By: Marissa Nolan

Published: February 27, 2024 | Updated: October 29, 2025

Read time: 15 minutes

- Table of Contents

Introduction

The choice between looking for value and looking to splurge. A desire for personalization. The need for a seamless mobile ordering journey.

All of these are driving the restaurant industry in 2024 as diner expectations and experiences continue to evolve.

The signs were there in 2023, when the industry saw a blending of “dining out” and “ordering in” as more consumers looked to have the restaurant experience in their homes. This was a natural consumer evolution from post-pandemic habits formed over the past few years. People continued to want the dining experience, so they changed how they spent.

Today, while consumers are largely returning to normal habits, some behaviors have been permanently altered.

In 2024, restaurants will focus on elevating their online sites and apps, rebooting their loyalty efforts, growing in-house delivery programs, optimizing their digital presence and implementing more measures to meet rising expectations for a personalized experience.

The global restaurant industry will see most of these trends strengthen this year, with many still showing plenty of opportunity. Here are the top trends in the restaurant industry for 2024:

- Consumers will continue to prioritize their resources in the face of macroeconomic factors

- Consumers and brands will align on the importance of loyalty and personalization

- Restaurants will look to increase reach across digital channels

- Technology investments will optimize operations and enhance the employee experience

- Investments in sustainability will speak to consumers’ growing desire to positively impact the world

- Explore more

Macroeconomic impacts

Consumers will continue to prioritize their resources in the face of macroeconomic factors

Macroeconomic forces have impacted consumer spending over the last three years. Where higher interest rates, rising prices and growing energy costs reduced consumers’ ability to spend and lowered consumer confidence, a thriving jobs market, wage growth and excess savings effectively balanced those impacts. Through it all, a resilient and empowered consumer emerged.

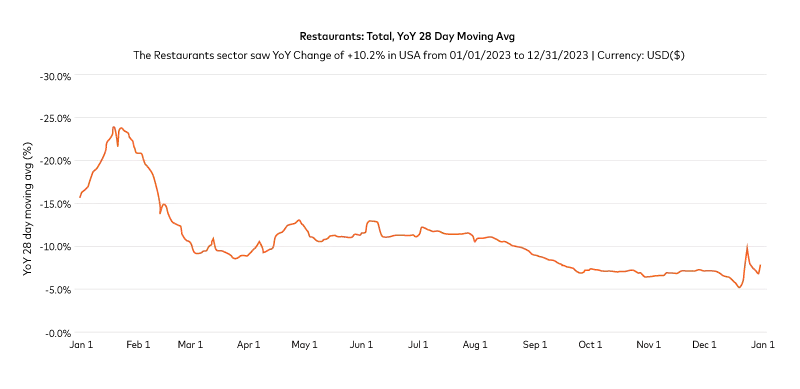

Faced with a tightening wallet, consumers prioritized experiences over things, providing a boost to restaurant sales. While pent-up demand for experiences may start to rebalance to pre-pandemic levels in 2024, according to Mastercard SpendingPulse™, which measures in-store and online retail sales across both cash and card and all tender types, the restaurant industry will likely continue its growth, albeit at a more tempered pace.

Consumers have started seeking different and unique dining experiences, whether that means a fine dining night out where the menu highlights seasonal ingredients, or a fast-food livestream where thousands of viewers eat along at home. However, pressures on their food-away-from-home budget pushes diners to make careful choices on how they meet their own personal needs.

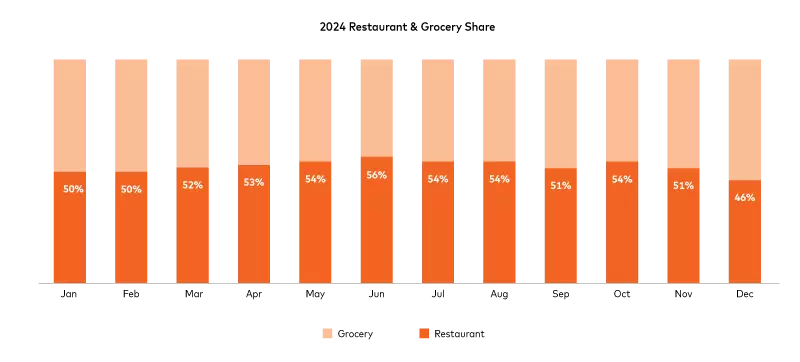

That means value is becoming increasingly important. In 2023, as consumers felt the inflationary pressure, many traded down to still enjoy the eating-out experience, opting for “a good deal.” That behavior persists today as the once-a-month expensive steak meal is replaced by frequent trips to casual dining and limited-service restaurants offering multi-item bundles and deals. With the cost of groceries also moderately rising, consumers want food alternatives, and restaurants see value as the key to attracting customers.

Some examples of this include:

- Quick service chain Wendy’s witnessed double-digit sales growth thanks to its 2-for-$3 biggie breakfast bundle.

- Casual dining chain Chili’s saw success with its 3 for Me meal, which includes an appetizer, entrée and dessert for $10.

- Casual dining chain PF Chang’s experienced increased traffic thanks to its “happy hour” window on weekdays where food and drink options are $6 or less.

Brands will need to carefully balance value offers to ensure that they drive profitable traffic. By measuring their impact on margin, they can see whether consumers are also buying full priced items and whether value items drive return visits. While some value offers may offer smaller profit, success in the form of increased sales and traffic indicate that value is what consumers want today.

Restaurants face some challenges in 2024, like labor costs, which are only expected to rise with recent minimum wage increases in 22 states and continued low unemployment. Although restaurant unemployment rates have returned to pre-pandemic levels, many workers will see a wage increase and other benefits.

- What’s going on in Brazil?

Restaurants in Brazilian shopping malls are experiencing the direct impact of changing consumer behavior. Food courts were once a major end-of-the-week staple. Now, they’re experiencing lower traffic — especially on weekends. Whether it’s desire for a wider range of menu options, more space between tables or a location that’s not in a high-traffic corridor, customer preferences are no longer aligning with the food court experience.

While no winning concept has yet been found, mall restaurants are starting to test some options to enhance food court storefronts, packing and presentation to entice as many consumers as possible to dine. In doing so, they’re playing to the diners’ desire for a restaurant experience that is both pleasant and familiar, and counting on the “delight” of an improved experience to build customer loyalty.

Rewarding loyalty and providing personalization

Consumers and brands will align on the importance of loyalty and personalization

Loyalty

Global membership in digital loyalty programs increased to 24 billion participants in 2022 and is estimated to reach 32 billion by 2026.1 Consumers are willing to sign up, but with the sheer amount of programs in-market, the traditional earn-and-burn approach is no longer enough. As a result, many restaurants are moving away in favor of more customized programs with dynamic offers, benefits and rewards.

2024 will be the year of the empowered consumer, so more restaurants are building authentic relationships to foster loyalty. Recognizing that consumers want personalization, restaurants should focus on providing a catered experience that meets those demands.

Over 70% of decision-makers feel that their brand’s loyalty program lacks a modern digital interface, is difficult to use, is old and outdated and lacks the ability to deliver one-to-one personalized offers or experiences, according to a Forrester Consulting study conducted on behalf of Mastercard. Driven by profitability and customer value, some restaurants are looking to redesign their programs. Many are moving away from bulk offers and providing more tiered, gamified and tailored loyalty experiences. Consequently, there are many perks to each:

No matter the type of offering, restaurants ask themselves: How can we best reward the most loyal diners while still providing good value for those who are not? It all comes down to knowing their customers, respecting and protecting privacy and finding the right balance of personalization and loyalty.

Personalization

Consumers are more likely to shop with a brand that delivers relevant, convenient and engaging experiences across channels.

Smart personalization has ushered in an era of consumer-centricity that will continue to change the way restaurants engage for the better. When a diner uses their app, visits the site or orders at a digital kiosk, contextual factors and consumer-permissioned data can be used to tailor the diner’s experience and suggest items based on past purchases, current trends, time of day or even weather.

For example, a global quick service restaurant (QSR) added personalized banners to their digital kiosks for customers that log into their loyalty account. When ordering, logged-in customers are subsequently greeted by their name and point count, along with items available within their specific point range. By facilitating easy access to this information when it matters most, the company promotes the loyalty program, reminds customers of the rewards associated with repeat business, introduces product discovery and increases the chance that a customer would generate additional value with a larger cart size.

This level of personalization is an easy way to drive engagement while also incentivizing loyalty signups to move customers from being unknown to being known. Deeper loyalty can be developed by a trending personalization technique: offering items exclusive to loyalty members. This method adds value to being a member, where the best items or opportunities are available only to the most loyal diners.

For instance, Buffalo Wild Wings partnered with BetMGM to offer BWW rewards members custom promotions and bet types while visiting. This type of in-restaurant experience uses technology-forward features to keep their members engaged while driving incremental visits and spend.

Loyalty and personalization are inherently linked. Personalization can help restaurants master context, perception and expectation to deliver the smart recommendations and authentic connections consumers seek. And when the focus is on connection, the metric of success is neither revenue nor return on investment — it’s loyalty.

- The UK takes to personalization

This particular trend is significantly impacting the European market, changing the food purchasing process dramatically. In the UK, personalization can now be found in a variety of formats previously unseen — including at kiosks, self-checkout stands, on websites and in apps.

Additionally, new to the European industry, communications are now more personalized. With consumer permission, items may be suggested based on past purchases at self-checkout screens and many more users might be prompted to use their loyalty codes. This type of customer engagement is ultimately enhancing the diner experience and optimizing revenue for the brand.

Pret A Manger is one such example where personalization drives loyalty. Users are rewarded at strategic moments in their journey and sent personal reminders. Their investments in the program have yielded 1.25 million redemptions a week in the UK, up 11% year-on-year. With digital usage growing exponentially, European consumers are getting used to personalization at all their food locations, from grocery stores to quick-serve restaurants, helping them become more loyal users.

Meeting on digital channels

Restaurants will look to increase reach across digital channels

Restaurants have been increasing engagement through mobile apps, virtual brands, social media and third-party aggregators — this trend looks to continue in 2024, but not all channels will receive the same priority. Regardless of method, the draw of digital remains the same for all restaurants: reach the maximum amount of people they can.

As reach increases, restaurant managers and owners are met with higher demand on expectations. Limiting friction across channels is a major part of good engagement. Restaurants who traditionally did not prioritize the digital experience find themselves now needing to be able to have some connectivity across their touchpoints.

Consumer behavior dictates that online ordering is here to stay. With the share of digital ordering growing — DoorDash recently estimated that 80% of diners are ordering online the same or more than the previous year — restaurants are finding that they must prioritize consumer-friendliness, ease and convenience.

Most restaurants see the need to invest in their mobile apps. According to the 2023 Mastercard-commissioned Forrester study, 90% of respondents were somewhat or very satisfied with mobile ordering and payment technology on personal devices, but only an average of 49% of restaurants deployed it.

Those that do are having success. Consumers are using restaurant apps to look up menus, order food, play games and collect rewards. For example, Starbucks has enhanced its app, where users experience friction-free ordering and payment and are presented with engaging, personalized challenges. Prizes include free drinks, exclusive content and unique opportunities like a trip to a coffee farm in Costa Rica.

Accelerating reach involves optimizing digital presence, so virtual restaurants, which were huge during the pandemic, will likely decline. As some restaurants start to find that maintenance isn’t worth it thanks to the requirements needed for success — like differentiated menus and separate branding — companies have started to de-emphasize their virtual brands (or launch them as physical brands) and re-focus on their core presence.

Despite those few cases, digital channels have shown that they can increase engagement with consumers. Proper utilization leads to a more profitable and efficient model for the restaurant and convenience and relevant offers for consumers.

- Third-party aggregators are the digital channel on everybody’s mind

Food ordering and delivery aggregators have grown their market share in recent years and are expected to remain a presence in the global industry. However, restaurants and consumers see both sides to their strong presence:

Considerations

- Some restaurants are beginning to question the high costs of working with aggregators and the lack of control over the customer experience. Others see a missed opportunity to build brand affinity. As a result, some are looking at launching their own delivery service. While this may help cut costs and increase customer engagement, it does take a powerful system and upfront investment to implement, making it difficult for many.

- Some consumers are put off by the costly price and question if it’s worth saving a trip to the restaurant. After all, the cost of food, delivery fee and tip can add up quickly.

Potential upsides

- Some restaurants see third-party aggregators as a necessity that offers benefits to the partnership. It’s easier to acquire new customers who may have never encountered the brand without the aggregator. This also improves the consumer perception of brand availability, expands a restaurant’s ordering capabilities and increases incremental sales.

- Some consumers have grown familiar with the service. Reliance on aggregators is already strong among most diners today and is projected to continue growing.

Restaurants must determine their business goals and evaluate their own capabilities and needs for aggregators in 2024.

Tech improving operations

Technology investments will optimize operations and enhance the employee experience

Technology has long provided many employee experience benefits. Newer technology like automation is only furthering that trend by taking over monotonous or less-desirable jobs. Many restaurants are willing to implement technology to reduce back-of-house costs and improve the employee experience in 2024.

Undoubtedly, operational efficiencies benefit both employees and consumers. Businesses can have smoother processes that lead to better results, while consumers receive a more frictionless interaction. To make this a reality, operations must not only be effective, but they must also be accurate and provide a positive customer experience.

While the use of new technology itself isn’t novel, it has not yet reached a point of peak efficiency and implementation in an industry that has been traditionally slow to adopt new tools. State-of-the-art tech exists at some restaurants, but it is not yet commonplace with brands and franchisees wary of the upfront investment.

New technology could come in a variety of implementations. These include:

Automation technology

Automation implementation can range from fully-processed automation to partial automation of a singular process. It can improve order accuracy, food quality and speed of service, enhancing both the customer and employee experiences. Today, robots are the most common example of this tool being used more widely.

For example, fast-fine New York restaurant Better Days is employing a full assembly line consisting of robots. The robotic chefs use AI to cook the dishes, while requiring as little as 200 square feet of space. With robotic programming, precise deliverance and unlimited memory, Better Days is able to deliver on a wider variety of menu options with more consistency and accuracy

In more hybrid examples, robots can handle single-process tasks like flipping burger patties or removing avocado pits. Staff then come in to apply the finishing touches.

Sweetgreen, which opened its first automated location in 2023, plans to open more and retrofit existing units. Their robots can prepare bowls, ensuring consistent portions and properly dispensing difficult, stickier ingredients like cheese that are more likely to need human intervention. Process automation for most of the assembly frees up workers to do other tasks like final order checks.

Labor challenges are also eased as robots take on tasks many humans prefer to avoid and allows them to instead focus on stocking, maintaining and providing more customer-facing services. Staff are also happier to avoid the risk of injuries and monotonous tasks.

Order and pay technology

Spanning a wide range of tools, from QR codes to tablets and kiosk stands, order and pay technology is a trending tech that helps ease operations.

Adoption of this technology is still early with tablets and kiosks having higher upfront costs, but investments can lead to improved efficiency. With diners using the tools themselves to order, customize and pay, it saves time for the staff. A whole step in the dining process is cut, inaccurate orders are diminished and staff can personally meet customer needs in different ways.

For example, McDonald’s is promoting mobile order and pay technology by expanding its “Ready On Arrival” program, which enables staff to assemble orders before customers arrive. Diners order, and using geofencing, staff is notified of their arrival once their GPS crosses a certain distance to the restaurant. With a reported 62-second reduction in wait time, this allows the restaurant to receive payment, provide faster service and build loyalty through the digital channel while maintaining the human touchpoint.

QR codes are here to stay post-pandemic despite some consumer fatigue with the technology’s lack of hospitality in the payment experience. Restaurants will have to find a balance. For instance, some operators may only opt to use digital for ordering, whereas others may find it best for payment. Whether it’s to pay, order or both, this tech allows staff to get the food out faster and gives the diner flexibility with split checks and instant closure.

Artificial intelligence (AI)

Still relatively nascent in industry implementation, this technology is undoubtedly buzzing.

Quick service drive-thrus is one area showing a lot of AI adoption. AI voice automation is being used to take orders and address several QSR challenges, including labor costs, order inaccuracies and missed upsell opportunities. This tool can quickly submit orders with high accuracy, provide a personalized experience to the customer in real-time and lessen the burden on employees.

The technology has not yet perfected order-taking, citing similar human challenges such as background noise. There is still a lot to learn about this tech, but this innovative tool is a source of excitement in the industry and even for curious customers.

As a whole, the pace of tech development is rapid and doesn’t look to be slowing down any time soon. Many of these new technologies also introduce unique privacy or regulatory challenges that are still taking shape. Nevertheless, whether through automation, ordering and payment, AI or the next innovation, increased implementation is likely in 2024.

- How is tech assisting Asia?

In a region known for embracing new technology, ELLA is making a name for itself in Asia as Singapore’s first fully autonomous robotic barista. Born out of “a very real problem and necessity” to address “shortage of labor and inconsistencies in quality [that] led to subpar experiences,” the autonomous ELLA is powered by AI and runs in an unmanned, contactless café measuring just 5 square meters. She boasts an ability to consistently produce drink orders and a fearlessness of handling hot coffee.

Yet coffee-serving robots aren’t the only technology seen in the region. Many restaurants across Asia Pacific are now seeing payments innovation, similar to that of the US. Some locations enable the ordering and payment process to be purely online, while others have systems where diners can just pay and leave at their discretion. Brands are seeking ways to make the process more frictionless while maintaining human interaction.

Prioritizing Sustainability

Investments in sustainability will speak to consumers’ growing desire to positively impact the world

Commitments to ESG (environmental, social and governance) are not a fad. Brands have been making commitments over the past five years, and 2024 will be no different for this sector. Restaurants will prioritize existing initiatives and make new commitments.

The restaurant industry is uniquely set up to tackle ESG initiatives in many ways. Trending solutions span a wide range, including:

- Reducing food waste

- Eliminating single-use plastic and other packaging

- Enhancing the menu to include healthier, less carbon-heavy options

- Offering condensed employee work weeks

- Providing education reimbursement

One popular way to implement ESG is with gamification. Many apps already use gamification to drive digital engagement, and brands can use it to raise money and awareness for various causes. By having promotions tied to generous giving, customers can build charitable behaviors while feeling good about themselves and earning loyalty points, reinforcing continued engagement.

In examples like this, companies are using ESG to publicly orient themselves to social causes as a growing number of consumers become more cognizant of a brand’s mission. Younger generations especially have been vocal about company ESG practices as they speak up about how companies treat their employees and contribute to causes and politics.

These generations have shown a propensity to lean towards more environmentally conscious products.

- According to a study, 77% of generations younger than Gen X would like restaurants to be clearer about the environmental impact of different foods.

- Furthermore, a fifth of Gen Z and millennials selected “environmental impact” as an important factor when ordering food — compared to 7% of Gen X and baby boomers.

- In another sustainability study, 65% of consumers said they wanted more sustainable food options and were willing to pay more for them.

Many companies are sharing their environmental initiatives. Some are making more powerful commitments, like Starbuck’s plan to drastically reduce paper cup usage or Wendy’s goal to reduce greenhouse gas emissions by 2030. In the end, brands are taking the steps to change consumer behavior — and the world — for the better.

- Australia gives the green light

Eating green doesn’t just mean eating kale and broccoli anymore. Diners like trying new menu offerings and are growing more conscious about their food choices. In parts of Asia, healthier options are preferred thanks to readily available information like caloric count. These new food innovations, like more vegan-friendly and plant-based meat dishes, help both the human body and the environment.

Australians, in particular, are starting to do their part. The country’s food industry produces more emissions per capita than any other Organization for Economic Cooperation and Development (OECD) country, according to the University of Technology Sydney. As such, some restaurants are providing new options that are climate-friendly, ethical and adapted to Australian tastebuds.

Conclusion

As we move through 2024, restaurants will test new methods and enhance their businesses through personalization, digitization and better customer experiences.

Loyalty, personalization and ESG will continue to play essential roles in allowing restaurants to attract, connect and nurture diners, and technology will also help restaurants to innovate and continue to enhance customer experiences. Looking forward, the restaurant industry is poised for continued growth and will rise to meet consumer expectations.

- Endnotes

1Juniper Research: Digital Loyalty Programme Memberships to Exceed 32 Billion by 2026, June 2022

*“Improve point of order engagements by serving your consumers digitally” Forrester Consulting, Mar. 2023To learn more about how Mastercard is working with restaurants, reach out to your Mastercard representative or request a demo.

For more information on Mastercard SpendingPulse™, request a demo.

© 2024 Mastercard International Incorporated. All rights reserved.

This Mastercard Economics Institute presentation (This "Presentation") and content or portions thereof may not be accessed, downloaded, copied, modified, distributed, used or published in any form or media, except as authorized by Mastercard. This presentation and content are intended solely as a research tool for informational purposes and not as investment advice or recommendations for any particular action or investment and should not be relied upon, in whole or in part, as the basis for decision-making or investment purposes. This presentation and content are not guaranteed as to accuracy and are provided on an "as is" basis to authorized users, who review and use this information at their own risk. This presentation and content, including estimated economic forecasts, simulations or scenarios from the Mastercard Economics Institute, do not in any way reflect expectations for (or actual) Mastercard operational or financial performance.