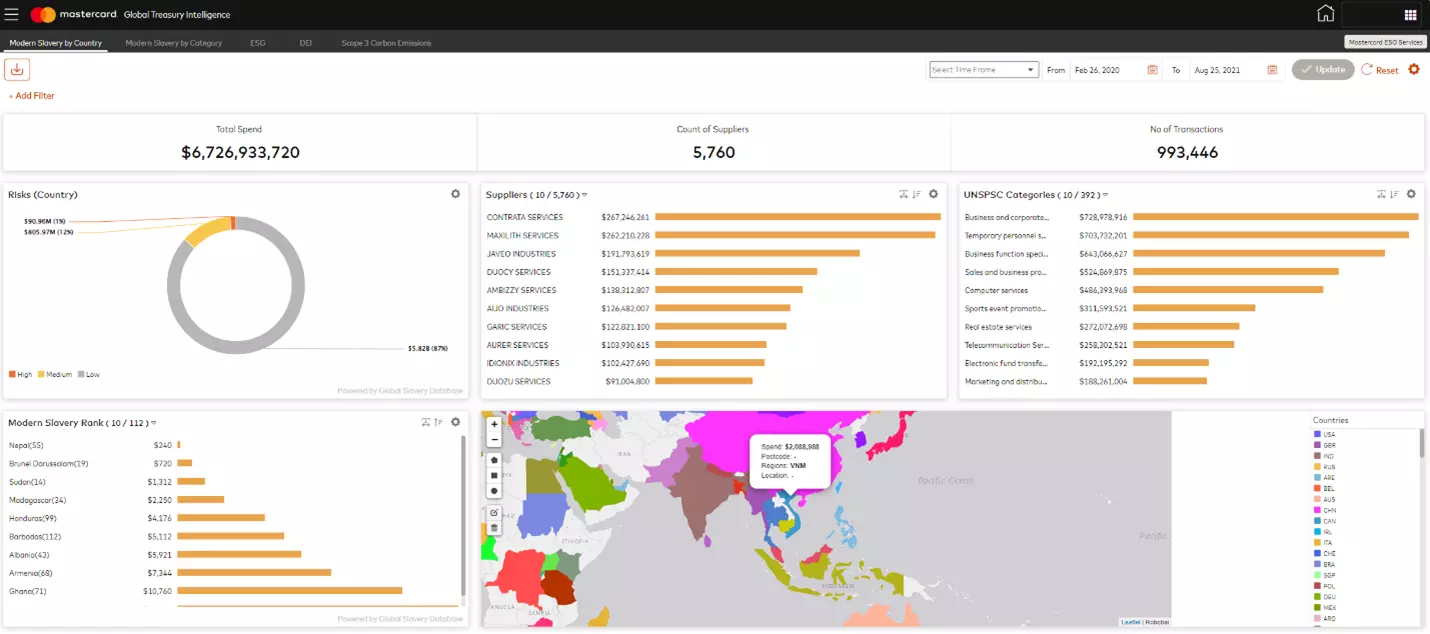

Reach business sustainability goals

Analyze ESG and DEI performance across the supply chain and prioritize suppliers that align with organizational goals.*

- Identify supply chain risks, prioritize suppliers for outreach and rationalize suppliers to meet ESG and DEI objectives

- Discover opportunities to shift payment methods and terms based on supplier’s ESG rating

- Access comprehensive ESG and DEI reports for each supplier

*Subject to 3rd party data integration

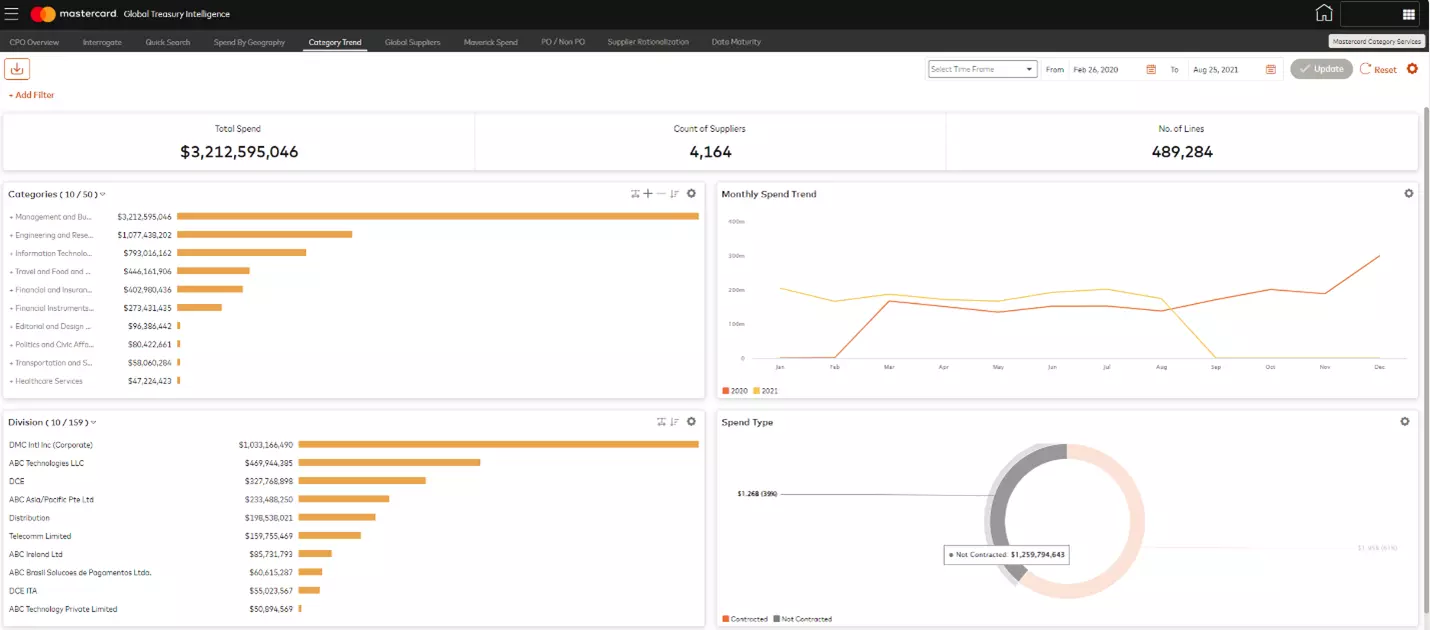

Reduce risk and compliance pressures

Understand supply chain risk with contracted vs. not-contracted spend.

- Access segmented views on contracted vs. not-contracted spend

- Identify categories and/or suppliers to prioritize based on risk factors

- Track progress towards year -over- year goals to improve contract compliance

Mastercard Consulting

Our consultants help clients optimize working capital performance and improve their bottom line. Our offering includes two key components:

- Opportunity Prioritization: We help you identify high-impact and low-complexity initiatives that can deliver quick results. By focusing on these opportunities, you can drive immediate improvements and maximize return on investment.

- Value Realization: We provide support throughout the execution process to help you achieve operational improvements and cost savings. Our team works closely with you to ensure that opportunities are implemented well.

Drive operational improvements and cost savings

An oil and gas company in Southeast Asia struggled to get a comprehensive view of supplier spend data due to its storage across multiple locations, inconsistent formats, various languages and incomplete data records.

The company used Mastercard’s Global Treasury Intelligence technology to quickly consolidate spend data to a centralized platform. With the improved visibility, the company identified low-volume suppliers to rationalize and transitioned the remaining suppliers to contracted terms.

The improved visibility and insights resulted in $360M in realized cost savings for the company.