How changes in the US housing market are impacting consumer spending

August 4, 2022 | By MICHELLE MEYER AND LUIS CARVALHO

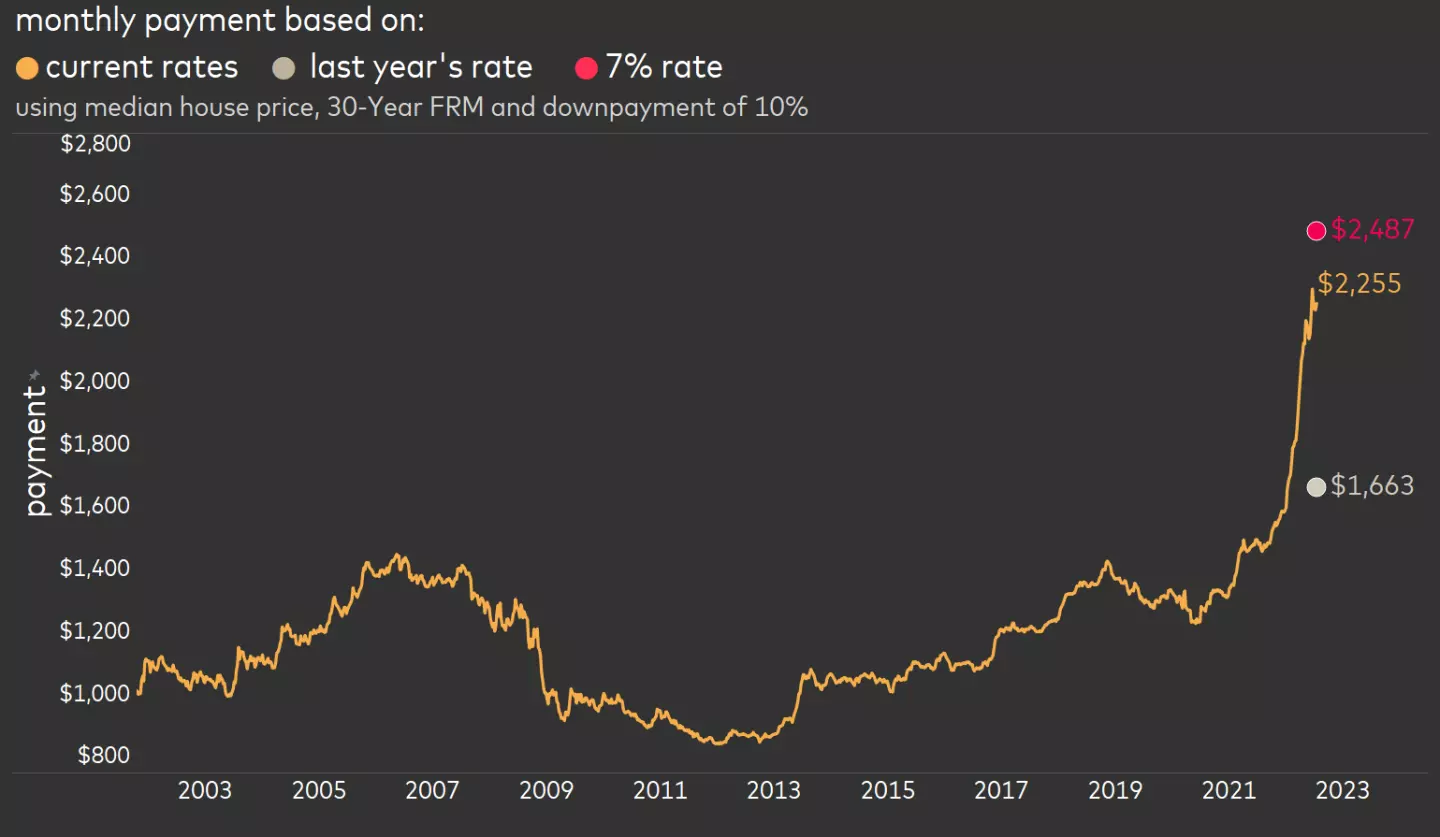

Assuming a 30-year, fixed-rate mortgage, the average homebuyer buying a home today will spend $600 more a month than this time last year given the rise in mortgage rates and home prices.

Housing softens and consumers respond

Mortgage rates keenly affect new buyers and people who need to relocate for a variety of reasons. Assuming a 30-year, fixed-rate mortgage, the average homebuyer buying a home today will spend $600 more a month than this time last year given the rise in mortgage rates and home prices. The good news is that most existing homeowners won’t directly feel the interest rate shock given the large number of fixed-rate mortgages. Still, a softening of the market could affect their perception of their overall wealth.

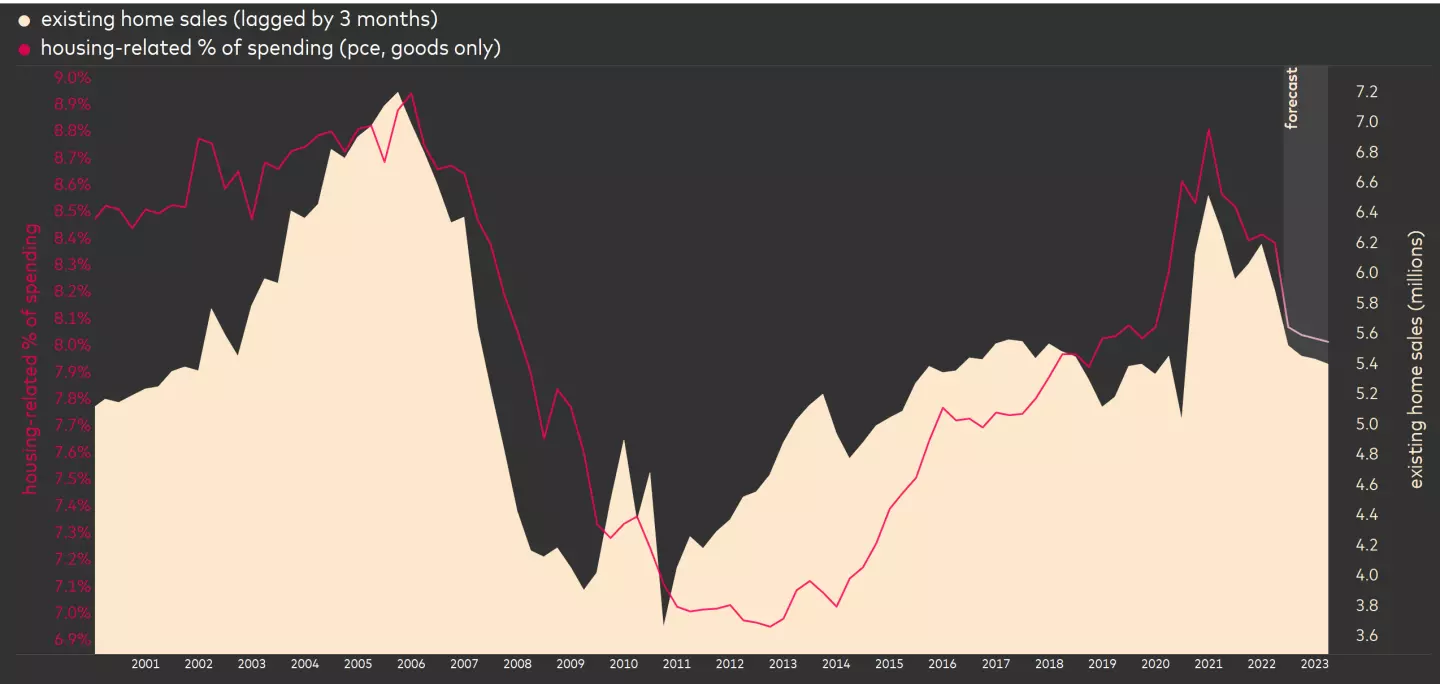

The response to the interest rate rise has been a decline in home sales and home-related purchases. Consider what happens when you purchase a home: you may refresh the paint, perhaps swap in new carpets, possibly install new window coverings and maybe upgrade some furniture. Each time a home changes hands, there tends to be a significant amount of spending associated with that transaction. With fewer homes sold, there is naturally going to be a reduction in housing-related spending.

We can offer a real-time assessment of this change in consumer wallets using aggregated and anonymized Mastercard insights. We created an aggregate of housing-related spending to see how the consumer is reacting to the downward pull of home sales. So far, there is little impact with trend-like growth in most of the housing-related categories in nominal terms.

At the peak rate of home sales in early 2021, spending on housing-related items made up 8.8 percent of goods spending.

But we want to understand the story for the full economy, so we used this measure to extrapolate the official government statistics from the Bureau of Economic Analysis and look at housing spend relative to overall goods. At the peak rate of home sales in early 2021, spending on housing-related items made up 8.8 percent of goods spending. In the second quarter of 2022, it stood at 8.4 percent but if the consensus forecast for home sales is on pace from the Bloomberg Consensus survey, it could slip to 8.0 percent. If the pace of home sales flirts with 2008 lows, we could see consumers only allocate 7.4% of goods spending on home-related items.

Housing trends differ based on where you live

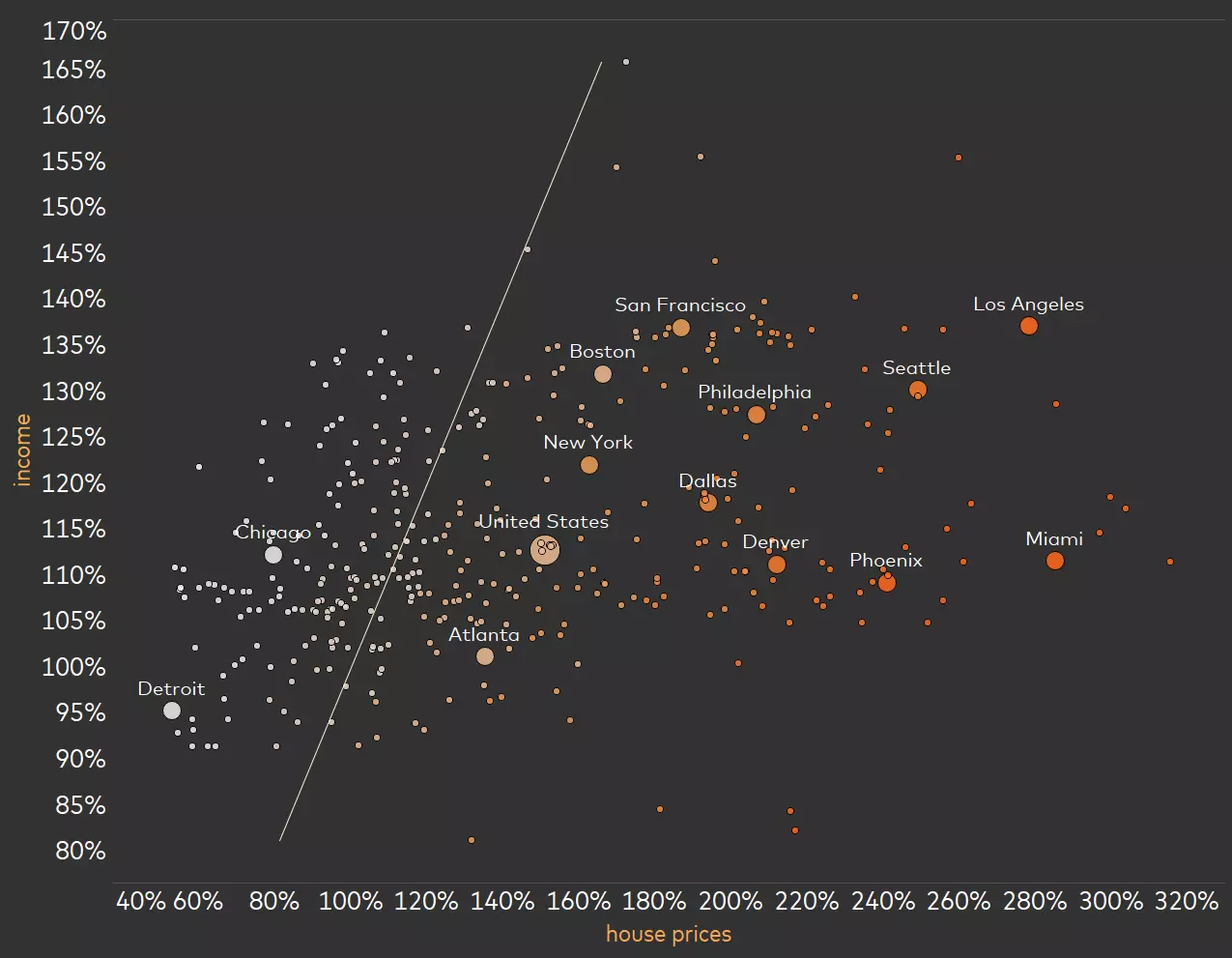

We know housing varies greatly depending on where you live. Beginning with the pandemic in 2020, the country saw home prices soar -- in some areas much more than others. Some of this was impacted by people relocating during the pandemic. We looked at how different areas of the US are impacted and uncovered the states with the most undervalued and overvalued real estate in the nation.

We found that the three most overvalued states are Idaho, Washington and Arizona. At the other end, the three most undervalued are Illinois, Connecticut and West Virginia.

Our measure of valuation looks at the change in home prices from 2000 through June 2022, relative to the change in income since 2000, by geographic area. On a state level, you generally see that the housing markets in the Mountain States and the Northwest are overvalued, as opposed to the Midwest and Northeast, which have not seen the same degree of price appreciation. We found that the three most overvalued states are Idaho, Washington and Arizona. At the other end, the three most undervalued are Illinois, Connecticut and West Virginia. Looking even deeper at these dynamics on a metro area basis, we found that a number of metro areas have seen extreme price gains. Take Miami, for example, where home prices are up 285 percent from 2000 versus a 112 percent gain in local area income.

Home is still where the heart is … but the housing market is strained

Michelle Meyer is chief US economist and Luis Carvalho Monteiro is econometrician, both with the Mastercard Economics Institute.