A regional spinoff from Economic Outlook 2023.

March 2023 | By Natalia Lechmanova and Max Lambertson

On New Year’s Eve, the thermometer reached a balmy 18 degrees Celsius (64 degrees Fahrenheit) in Prague, much warmer than the typical near-freezing temperatures. Since Europe entered 2023, many people have been experiencing warmer weather – and with it, a warming economic outlook.

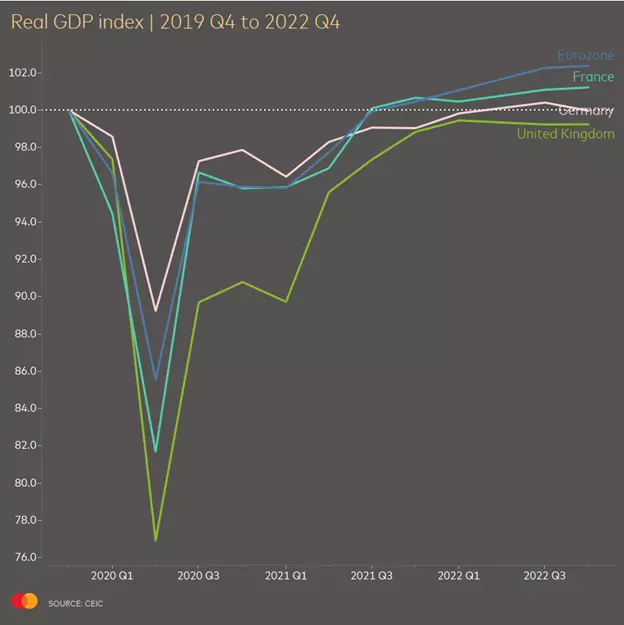

According to preliminary estimates, Eurozone’s Q4 2022 gross domestic product (GDP) unexpectedly grew by 0.1% vs. the prior quarter, exceeding expectations of a -0.1% contraction and avoiding the much-anticipated recession. This means that the economy expanded by 3.5% for the full year of 2022, a pace that’s more than 2.5 times faster than in a typical year. The U.K. grew at 4% last year, also about 2.5 times faster than usual. The U.K. also narrowly managed to avoid recession with a growth rate of 0% quarter over quarter in the last quarter of 2022, better than the expectations of a -0.1% quarter-over-quarter contraction.1

That’s welcome news for those who feared an energy crisis that could send Europe into a recession. Lower gas consumption caused prices of natural gas to tumble to 2021 levels. Gas inventories are estimated to end the winter about 50% full, compared to 25% in 2022.2 With the energy crisis averted, recessionary risks also lessened.

The fundamentals that underpinned the consumer in 2022 – healthy balance sheets, tight labor markets that are still adding jobs, government support to help households cope with the pain of the high cost of living and pent-up demand for experiences – are also carrying Europe into 2023.

Finally, the earlier-than-expected reopening of China’s economy3 also presents opportunities for European exporters and for the travel sector.

A European economy moving at multi-speeds

For this year, we forecasted the global economy to achieve multi-speeds, defined by uneven outcomes across regions, countries and sectors, according to our Economic Outlook 2023 report.

Of the G7 economies (Canada, France, Germany, Italy, Japan, the U.S., the U.K. and the European Union), the U.K. is the only one with output still below pre-pandemic levels and with the weakest growth prospects for 2023.4 Contributing factors include the effects of Brexit, which pushed down investment and trade and resulted in lower productivity and added to labor shortages. High and sticky inflation, very tight monetary policy and less accommodative fiscal policy compared to continental Europe are also factors.

Looking into 2023 within continental Europe, although the region as a whole avoided falling into recession in Q4 2022, countries with higher energy dependence on gas, such as Germany, Italy, Austria or the Czech Republic, did contract and remain at risk of a technical recession (two consecutive quarters of negative growth). Having said that, leading indicators suggest improvement in their growth momentum in Q1 2023.5 On the other hand, less energy intensive economies with larger services sector such as France, Spain or Portugal continue to register positive growth rates and their prospects are brighter. Growth will also be impacted more in the Nordic countries, where 80-95% of mortgages are at variable rates, making their sensitivity to interest rates higher.

Reasons for (cautious) optimism

As Europe nears the end of the first quarter of 2023, drivers that underpinned consumer resilience last year remain at play and provide reasons for (cautious) optimism:

Strong balance sheet

Households did not increase debt during the pandemic -- in fact, in many cases they de-leveraged and balance sheets were further padded by excess savings. Balance sheets remain healthy as Europeans have tended to show caution in both spending their pandemic savings and increasing their borrowing.

Strong labor market

While unemployment may rise in Europe, expectations are that it may only rise a bit. Tight labor markets and companies struggling with labor shortages means there is capacity to reabsorb workers who lose their jobs. Employers also appear reluctant to let workers go, knowing how difficult it may be to rehire them later.

Strong labor markets not only provide people with incomes. They also help to encourage spending. When people have jobs, they feel more comfortable using credit cards and dipping into savings. For workers who lose jobs, a strong labor market means they can more easily find a new one.

The Euro area unemployment was at 6.6% in December 2022, unchanged since November 2022, suggesting labor markets continue to hold up. By the fourth quarter of 2023, we expect unemployment to increase by 0.4 percentage points (ppt) in the UK, to 4.1%, and by 0.2ppt in the Eurozone, to 6.8%.

Pent-up demand for experiences caused by pandemic restrictions pushed people to spend on travel last year, no matter the price or chaos at the airports. That demand continued throughout the year with no signs of abating. Global airline bookings remained above pre-pandemic levels and Europe, which receives more than half of global tourist arrivals, disproportionately benefits from this.6

The expected return of Chinese travelers may provide further tailwinds to the travel recovery this year. However, it will likely only be gradual as logistical issues to meeting demand, from issuing visas to bringing back extra flight connectivity, are resolved.

Cost-of-living crisis eases

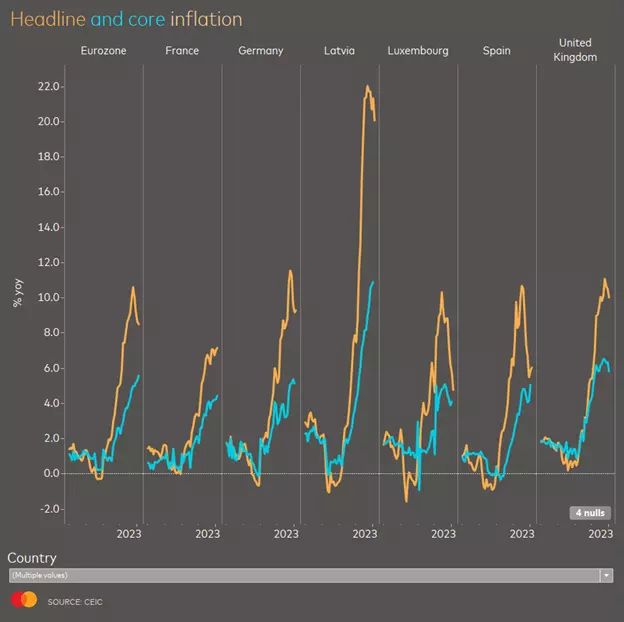

The cost-of-living crisis is easing as inflation appears to have peaked in October. This is welcome news after Europe struggled to contain inflation in 2022. Euro area inflation fell to 8.5% year over year in February from 8.6% year over year in January, driven by a slowdown in energy price increases. Food inflation continued to push higher to 15.0%, from 14.1% in January. Core inflation also accelerated, to 5.6% in January (from 5.3% in January), against an expectation of a stabilization, with both prices of goods and services rising.7

However, inflation, which has been highest in The Baltics and lowest in Luxembourg and Belgium, is expected to stay elevated, decelerating to around 4% by the end of the year, twice the European Central Bank’s 2% target rate, due to persistently high energy prices and tight labor markets. Moreover, the underlying core inflation (excluding food and energy) is yet to start decelerating.8

High rates & housing

The biggest drag on and downside risk to European growth right now is the sharply rising cost of borrowing. The European Central Bank remains determined to get inflation under control and it is set to continue to raise interest rates in the coming months by another 100-150 basis points (bps). The tighter monetary policy is already having an impact on credit growth. In January, the European Central Bank’s Bank Lending Survey for Q4 2022 showed a significant tightening of financial conditions, with both demand for credit falling as a result of high interest rates and banks’ lending standards being toughened due to rising credit risks from inflation and economic slowdown. This makes it more difficult for those who want to borrow to do so and will weigh on consumption.

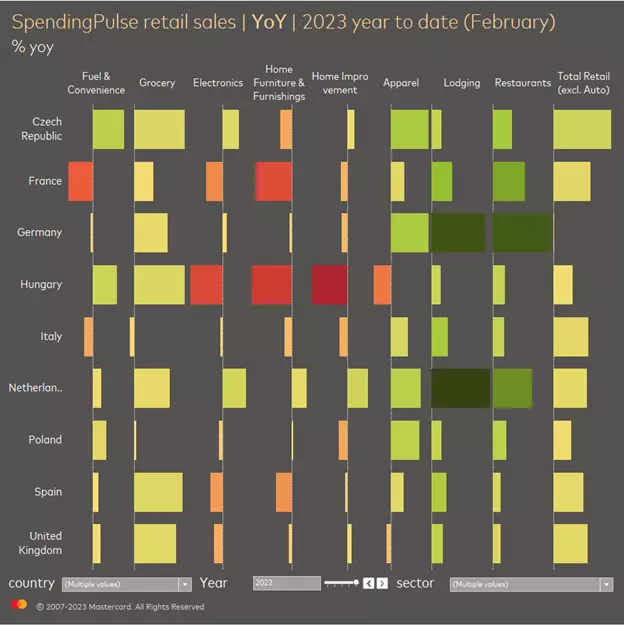

We expect high interest rates to have a significant impact on housing markets, with Nordic countries standing out as most vulnerable due to the high proportion of variable mortgages. Housing-related spend on items like furniture, home improvement and home appliances that outperformed during the pandemic is likely to decline correspondingly. In the U.K., Denmark, Switzerland, Italy and Poland, it is already below pre-pandemic levels. However, with less spending on home, more spending should be available in sectors where there is still plenty of evidence of pent-up demand, such as travel.

Trading down & shopping around

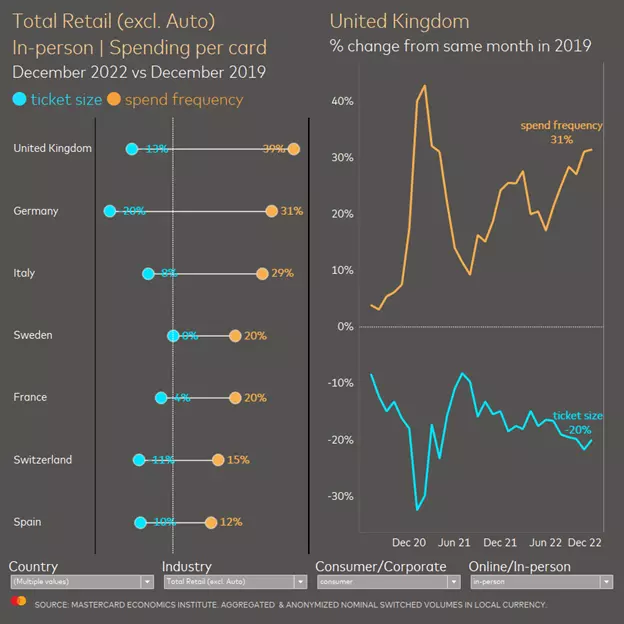

Consumers have adjusted to inflation by reprioritizing spending and trading down. When it comes to spending reprioritization, Mastercard SpendingPulse insights show that the post-pandemic adjustment in spending away from goods and into services continues, with spending on electronics, furniture and home improvement underperforming while spending on restaurants and lodging outperforming.

According to our analysis of average spend and spend frequency, consumers have also changed their habits. Especially in the essentials category of groceries, consumers are trading down and increasing the frequency of their shopping. Average transaction size in grocery stores is lower than before the pandemic, despite higher prices, as people are choosing cheaper alternatives of their staple products and going to store more frequently to buy what they need to minimize waste.

Conclusion

In 2023, European economies may be lifted by the same fundamentals that carried the consumer during a strong 2022. With the energy crisis averted and China’s reopening, recessionary risks also lessened. However, the high cost of living and borrowing are persistent issues that bear close watching. While the risk of much-anticipated recession still looms, European performance is again proving to be more resilient than expected.

1 Eurostat Euroindicators; GDP first quarterly estimate, UK - Office for National Statistics (ons.gov.uk)

2 Analysis: Healthy gas storage warms Europe, but not enough | Reuters; Preparing for the next winter: Europe’s gas outlook for 2023 (bruegel.org)

3 “China reopening earlier than expected could hit supply chains in the short term, but boost growth in 2023,” CNBC.com, Dec. 29, 2022

4 GDP - International Comparisons: Key Economic Indicators - House of Commons Library (parliament.uk)

5 S&P Global

6 United Nations World Tourism Organization Barometer | UNWTO

7 Europa.eu 91fa331d-8f61-adff-5e42-d92a64b6ee81 (europa.eu)

8 Eurostat Euroindicators

Notes & Disclaimer

| Natalia LechmanovaSenior economist, Mastercard Economics Institute | |

| Max LambertsonEconomist, Mastercard Economics Institute | |