June 21, 2023

Last year, we published our Tokens on a chain report that explored opportunities for banks around blockchain-based applications including crypto assets. We offer a follow-up to that report with our thoughts on the possibilities that the blockchain brings to the retail industry. Blockchain represents the next step for retail after its progression from pure brick & mortar into an e-commerce hybrid. The story here, like the one for banks, remains one of evolution rather than revolution or reinvention.

As governments worldwide explore the viability of central bank digital currencies, retailers are looking at how proprietary in-store currencies may overlap with reward points in loyalty programs. Retailer-specific fungible tokens blur the line between in-store currencies and reward points by embodying the very concept of paying with rewards. Meanwhile, non-fungible tokens (NFTs) can offer dynamic versions of loyalty perks and then function as tradeable assets in tandem with their fungible counterparts.

The combination of payments and loyalty on a blockchain allows retailers to control entire brand narratives on standalone sites or in partnership with other retailers on online marketplaces. There is a similarity with video games and their immersive worlds with in-game currencies, but the comparison only goes so far. Retail is as much about facilitating seamless commerce with frictionless payments as it is about building brand engagement and recognizing loyalty. Fulfilling retail experiences matter of course, but they matter little without the support of order fulfillment on supply chains, and blockchain can enhance both.

Blockchain’s immutable records can track real-time location data to allow for automatic invoice calculation with payments at set times. Instant reconciliation can be guaranteed by putting payments on the same blockchain. The trust and transparency of the blockchain can then be used to enable supply chain financing.

Blockchain applications have the potential to enhance many aspects of the retail experience. Yet, whether pertaining to payments, loyalty, locations or supply chains, these new builds will not pop up overnight. They are conducted block by block via carefully made plans, focused execution of resources and considered investment. I hope this report can serve as some initial inspiration about their potential.

The blocks used to be entirely brick and mortar. E-commerce then shifted some blocks online. Now another kind of block looks set to build on the foundations of both.

This lofty new build will impact everything from payments and loyalty programs to retail locations and supply chains. To achieve it, blockchain first needs to overcome its unhelpful association with a growing distrust of cryptocurrency. The purpose of cryptocurrency as an alternative form of payment is largely overshadowed now by its predominant use as a speculative and unstable investment.

That cryptocurrencies with unstable values are but one kind of blockchain-based crypto asset seems to matter little in terms of public perception

That cryptocurrencies with unstable values are but one kind of blockchain-based crypto asset seems to matter little in terms of public perception. The term crypto tends to be used synonymously with cryptocurrency, and the colloquialism is proving almost as tough for blockchain to shake as one of its immutable blocks.

It does not help that 76% of consumers know little to nothing about blockchain.1 The situation hardly fills a blockchain advocate with confidence when trying to convince decision makers, and blockchain’s catchy name does little to quash skepticism.

Technological change usually comes from disruptive startups rather than established incumbents for good reason: it begins small. Yet blockchain’s grandiose promises are anything but small.

Misleading comparisons between blockchain and the internet confuse things further. Whether blockchain ultimately ushers in a new “Web3” version of the internet is largely immaterial. As an electronic ledger, blockchain relies on the internet to function; it does not replace it.

As an electronic ledger, blockchain relies on the internet to function; it does not replace it

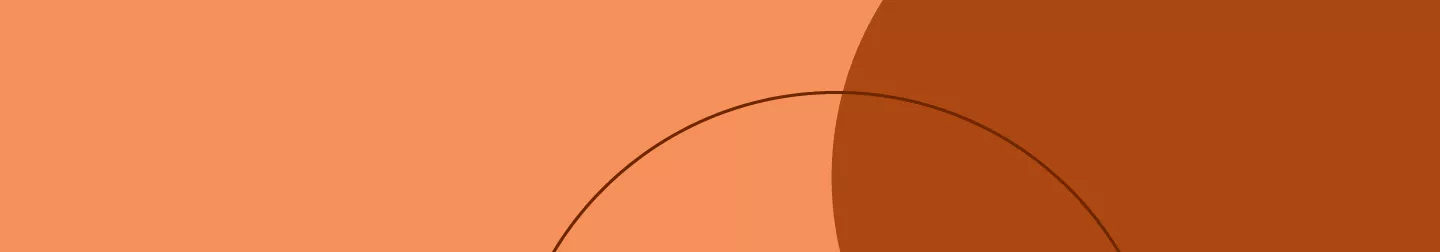

Where blockchain and the internet are similar is in adoption rates, and “crypto” in all its facets appears to be tracking the early years of the internet closely (figure 1). The internet, still an “alien lifeform” in the words of British singer David Bowie in 1999,2 was no less daunting in the late 1990s than blockchain is today.

Different technologies and purposes mean the shift of retailers to blockchain might not be exactly like the shift of retailers to e-commerce. But the existence of a retailer in the future without blockchain capabilities risks ending up like the plight of a retailer today without an online presence.

In January 2022, 10% of Latin American & Caribbean consumers said they would like to be able to spend their cryptocurrency balances in store with a debit card. A subsequent decline in many cryptocurrencies’ values likely dented that desire for now, but demand remains in many countries worldwide. Cryptocurrency-linked payment cards, which allow instant conversion of cryptocurrencies to fiat currencies immediately prior to payment, let retailers meet that demand without adjusting current acceptance practices.

More substantial change and opportunity for retailers may come from the crypto assets outside of cryptocurrencies with unstable values. These assets attract the attention of governments and central banks in various ways. For example, the Monetary Authority of Singapore (MAS) shuns unstable cryptocurrencies while embracing other blockchain uses, including alternative payments via fiat-backed cryptocurrencies known as stablecoins.4

More substantial change and opportunity for retailers may come from the crypto assets outside of cryptocurrencies with unstable values

Alternative payments

Yet the use of stablecoins for cash displacement does not eliminate many of the existing challenges with A2A retail payments. In economies where card payments are common, A2A payments tend to be limited to non-retail payments, such as bill payments and donations, where the irreversibility of transactions and the lack of chargeback mechanisms matter little. A further wrinkle for retailers may come from having to decide which stablecoins to accept.

Central intervention from governments could change the narrative. For example, A2A payments at retailers in Thailand are the result of a government directive to use a standardized QR code for payments and the establishment of a real-time payments network in partnership with Mastercard. With 94% of Thai consumers saying they have used digital payments, Thailand’s adoption rate is one of the highest in the Asia Pacific region.5 The aim is to reduce reliance on cash, and it overlaps with the aim of central bank digital currencies (CBDCs) to modernize cash in a digital world.

Unlike current digital representations of cash in bank accounts or in online wallets as e-money, retail CBDCs are digital replacements for cash to be stored in accounts or wallets directly guaranteed by central banks. Blockchain is not required for CBDCs any more than it is for any other A2A payments. But CBDCs on a blockchain can operate like stablecoins with all their associated benefits, including transparent and traceable transactions, automatic or “decentralized” clearing, and programmable “smart contracts” that may prescribe and proscribe use.

CBDCs are only live in a handful of markets as most governments continue to probe the possibilities. It remains unclear if they will ever become a mainstream replacement for cash. Singapore’s MAS has more faith for now in wholesale CBDCs for use by financial intermediaries than in retail CBDCs for use by consumers.6 Meanwhile the Reserve Bank of India, otherwise highly skeptical of any currency-related crypto assets, has confidence in both retail and wholesale applications.7

Judging from the Bank of England and UK Treasury's proclamation that “it is likely a digital pound will be needed in the future” for everyday payments,8 retailers will want to watch the space. For now, retailers able to deftly accommodate omnichannel payment flows are in good stead. On the frontend, the user experience of a CBDC via a digital wallet should be similar to other wallet-based payment methods.

Proprietary “coins”

A stablecoin provided by a major retailer for use across its store network or by a big tech company for use with affiliated retailers is a tantalizing opportunity. In theory, it entails no outside costs beyond the technological investment. Still, it is only possible for those with the financial resources to support it and a customer base likely to adopt it. Even then, it remains largely unfeasible.

A stablecoin from a major retailer for use across its store network is a tantalizing opportunity that remains largely unfeasible

The first problem is internal. Large amounts of financial reserves are required to maintain a stable pegging or value for a stablecoin. Amassing that can be a challenge even for the biggest retailers. Then there are more mundane technological challenges, such as how to handle chargebacks and how to redesign cryptocurrency wallets for use at the point of sale rather than on investment platforms.

The second problem comes from external scrutiny. A retailer or big-tech company holding financial reserves in such quantities can gain an outsized control of the financial system. That is as alarming to central banks and regulators as it is challenging for retailers to put into practice. No regulation exists to support such initiatives, and CBDCs exist as government responses to them.

Instead of entertaining a remote possibility for only the very largest retailers, a more practical application of blockchain for retailers of all sizes comes through another kind of “currency”: reward points in loyalty programs.

Any transaction on a blockchain is essentially just an exchange of tokens, regardless of the underlying physical or virtual assets they represent.

Tokenization of assets on a blockchain does not alter assets; it just makes them easier to transact as readily exchangeable tokens. The benefit is particularly relevant to recent shifts in retailers’ loyalty programs away from a purely monetary focus. The convenience and personalization associated with the experience of redeeming rewards is now as important as the monetary value of the rewards themselves.

“Utility tokens” as reward points

Utility tokens function as organization-specific currencies that provide privileged access to products and services.

They are often associated with raising startup capital, but an alternative application of utility tokens is in retailers’ loyalty programs. They complement standard payments as organization-specific tokens that blur the line between reward points and in-house currencies by taking the concept of “pay with rewards” at its most literal.

The blockchain allows transactions with reward points to occur instantaneously with no need for later reconciliation. Meanwhile, opportunities for personalization, such as tailored discounts and offers, are enhanced by the ability to automatically trace previous transactions and adjust rewards and discounts based on dynamic inputs from smart contracts.

Utility tokens can blur the line between reward points and in-house currencies by taking the concept of "pay with rewards" at its most literal

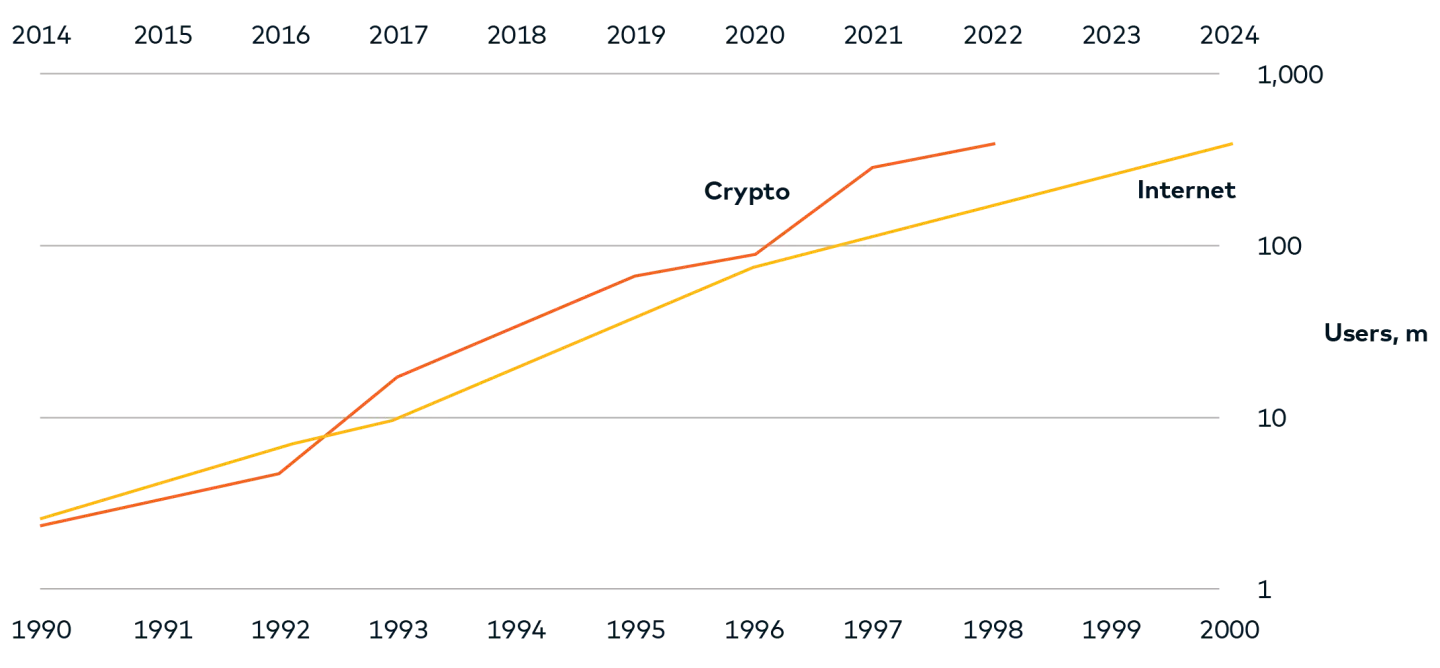

Retailers may either determine a fixed value for their utility tokens on a private blockchain that they may share with partner retailers,9 or they may opt for a variable token value that reflects the loyalty ecosystem and may be transacted on a permissionless public blockchain.10 Examples of both already exist. The tradeoff is between greater control or greater access.

The public option theoretically opens the utility tokens up as a full-fledged currency that may be bought and exchanged in addition to being earned through brand engagement (figure 2). The fundamental token values can go no higher than the rewards associated with them. They can however attract a premium if associated with other aspects of a broader loyalty program, such as the acquisition of non-fungible tokens (NFTs).

NFT-based rewards

A non-fungible token (NFT) represents ownership on a blockchain of a unique or rare asset that cannot be transacted in a like-kind exchange. NFTs are particularly suited to loyalty programs when personalization extends into exclusivity.

In the same way that utility tokens in a loyalty program can be seen as an evolution of reward points, NFTs can be seen as an evolution of exclusive perks that provide access to discrete discounts or promotions. The benefit with NFTs is that they offer something more dynamic than just a one-off reward.

When a loyalty member redeems an NFT or a set of NFTs for access to an exclusive event, a smart contract can then automatically unlock other content, such as another NFT representing verifiable ownership of an authentic ticket stub. The record of ownership on the blockchain authenticates the unique item of branded memorabilia while offering opportunities for further engagement over a defined period or at specific occasions along a customer journey.

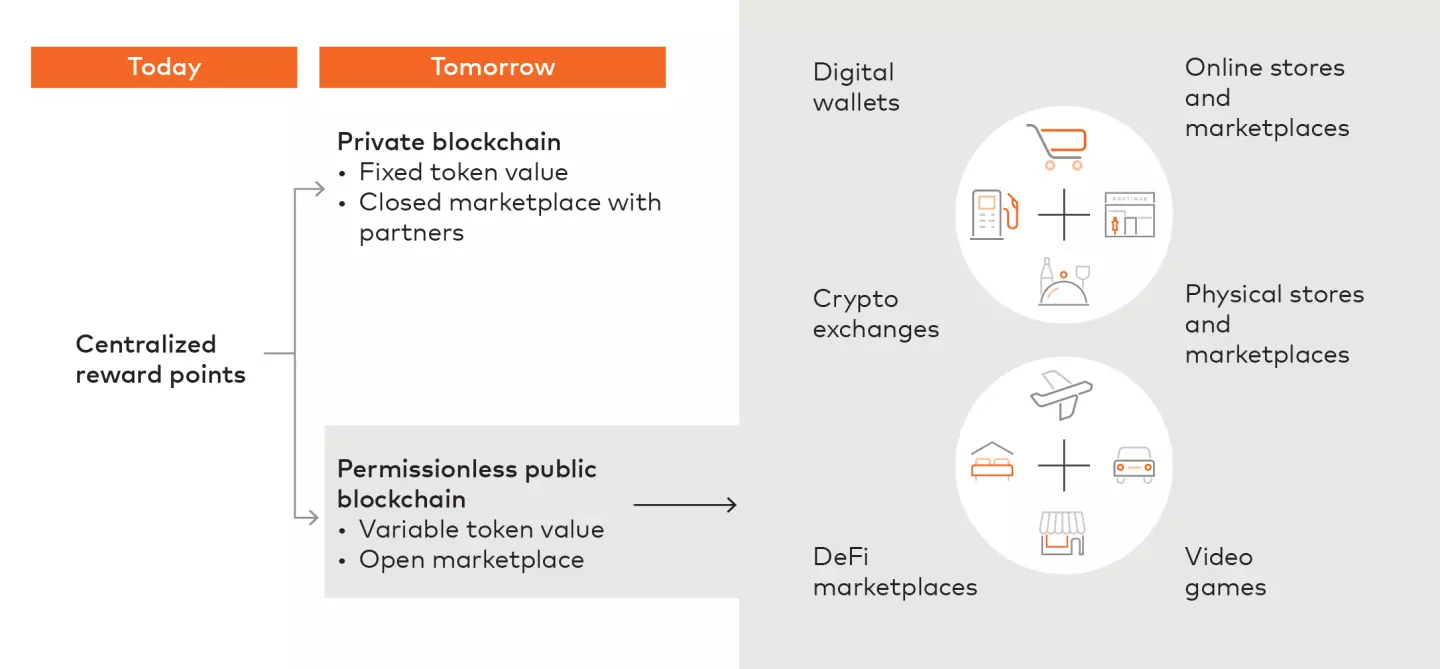

An element of gamification comes from how consumer participation in brand-related activities can let an NFT-based reward evolve via smart contracts as an earnable asset. Its further ability to interact with fungible token-based reward points also makes it a readily tradeable asset. For example, points from a retailer could be transferred to an airline to top up an NFT “suitcase” granting exclusive airport lounge access. The readily exchangeable tokens incentivize all stakeholders to jointly develop a shared loyalty program (figure 3):

The incorporation of tradeable NFTs into retailers’ approaches to loyalty, including one of North America’s historically most successful programs,11 is set to have broad ramifications for e-commerce interactions in general. In combination with fungible tokens, it points to an evolution in retail locations.

Lofty visions of the metaverse in terms of futuristic 3D virtual worlds do little to dispel skepticism around practical applications for blockchain in retail. That is unfortunate since the concept need not involve flashy graphics, let alone the donning of virtual-reality headsets.

What really matters to retailers is an appealing and functioning e-commerce environment with all the loyalty trappings. The rest is just gift wrapping: an important part of branding but wholly contingent on what is inside.

The concept need not involve flashy graphics, let alone the donning of virtual-reality headsets

Standalone sites

The term immersive commerce describes a virtual version of a brick-and-mortar store. The idea is to provide interactive experiences online that go beyond scrolling through endless lists of products. The concept is rare among retailers but not particularly new. it takes its lead from video games where in-game purchases are now commonplace through in-game currencies.

The use of blockchain to provide immutable transaction records in a fully functioning economy will increasingly matter to the video game industry. Verifiable ownership of a token-based currency for the purchase of token-based assets, such as character accoutrements or in-game items, provides for smoother gaming transactions while offering greater protection against fraud.

The opportunity for retailers is to take those in-game, or rather in-store, currencies and put them on a blockchain as utility tokens to create a functioning economy. Fickle consumers will no longer be deafened by marketing noise as flailing marketers struggle to make sufficient noise. Instead, retailers can control entire brand narratives in carefully curated e-commerce environments.

The bigger opportunity is perhaps for brand engagement rather than immediate sales. In recent years, many physical retail locations have become experiential showrooms focusing on brand building for leisurely browsing rather than quick sales to shoppers on the go. The opportunity now is to enmesh the on-chain economies of immersive commerce sites with blockchain-based digital interactions in physical showrooms.

Retailers can control entire brand narratives in carefully curated e-commerce environments

Yet comparisons of blockchain-enabled e-commerce with virtual gaming worlds can be misleading. Legitimate discussions around gamification to boost consumer loyalty and engagement do not necessarily entail full-on immersion. One of the benefits of online shopping is the ability to check out quickly without having to browse or, in video game parlance, play. The level of immersion on an e-commerce site should be weighted appropriately for maximum impact.

For example, an NFT-based visual representation of a consumer as a customizable avatar risks being superfluous if it has no tangible benefit. What matters is whether the NFT can provide consumers privileged access to highly personalized and connected benefits. A branded graphic representation of an NFT that visually evolves via a smart contract can add a tangible gaming component to boost engagement, but a more mundane interface might suffice for a consumer just wanting to get in and out.

Online marketplaces

Where market presence and budgets allow, retail partners on the same blockchain can create a single e-commerce marketplace where consumers can interact across a retailer’s multiple brands.

Some brands are even bridging online and offline environments

The possibility of then further extending the e-commerce marketplace to unaffiliated brands via one centralized solution is challenging but possible. A comparison exists in video games where competing brands and retailers host experiences in centrally managed virtual worlds,12 including some via the ownership of NFTs.13 Some brands are even bridging online and offline environments to engage with next-generation consumers by making their NFT-linked virtual products redeemable for real-world counterparts.14

These approaches to e-commerce are now attracting attention from governments. Indonesia is developing a national online marketplace,15 and its central bank is working on a blockchain based CBDC that can be used in the marketplace.16 Meanwhile, Saudi Arabia might still be mulling over the possibility of a CBDC, but its designs for a virtual counterpart to a physical city are no less expansive.17

An alternative open-source approach preserves the decentralized spirit of blockchain by favoring collaboration over centralized control. It lets brands and other parties claim a say in the evolution of a marketplace via ownership of virtual “land” through NFTs.18

Ultimately, whether centralized or decentralized, virtual stores need to be more than just destinations for brand engagement and hassle-free transactions. They also need to support fulfillment centers for product delivery in the same way that offline experiential showrooms deftly cater to consumers as they flit between purpose and pleasure when shopping. The future of supply chain management hinges on the ability to sync product inventory and delivery with standalone e-commerce sites and shared online marketplaces.

From limited-edition music files to custom avatar skins, tokenization as NFTs can provide clear ownership and simplify transactions while accounting for copyright issues. With no need for physical transportation or logistics, supply chains are simple.

Yet most retail products have commercial values that reflect mass consumption, are not purchased as investments, and are physically owned. Tokenized representations are largely meaningless for consumers, who just want to receive the product on their end. Not so for manufacturers and retailers on the other end, who are preoccupied with how to deliver the product in the first place. That calls for supply chains with clear and identifiable product provenance.

Tracking

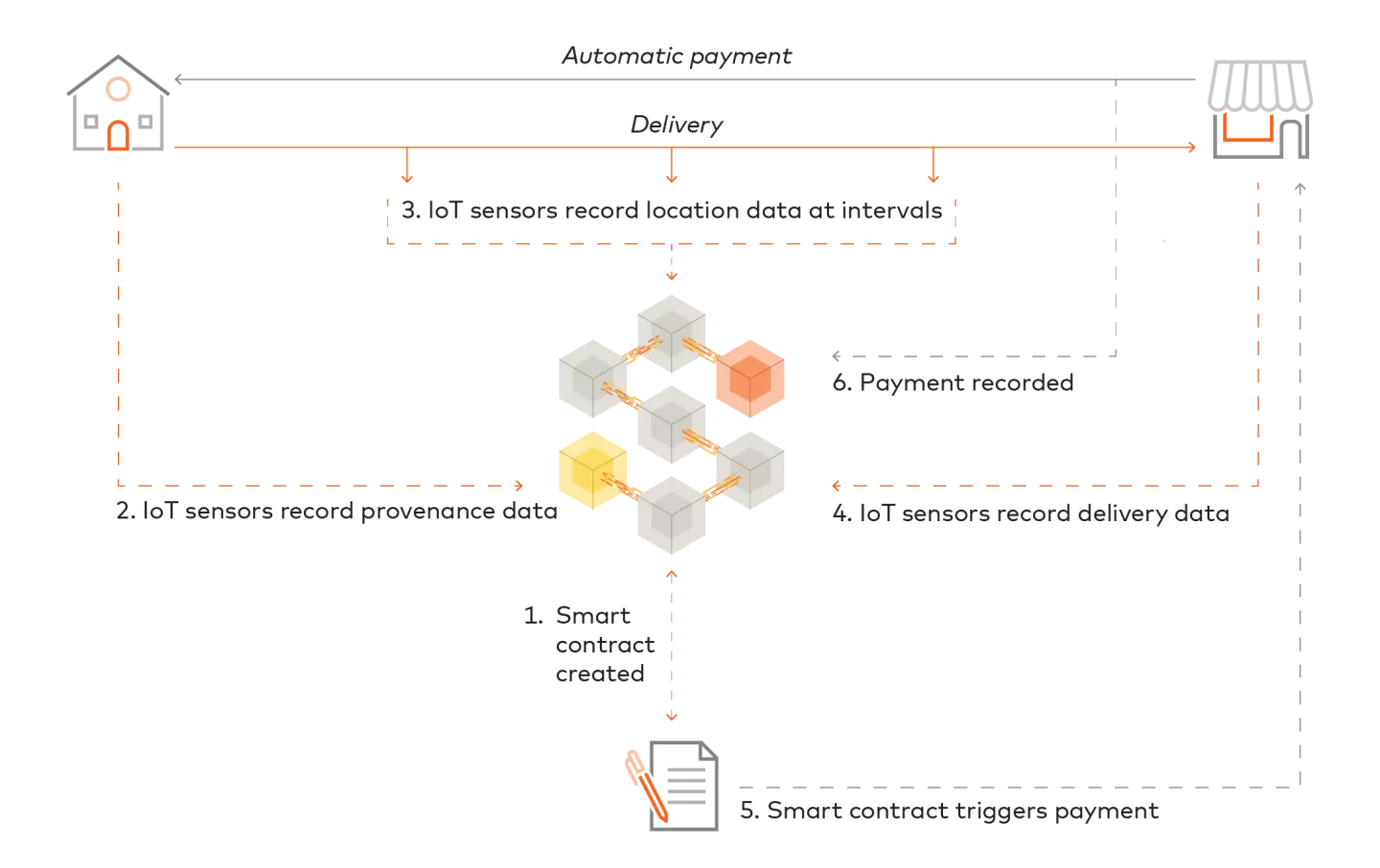

Blockchain oracles are interfaces that provide dynamic off-chain inputs to on-chain smart contracts. A smart contract associated with an NFT representing a batch of products at source can rely on oracles with real-world data from internet-of-things (IoT) sensors at key stages along supply chains to record the batch’s location.

The two metaphorical chains work in harmony as the blockchain provides a transparent record of the supply chain

The immutable chain of location data allows retailers to verify sourcing claims, such as environmental sustainability, while accessing real-time and automated shipping information. The two metaphorical chains work in harmony as the blockchain provides a transparent record of the supply chain.

Supply chain tracking on a blockchain is like any token-based transaction on a blockchain. Programmable smart contracts can allow automatic invoice calculation based on real-time shipping data and then issue automatic payments in specific amounts at designated times. The ideal scenario includes the payments on the same blockchain as the supply chain for instant reconciliation in what constitutes a simple exchange of tokens (figure 4).

Financing

The trust associated with transparent transactions and automatic reconciliation also promotes affordability on blockchain-enabled supply chains.

Central lists of retailers and suppliers already provide central connections with easily adjustable payment terms. Blockchain then makes it easier to reach agreements on those payment terms by providing more complete and trusted overviews of entire supply chains. Further reassurance comes from adding payments to the same blockchain by guaranteeing funds at set values and times via smart contracts.

Blockchain is also poised to redress the global trade-finance gap, which estimates in 2020 put at US$1.7 trillion.19 Financial service providers, such as banks operating on the Hong Kong Monetary Authority’s blockchain-based trade finance platform,20 can offer trade finance more often and more affordably. Retailers can then benefit from access to short credit lines to optimize working capital before paying balances in full.

In 1997, David Bowie, presciently aware of the havoc the internet was about to unleash on music sales, hit on the idea of selling securities that would pay out royalties from future sales of his back catalog over a defined period. Dubbed “Bowie Bonds”, the approach was as innovative at the time as his music.21

Were he introducing the bonds today, Bowie might plump for blockchain as the latest innovation. With the bonds tokenized as crypto securities, smart contacts could automatically release dividends on schedule and cancel them at term. Tokenization would not alter the bonds, but it would simplify any transactions associated with them. The same goes for any other crypto asset, and blockchain’s impact on retail and its associated assets will not alter retail’s foundations either; it will just build on them.

New builds, even ones on existing foundations, do not generally happen overnight. That is particularly the case when the necessary technology is nascent. Rather, they call for carefully planned and considered investment one block at a time.

He did not know exactly how his industry was going to change, but he knew enough not to make the mistake of ignoring what was afoot

A few months prior to his “alien lifeform” quip about the internet in late 1999, Bowie had become the first popstar signed to a major record label to release an entire album online. He did not know exactly how his industry was going to change, but he knew enough not to make the mistake of ignoring what was afoot.

2 “20th century music: David Bowie,” interview by Jeremy Paxman. BBC Newsnight, 3 December 1999.

3 University of Cambridge global crypto asset benchmarking study; Crypto.com market sizing research; the World Bank; Mastercard analysis.

4 “Making sense of crypto,” article by Ravi Menon (MAS). Finance & Development 59.3 (IMF), September 2022.

5 Mastercard New Payments Index.

6 “Making sense of crypto,” article by Ravi Menon (MAS). Finance & Development 59.3 (IMF), September 2022.

7 “Concept note on central bank digital currency.” FinTech Department, Reserve Bank of India, October 2022.

8 “The digital pound: A new form of money for households and businesses?” Bank of England and HM Treasury consultation paper, February 2023.

9 “NEAR to join forces with Grupo Nutresa in LatAm to launch Web3 loyalty programme.” NEAR, 1 December 2022.

10 “Lançamento Mercado Coin: A criptomoeda do Mercado Livre.” Mercado Pago, 23 September 2022.

11 “The Starbucks Odyssey begins.” Starbucks, 8 December 2022.

12 “Brand partnerships,” podcast with David Baszucki (Roblox). Roblox Tech Talks, 26 October 2022.

13 “Why games became luxury fashion’s NFT on-ramp.” Vogue Business, 10 August 2021.

14 “Nike dotSwoosh will sell NFT shoes starting ‘under $50’.” Fast Company, 14 November 2022.

15 “Telkom Luncurkan metaNesia, Dunia Baru untuk Sinergi BUMN, Swasta, dan UMKM.” Telkom Indonesia, August 5, 2022.

16 “Project Garuda: Navigating the architecture of digital rupiah.” Bank Indonesia, 30 November 2022.

17 “NEOM Tech & Digital Company steps into the future as ‘Tonomus’. NEOM, 27 September 2022.

18 “Decentraland whitepaper.” The Decentraland Foundation, 2017.

19 “2021 trade finance gaps, growth, and jobs survey.” ADB (Asian Development Bank) brief 192, October 2021.

20 “Connecting the digital islands—next steps in trade finance,” remarks by Eddie Yue. Hong Kong Monetary Authority, 26 January 2022.

21 “A short history of the Bowie Bond.” Financial Times, 11 January 2016.