Credit cards have evolved from simple transaction tools into sophisticated financial and lifestyle products.

Issuing financial institutions are constantly enhancing their credit card offerings with new benefits to meet the diverse needs and expectations of different customer segments.

Read the latest analysis of our extensive credit card database highlighting global trends in premium and travel cards, as well as security and convenience.

For these and more insights our Mastercard Business Intelligence Cards Comparison tool lets you compare detailed payment card value propositions of more than 9K cards around the world.

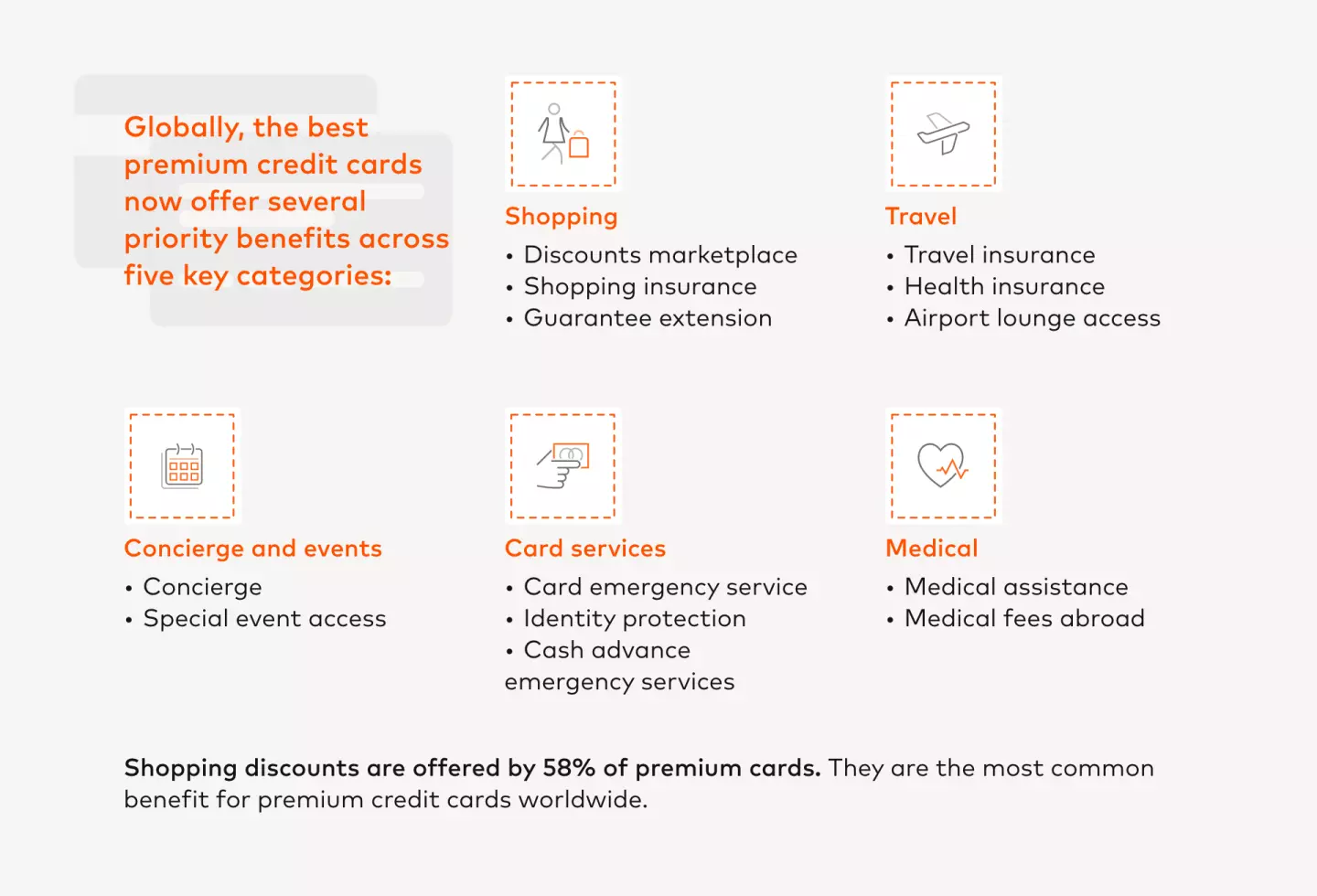

Premium credit cards

Premium credit card customers increasingly demand a harmonized blend of luxury, convenience, security and personalised experiences, reflecting their multifaceted lifestyles and values.

Which region offers the most extensive premium card features?3

Premium credit cards in Latin America offer the most extensive blend of benefits in four of the five categories. Their ‘card services’ benefits were second only to the USA.

Travel cards

Global consumer flight bookings exceeded pre-pandemic levels by more than 20% in 2022. In fact, 63% of leisure travellers plan to increase or maintain their travel spend in 2023.4

Travel bookings have been boosted by:

Best-in-class travel card offerings:

Although a large proportion of travel cards offer shopping discounts, few include 0% currency conversion fee as well. Travel cards that offer both these benefits can drive the greatest value to customers.

Which region offers the most travel card benefits?

Travel cards in Latin America differentiate themselves from other global regions through shopping discounts, shopping insurance, medical assistance and concierge benefits.

However, it is the region with the lowest penetration of 0% currency conversion fees.

Security and convenience features

Cybercrime has increased by 600% since the pandemic.5

Security remains the top priority for online shoppers, though convenience plays an important role as well.6

To meet these growing challenges, best practice credit card security features include:

While traditional banks more commonly offer SMS alerts and 3D Secure, fintech companies differentiate themselves by offering more control-based security features, including temporary blocking, spend control and geo control.

To meet customer expectations for seamless, fast, and convenient payments, best practice credit card offerings include:

Recurring payments and card tokenisation are the most highly penetrated convenience features. They are offered by 82% and 71% of cards respectively.7

However, contactless adoption is growing rapidly worldwide, is now offered by 58% of cards.8

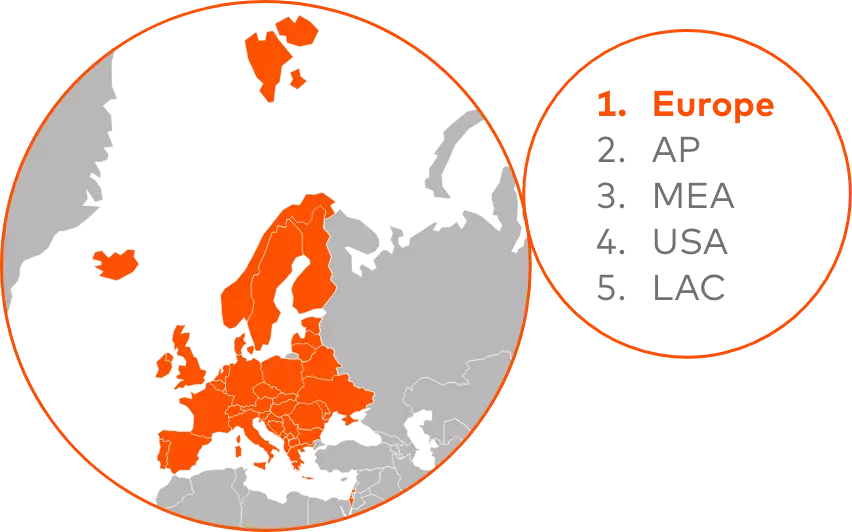

Which region offers the most comprehensive security and convenience features?9

Europe offers the most comprehensive security and convenience features, closely followed by AP and MEA regions.

LAC cards could differentiate themselves by offering more best practice security features, particularly SMS alert, 3DS and control based features, and improve their convenience functionality, especially recurring payments and card tokenization.

Access Mastercard Business Intelligence Cards Comparison tool, to compare features across all card products globally, including fees, limits and benefits.

2 CapGemini. ‘World Wealth Report,’ 2022.

3 Calculated by comparing features across the five key categories listed of over 9k cards in the Market Trends Cards Comparison credit card database.

4 Mastercard Economics Institute. ‘Travel Reimagined,’ 2023.

5 IBM. ‘Cost of a data breach,’ 2022.

6 WeAreTechWomen. ‘Security vs convenience: finding the right balance for online payments,’ 2022.

7 This is proportion of cards in our database of over 9k cards with recurring payments and tokenisation features.

8 This is proportion of cards in our of over 9k cards database with contactless functionality.

9 Calculated by comparing 10 features across security and convenience of over 9k cards in the Market Trends Cards Comparison credit card database.